The cryptocurrency market is currently in a state of flux, influenced by broader economic factors. Recent data showed a surprising increase in U.S. job growth, far exceeding expectations.

This suggests the economy is coping well with higher interest rates, reducing the likelihood of rate cuts, which affects the flow of money into riskier investments like cryptocurrencies.

In light of this economic backdrop, Finbold has identified two cryptocurrencies that are currently overbought and may present a good selling opportunity.

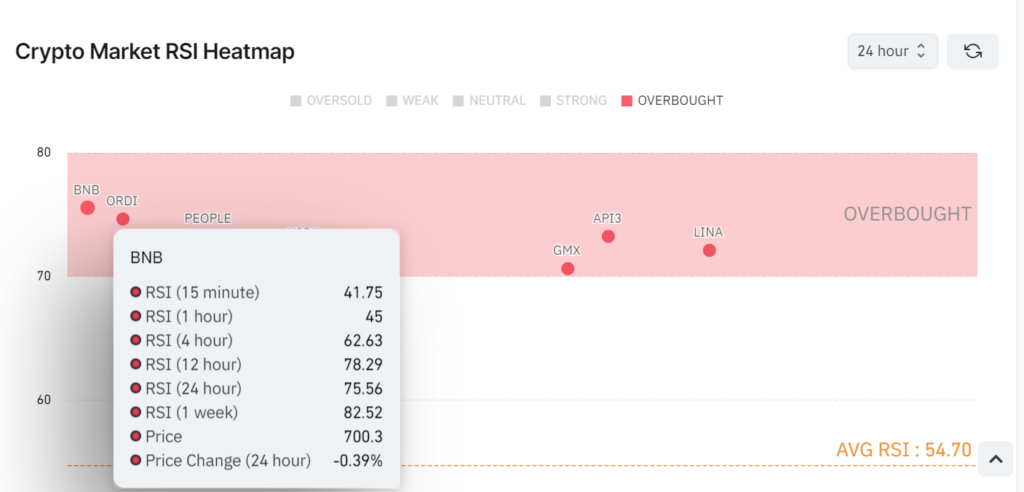

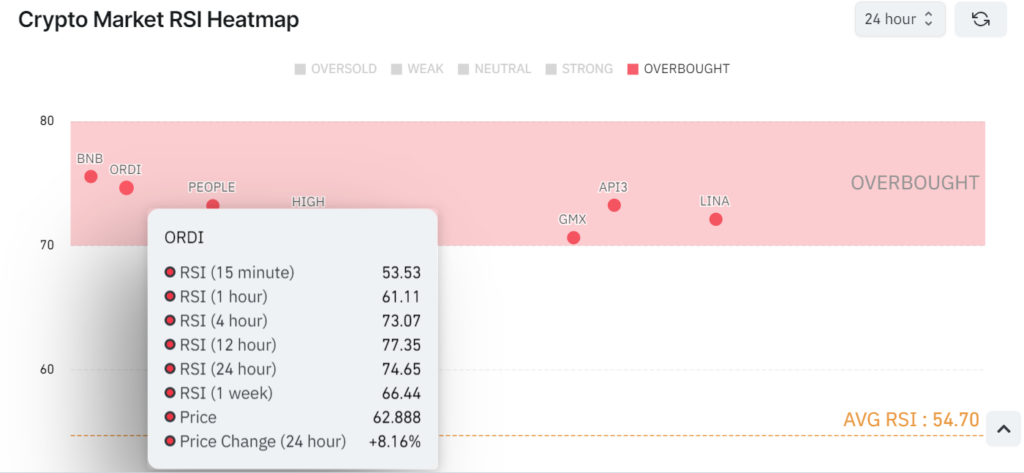

Based on CoinGlass’s 24-hour relative strength index (RSI) heatmap on June 7, the average daily RSI is 54.70, indicating a neutral market.

However, cryptocurrencies that deviate significantly from this average, either by being overbought or oversold, are likely to correct back towards the mean.

Binance Coin (BNB)

At press time, Binance Coin (BNB) is priced at $700.30, with a slight price drop of 0.39%. BNB’s RSI values over various time frames show it is overbought, especially over the past 24 hours.

The 24-hour RSI for BNB is 75.56, which is above the overbought threshold of 70. This indicates strong buying pressure that may not be sustainable.

The 1-week RSI of 82.52 suggests a prolonged overbought condition, pointing to a potential price correction.BNB recently reached an all-time high, highlighting possible overvaluation and market saturation.

Ordi (ORDI)

ORDI, the first token minted using the BRC-20 standard, has also shown significant price movement. Currently, ORDI is priced at $62.888, reflecting an 8% increase. ORDI’s RSI values also suggest it is overbought.

The 24-hour RSI for ORDI is 74.65, indicating it has been overbought recently. ORDI has surged nearly 17%, reaching just below $57.5, its highest price since early April.

This rapid increase, combined with high RSI values, suggests that ORDI might soon see a price correction as the market stabilizes

Both BNB and ORDI are exhibiting high RSI levels, signaling that they are currently overbought and may be poised for a price correction.

However, it is important to note that an overbought RSI does not necessarily guarantee an imminent correction.

This status often follows a period of strong performance and can be sustained during prolonged bull markets.

Therefore, while the technical indicators suggest caution, traders should also consider the underlying fundamentals of each cryptocurrency before making investment decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.