In the face of a major correction in the cryptocurrency market, traders and investors wonder whether the bull rally has reached an end. Some even ponder if the recent meme coin boom was an obvious local top signal for cryptocurrencies.

Bitcoin (BTC) reached new highs of $73,805 on March 14. However, the leading cryptocurrency sharply retraced below the previous all-time high of $69,000, impacting the entire market. Bitcoin comes from a remarkable performance with gains superior to 310% since January 2023.

Meanwhile, other cryptocurrencies surged along with BTC’s rally and conquered relevant positions year-over-year. Solana (SOL) and Render (RNDR) were two projects that massively increased their market share in the past 12 months.

Following this positive trend, crypto traders suddenly experienced huge euphoria in a meme coin boom that raised concerns. The rising interest from the mainstream market in, the now popular, new meme coins has made investors wonder if this was a clear top signal to watch for.

Meme coin boom in 2024

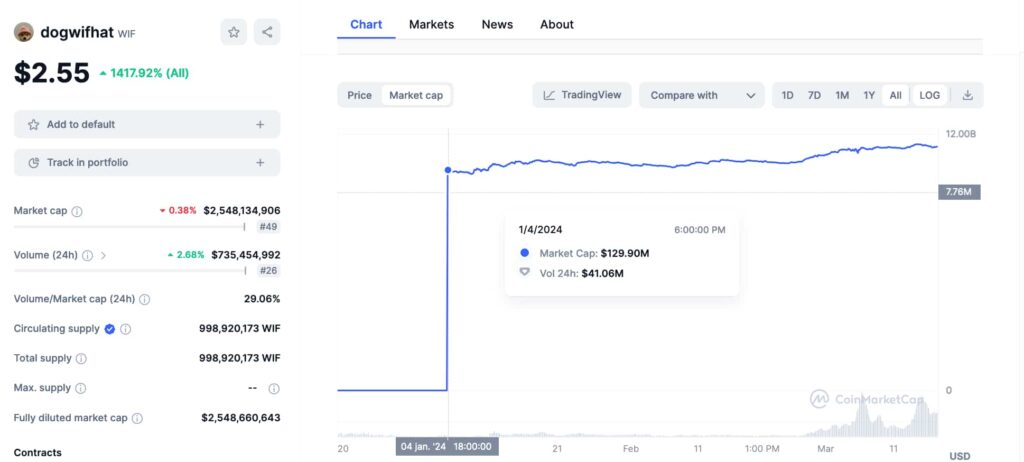

In particular, a meme coin named dogwifhat (WIF) has gained spotlights in 2024, accompanying an increased volume in DeFi. WIF is a token created on the Solana blockchain, similar to Bonk (BONK) – a previous meme coin success.

Notably, WIF has made nearly 1,500% gains since launch, going from a $129 million market cap to over $2.5 billion in less than three months.

Before Dogwifhat’s success, Dogecoin (DOGE), Shiba Inu (SHIB), Floki (FLOKI), and Pepe (PEPE) all had their moments with expressive gains. More recently, Book of Meme (BOME) made up to 200% gains in 24 hours after Binance listed it.

This behavior could be compared to historical financial bubbles driven by greed and unsustainable price speculation, considering the lack of fundamental utility behind these tokens, described by finance experts as “the greater fool theory:”

“The Greater Fool Theory is the idea that, during a market bubble, one can make money by buying overvalued assets and selling them for a profit later, because it will always be possible to find someone who is willing to pay a higher price. An investor who subscribes to the Greater Fool Theory will buy potentially overvalued assets without any regard for their fundamental value. This speculative approach is predicated on the belief that you can make money by gambling on future asset prices and that you will always be able to find a “greater fool” who will be willing to pay more than you did. Unfortunately, when the bubble eventually bursts (which it always does), there is a large sell-off that causes a rapid decline in the asset values. During the sell-off, you can lose a great deal of money if you are the one left holding the asset and cannot find a buyer.”

– Harford Funds blog post: “The Greater Fool Theory: What Is It?”

Fear rises in the market

In this context, the professional trader and analyst Ali Martinez commented on a rising fear in the market. Martinez points out that Bitcoin’s recent price correction has brought a notable shift with a dominating negative sentiment.

Nevertheless, this behavior is expected even in bull markets, as traders adapt to different circumstances and partially realize profits. These technical indicators are simply an effect of recent price action and things can change quickly in the crypto landscape.

All things considered, the meme coin boom has raised concerns about the sustainability of a yearly rally and investors are now more cautious than before.

Yet, Bitcoin still trades above two strong support levels, while DeFi shows very positive growth data. Particularly regarding the $100 billion in total value locked on protocols and over $10 billion of daily volume on decentralized exchanges.

As usual, traders must understand the volatile and unpredictable nature of cryptocurrencies and avoid making emotion-driven decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.