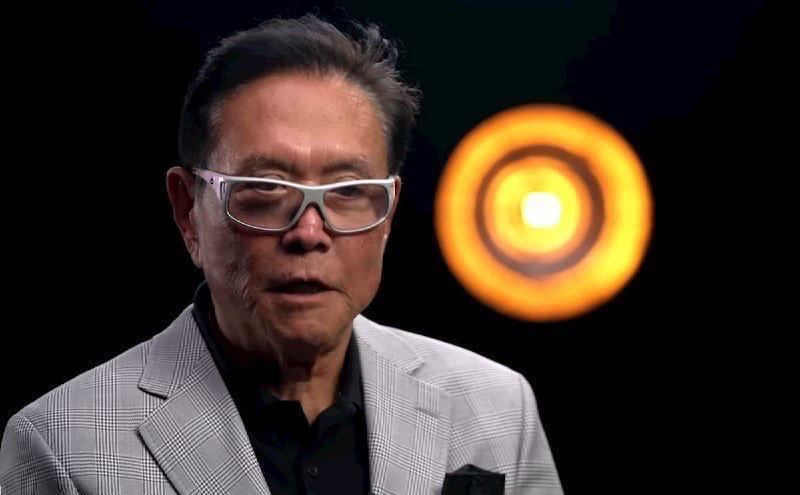

Amidst the ongoing rally of the stock market and a strong 2023 behind us, Robert Kiyosaki, the acclaimed investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ has decided to go against the popular trend and forecast a gloomy outlook for the U.S.

Specifically, he blamed U.S. President Joe Biden, Secretary of Treasury Janet Yellen, and Federal Reserve Chairman Jerome Powell for driving their country towards depression and war in his latest X post on December 31.

Additionally, he advised traders to invest in gold, silver, and Bitcoin (BTC), which are resilient during times of turmoil and preserve their value.

Previous warnings

In the past, the author raised concerns about an impending “global banking crisis,” labeling the US banking system as corrupt. He advised his followers to focus on acquiring Bitcoin, gold, and silver “while you still can,” referencing his accurate past predictions of the Lehman Brothers collapse in 2008 and Credit Suisse’s crash in 2023.

He suggested that UBS, the United Bank of Switzerland, might be the next banking giant at risk, especially after its acquisition of Credit Suisse in March, which he believes prevented a potential bankruptcy.

Gold, silver, and Bitcoin

Kiyosaki suggests that investing in commodities such as precious metals, particularly gold and silver, provides a haven for investors because these assets often maintain resilient prices during challenging geopolitical and economic conditions. Gold, renowned for its security, he says, proves durable, especially during economic uncertainty or inflation.

Silver, with its dual appeal, caters to both industrial and investment requirements. Similar to gold, it serves as a hedge against inflation. Moreover, silver gains value from its industrial applications.

Additionally, the author of ‘Rich Dad Poor Dad’ favors Bitcoin as a decentralized digital currency, often seen as a safeguard against inflation and a digital store of value. Sharing certain traits with commodities, it is a finite resource with a maximum supply of 21 million coins, influenced by supply and demand dynamics.

Whether his predictions of ‘depression and war will come true remains to be seen. However, investors should conduct their research and decide whether to heed his warnings.

Featured image via Ben Shapiro’s YouTube.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.