The software developer Salesforce (NYSE: CRM) stock price lost more than 4% of value since reports suggested that Salesforce is in talks with workplace messaging app Slack (NYSE: WORK) for possible acquisition.

The deal is likely to be valued at around $17 billion as Salesforce expects to add the slack app to its office product portfolio.

Slack stock has been rallying on the news while Salesforce shares are under pressure amid investor’s concerns over higher acquisition price. This would be the largest ever acquisition for Salesforce. Last year, the software developer has bought Tableau Software for $15.7 billion.

“This deal would be a major shot across the bow at Microsoft with the company’s Teams offering a direct messaging competitor against Slack that has been a clear hurdle to growth and now would be a two-horse race between Microsoft and Salesforce,” Wedbush analyst Dan Ives said. “For Microsoft, this would competitively change the landscape and make Salesforce even that much more of a competitor,” Dan Ives added.

Expansion strategies could negatively impact margins

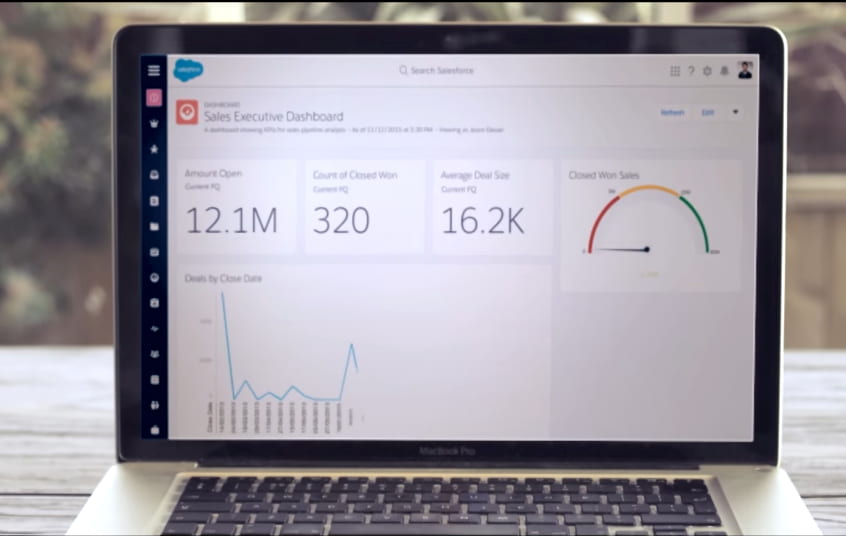

Salesforce has aggressively been looking to expand its product portfolio and market share through acquisitions and investments in organic growth opportunities.

Morgan Stanley has recently dropped Salesforce stock from Overweight to Equal-Weight amid concerns over margins. Analyst Keith Weiss said, “Significant margin expansion” is unlikely due to Salesforce’s subscription model and M&A focus.

Revenue growth trends are optimistic

The company recently announced a plan of adding 4,000 jobs in the next six months and 12000 in the next year, thanks to strong demand trends and growth plans.

It has also raised a full-year revenue outlook to $20.8 billion from the earlier forecast of $20 billion. The potential slack acquisition would significantly boost its revenue in the years ahead. Meanwhile, BMO analyst Keith Bachman expects 17% year over year growth in fiscal 2020 from its services cloud business.