The cryptocurrency market has cooled down in the past few days after weeks of high volume and volatility. Despite that, open interest levels continue at yearly highs, fueling the threat of short squeezes in some cryptocurrencies.

A short squeeze happens when a significant amount of traders carrying short positions are forced out through liquidations when the underlying asset reaches a pre-determined price region. Essentially, the higher the market’s open interest in a cryptocurrency, the higher the chances of squeezing downwards or upwards.

Finbold gathered data from CoinGlass on March 22 and spotted two cryptocurrencies to watch for next week.

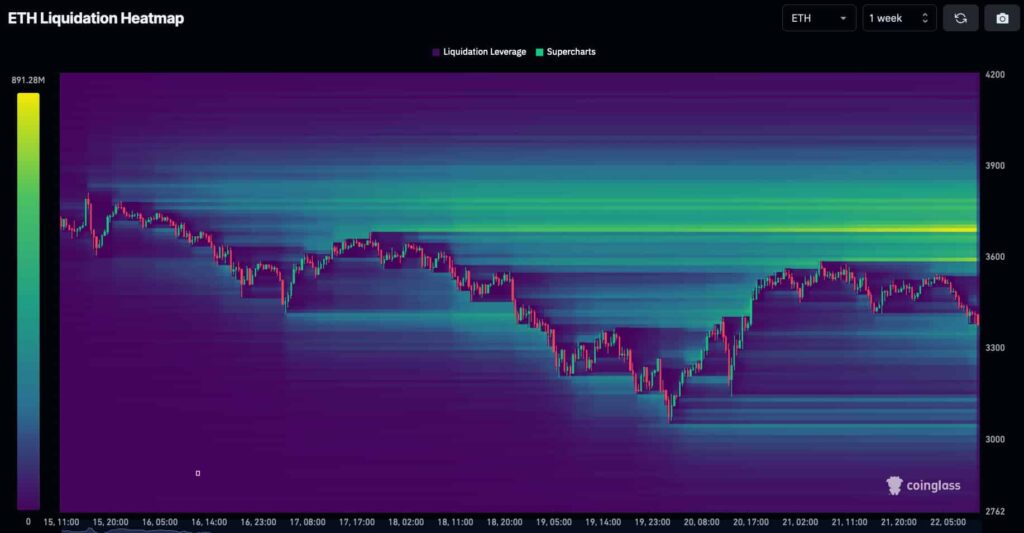

Short squeeze alert for Ethereum (ETH)

In particular, Ethereum (ETH) has seen an increase in short positions, which created significant liquidity pools to the upside.

The $3,700 zone has the larger amount of liquidations in the weekly time frame, making it a possible target. However, a short squeeze could drive ETH’s price to as high as $3,900 – a 15% pump from $3,380.

Notably, the derivative market open interest in Ethereum reached record levels on March 14 and continues to hold strong. As of writing, over $13 billion in contracts remain open for the second-largest cryptocurrency.

ETH futures open interest in USD. Source: CoinGlass

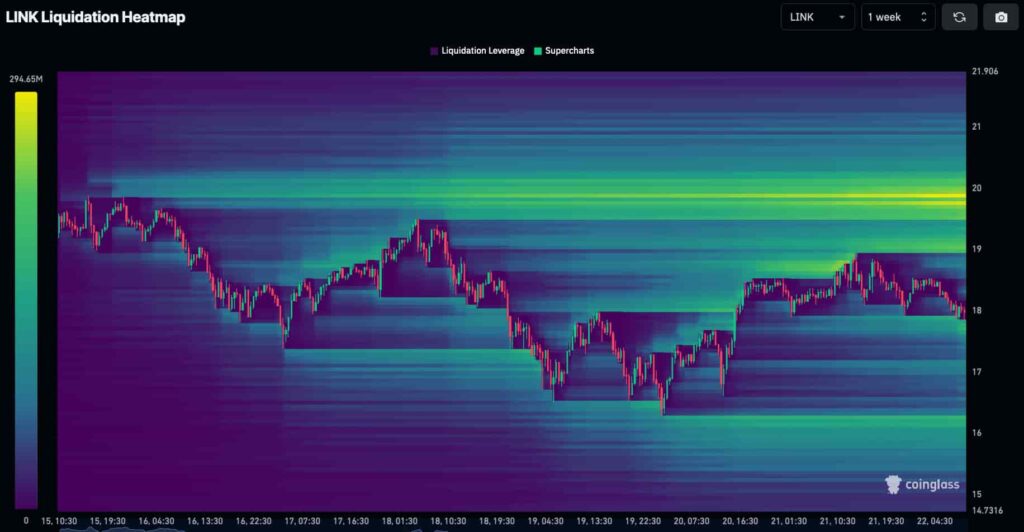

Potential pump for Chainlink (LINK) next week

In the meantime, Chainlink (LINK) also shows record volumes in futures, signaling potential volatility and liquidations are on the edge.

As for liquidations, a short squeeze could pump LINK to above $20 per token. This is where the largest liquidity pools lie for Chainlink and would reflect gains superior to 10% from current prices.

Nevertheless, these liquidation levels do not guarantee any further price action and traders can close their short positions before being liquidated.

As observed, opening leveraged short positions exposes traders to liquidations and incentivizes the market to go in the opposite direction of what most speculators are biased toward.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.