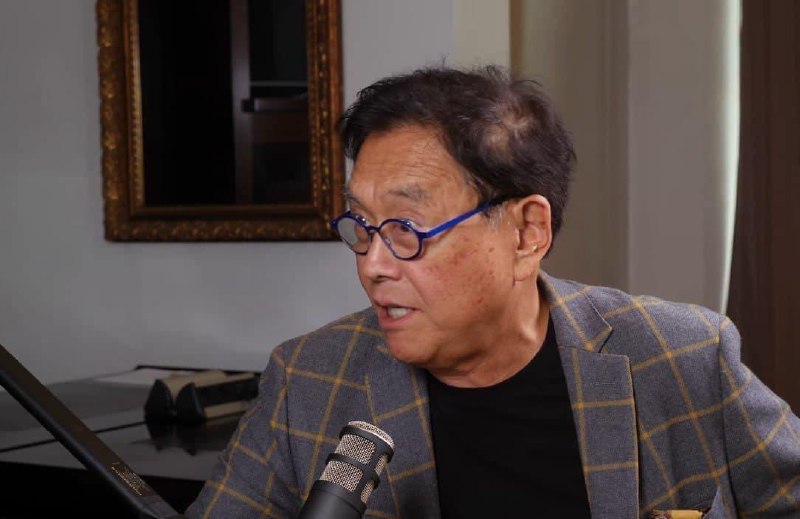

Robert Kiyosaki, American businessman and educator, has sounded yet another financial alarm.

In a recent social media post, the author of Rich Dad Poor Dad warned that the global economy could be on the brink of a collapse comparable to the 1929 crash and the Great Depression.

Kiyosaki’s warning cites ballooning U.S. debt as the chief reason for concern and recommends, in his characteristic fashion, a shift toward assets such as gold, silver, and Bitcoin (BTC).

“I sit tight with gold, silver, & Bitcoin. Good luck. We may be on the brink of another 1929 crash and another Great Depression. America’s debt is out of control. America is the worlds biggest debtor nation in history. You can only print money to pay your bills….for so long.”

What is the future of Bitcoin?

In the hours leading up to the post, the Bitcoin price dipped below the critical $119,000 mark. While the asset has somewhat rebounded since, some of the ongoing market developments could undermine its status as a hedge in the future.

Nonetheless, Kiyosaki appears steadfast in his advocacy for “digital gold”, implying once again that the coin is a viable counterweight to fiat instability.

His reasoning appears to follow that of veteran financiers like Warren Buffett and Jim Rogers, who have reportedly also increased their exposure to cash and precious metals.

On July 25, Kiyosaki also noted the limitations of exchange-traded funds (ETFs), which he called “paper assets,” given their intrinsic lack of security that comes with tangible holdings like precious metals.

“ETFs make investing easier for the average investor… so I do recommend them.… Yet an ETF is like having a picture of a gun for personal defense.”

The author’s most recent remarks thus reflect a long-standing skepticism toward traditional financial instruments. His strategy remains consistent: focus on accumulating tangible stores of value and non-fiat hedges.

Featured image via Shutterstock