Ripple has prepared its treasury account for a significant monthly XRP selling activity. The company has reserved 300 million XRP tokens worth $145.50 million for its sell-off in July.

Every month, Ripple, the largest XRP holder and entity behind the XRP Ledger development, sells part of its reserves, inflating the circulating supply.

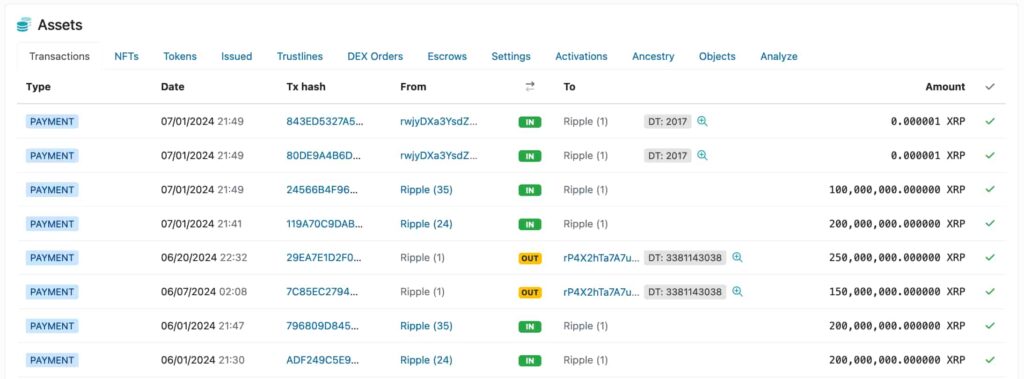

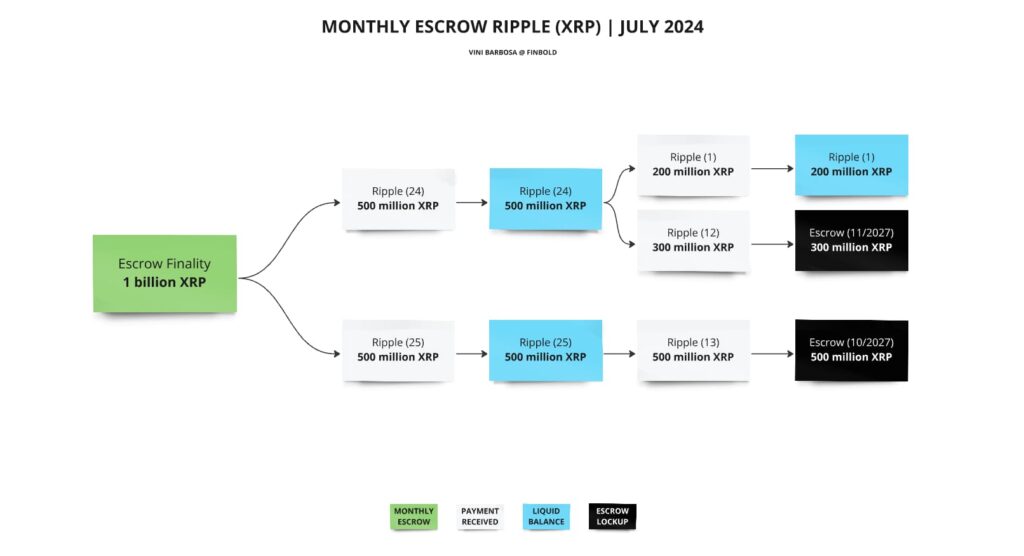

As usual, the company unlocked 1 billion XRP, worth $485 million, on July 1. This happened through the XRP Ledger escrow system from two labeled accounts: ‘Ripple (24)‘ and ‘Ripple (25).’

However, in addition to the usual 200 million tokens sent to the treasury each month, the alternative account ‘Ripple (35)‘ added another 100 million XRP to ‘Ripple (1),’ which could mean the company is preparing for a larger dump this month.

Ripple XRP reserves and escrow activity in July

As developed, ‘Ripple (24)’ first sent the 200 million XRP for July’s sell-off to ‘Ripple (1)’. Later, the account sent 300 million tokens to ‘Ripple (12)’ and re-locked the amount for an escrow to November 2027.

In the meantime, ‘Ripple (25)’ sent the 500 million unlocked tokens to ‘Ripple (13),’ locking them up until October 2027. All these transactions can be verified on-chain through the block explorer XRP Scan.

Ripple historical dumps

Since 2017, when it implemented escrows, Ripple has systematically reserved no more than 350 million XRP for its monthly dumps.

The company has sometimes kept part of the month’s reserves, waiting for a better sell-off opportunity in the following months. Conversely, other months saw a superior dump of what was previously reserved, never surpassing 400 million XRP before last month.

In 2024, Ripple sold 226 million, 260 million, 240 million, 200 million, 200 million, and 400 million from January to June, respectively.

Interestingly, Ripple implemented the escrow system in 2017 due to investors’ complaints about the lack of transparency in the ongoing dumps, which heavily affected prices. Nevertheless, despite the increased transparency, the economic effects of supply inflation continue to impact XRP’s performance.

XRP price analysis amid Ripple sell-offs

It is noteworthy how Ripple sales directly impact XRP’s price, considering the supply pressure they create on the spot market. Historically, XRP suffered a local crash most of the time Ripple sold its tokens.

Year-to-date, only five of the 14 sell-off days had positive price action: February 5, 11, April 14, May 13, and 20. All nine other days were of local crashes, evidencing the importance of monitoring the company’s activities.

Moreover, XRP had a negative monthly performance in four of the first six months of 2024, year-to-date.

As of this writing, XRP trades at $0.484. Therefore, investors should closely monitor Ripple’s dumps in July, as they could slow down an expected bull rally this cycle.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.