As Rivian Automotive (NASDAQ: RIVN) hits an all-time low, the electric vehicle (EV) manufacturer faces a range of challenges that cast doubt on its future.

Once hailed as a potential Tesla (NASDAQ: TSLA) rival, the company’s recent performance has left investors questioning its viability in a crowded EV market.

However, is there a chance Rivian could still be a worthwhile investment?

Rivian’s long-term potential

Following a remarkable performance in 2023 with total revenue of $4,434 million, supported by 50,122 total vehicle deliveries, Rivian’s shares have encountered turbulence in 2024.

While revenue is growing, Rivian is still losing money on each vehicle it sells. This raises concerns about the company’s ability to become profitable in the near future.

High production costs, low volume, and profitability concerns are driving Rivian’s stock price down despite exceeding some production targets.

Additionally, the broader market, reflected by the Nasdaq (NDAQ) and the S&P 500, tends to focus more on short-term performance and profitability. Rivian, like other high-growth startups, is valued based on future potential.

This disconnect between short-term struggles and long-term potential can lead to significant stock price fluctuations.

RIVN stock price analysis

Over the past year, the price has taken a dramatic decline, falling from a high of around $28.06 to a current price of $9.57 as of April 11, 2024. This represents a staggering decrease of approximately 66%.

RIVN shares fell to an all-time low of $9.50 a share on Thursday after Ford Motor Co F lowered the price of its F-150 Lightning.

The leading electric pickup truck is now on offer with a discount of up to $5,500, marking the largest price reduction announced by the legacy automaker to date.

Legacy automakers such as Ford can manage price reductions to boost demand, but smaller competitors like Rivian might not have that flexibility, especially given their rapid cash burn.

Wall Street analysts bullish despite price decline

However, this pessimism appears to be at odds with the broader outlook among Wall Street analysts.

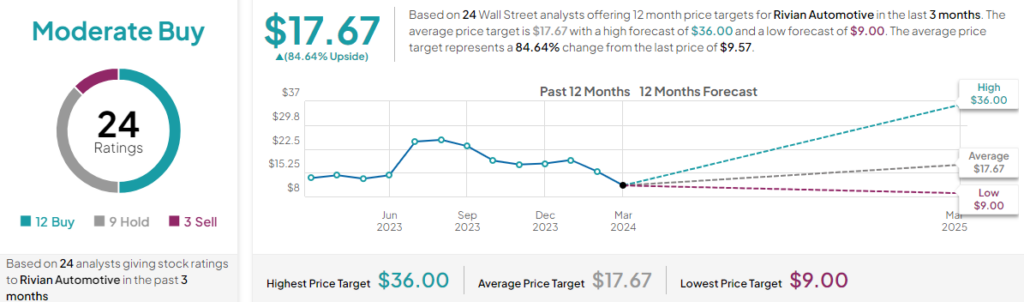

As of April 12, TipRanks shows 24 experts weighing in: twelve recommend buying, nine suggest holding, and three advise selling.

Despite the current low of $9, analyst targets paint a more optimistic picture. The average target sits at $17.67, representing a potential 84.64% upside. The most bullish predictions are even higher, reaching as high as $36, highlighting the range of expectations for this growth company.

Analysts at Mizuho, led by Vijay Rakesh, downgraded their assessment of Rivian, along with other EV companies, citing near-term headwinds impacting the price.

Rakesh slashed the price target for Rivian to $12, at the end of March. This news caused Rivian’s stock to dip initially, although it partially recovered later in the trading day.

Elsewhere, Bank of America analyst John Murphy lowered Rivians price target $25 to $21 while maintaining his buy rating.

Rivian’s turbulent terrain

Rivian’s sharp decline contrasts with earlier optimism. While the company delivered more vehicles in 2023 and doubled its revenue compared to 2022, Rivian still struggles to turn a profit.

Adding to the uncertainty, Rivian revised its production plans downward to 57,000 vehicles in 2024. This decision comes despite the company demonstrating a capacity for 70,000 vehicles annually in Q4, 2023.

While the company attributes this adjustment to economic and geopolitical headwinds, the effectiveness of this strategy remains to be seen.

However, there’s a glimmer of hope. Despite its struggles, Rivian still boasts a market capitalization exceeding $9 billion. This suggests that some investors see long-term potential in the company.

If Rivian can address its operational inefficiencies, improve margins, and adapt to the changing market landscape, it could turn things around.

But for now, the company faces an uphill battle, requiring significant improvement and strategic maneuvering to regain investor confidence.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.