Bitcoin (BTC) has had an impressive performance in the past two weeks, breaking the previous all-time high of $69,000. This movement rewarded investors 40% gains in 15 days, and Bitcoin whales started realizing profits by “increasingly cashing out.”

In particular, Ali Martinez spotted the profit-realization attitude through Glassnode data. The on-chain analyst posted the sell-off alert for Bitcoin on X on March 12.

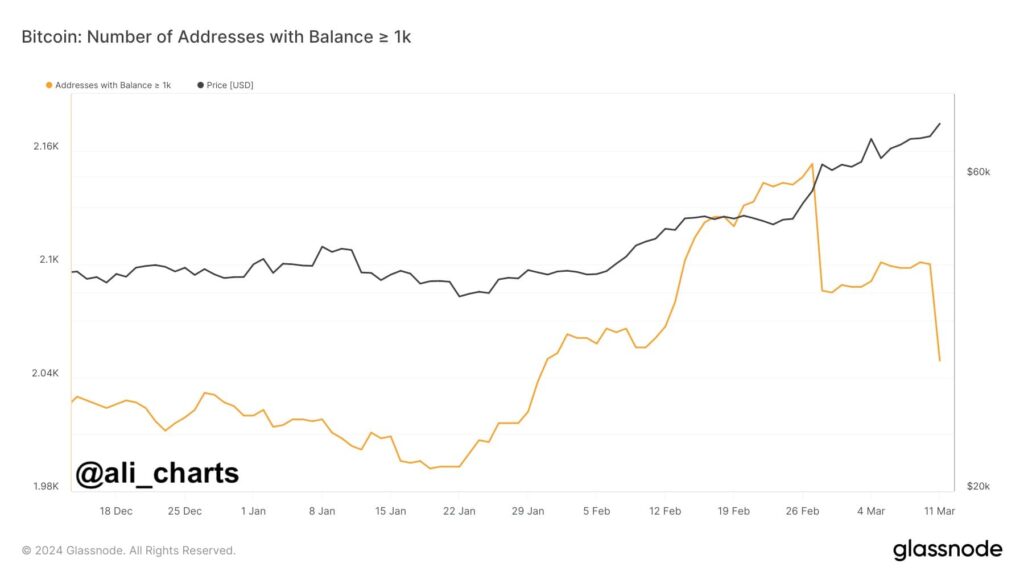

Notably, the number of Bitcoin whales holding 1,000 BTC or more dropped 4.83% in the last two weeks. According to Martinez, this scenario suggests these big investors have been “increasingly cashing out” during the nearly 40% price surge.

“Recent data reveals a notable trend among Bitcoin whales. Those holding over 1,000 $BTC are increasingly cashing out, resulting in a 4.83% drop in such BTC addresses over the last two weeks.”

– Ali Martinez (@ali_charts)

Bitcoin price analysis

Meanwhile, Bitcoin is trading at $72,140 by press time, up nearly 40% from the $51,726 two weeks ago. The leading cryptocurrency traded as high as $72,863 on March 11, creating the perfect opportunity for BTC whales to cash their profits.

Interestingly, Finbold published a sell signal for an overbought Bitcoin during this new all-time high rally.

On that note, the digital asset has one of the highest Relative Strength Index (RSI) in four different time frames. BTC shows an overbought status above 70 points of the index from the hourly to the weekly RSIs. In the daily chart above, Bitcoin’s relative strength worryingly marks 79.42 index points.

This technical indicator suggests a correction is on the horizon for the leading cryptocurrency as investors decide to take profits. Moreover, Ali Martinez’s recent data validates the RSI analysis, signaling the correction trend may already have started.

Other reasons for a diminishing number of Bitcoin whale addresses

However, it is worth considering other reasons for Glassnode’s diminishing number of Bitcoin whale addresses above 1,000 BTC.

Due to privacy and security concerns, each Bitcoin holder can own multiple pseudonym addresses. Therefore, whales that previously held larger amounts in a single address could decide to manage and distribute these holdings. This would cause a similar effect to what Ali Martinez described as “increasingly cashing out.”

In conclusion, on-chain and technical analyses often yield inconclusive data despite offering valuable insights. Investors and analysts must always consider the context and every possibility before making data-driven decisions. Also, the cryptocurrency market is volatile and unpredictable, demanding proper knowledge and strategy to navigate.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.