The meme coin mania is back in the cryptocurrency market, and cryptocurrencies like PEPE show signals of being overvalued. This could foreshadow a short-selling opportunity, as suggested by increased open interest (OI) and high funding rates.

Previously, the meme coin boom marked a local top, followed by a market crash that rewarded these crypto short-sellers. Should a similar pattern play out, this asset class is at the peril of suffering another hit despite positive social activity from influencers.

As of this writing, PEPE has $644.85 million in open interest, ranking fifth on CoinGlass. This value represents 10% of the meme coin’s $5.98 billion market cap, trading at $0.0000142. Despite a drop of 20.34% in the $1.55 billion 24-hour volume, the market’s open interest has fallen by 6.37% on the meme coin.

PEPE funding rates and a short-selling opportunity

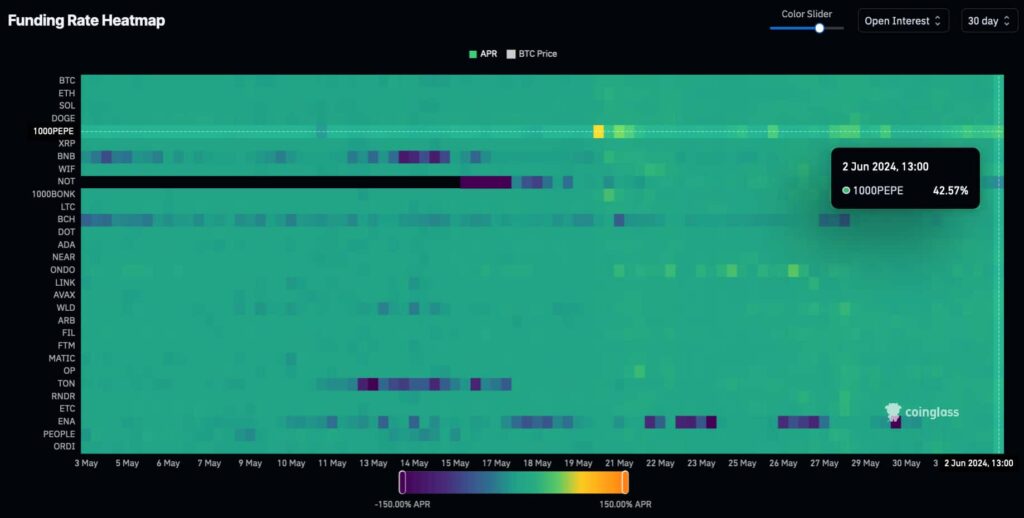

In particular, the consolidated exchanges’ funding rates for PEPE indicate an open interest weighted to long positions. Currently, long-position traders pay an APR of 42.57% to short-sellers to remedy derivatives imbalances.

Therefore, this high funding rate creates an opportunity to open shorts against PEPE and profit from the current imbalance. Short-selling PEPE now represents a bet against the market and presents risks, as the landscape could quickly change.

On that note, cryptocurrency traders have already started positioning within this short-selling opportunity, which is visible on the liquidations heatmap. As these traders place their bets, accumulated liquidity upwards could trigger a short squeeze, punishing these bearish speculators.

Recently, PEPE’s price action has already liquidated long positions through a long squeeze to the current levels.

Still, the meme coin could move either way according to the capital volume that enters for short or long positions in the following days. Cryptocurrency traders and speculators must understand the volatile nature of these digital assets and act cautiously moving forward.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.