Cryptocurrencies are back to what could be an uptrend after 10 days of an overall correction in the crypto landscape. Bitcoin (BTC) and Ethereum (ETH) are leading the recovery and currently present short squeeze potential in the derivatives market.

Interestingly, the most recent bearish sentiment that dominated the market has driven traders to open short positions against the leaders. For that reason, Bitcoin and Ethereum now have a meaningful accumulation of future liquidations at higher prices.

This occurs because short-sellers agree upon a liquidation price while opening these positions. If the underlying asset’s price rises to these marks, traders’ positions are force-closed, liquidating their collateral and re-purchasing the asset at the liquidation price.

Thus, this phenomenon is called a short squeeze, which can potentially make cryptocurrencies skyrocket.

Bitcoin (BTC) with skyrocket potential to $75,000

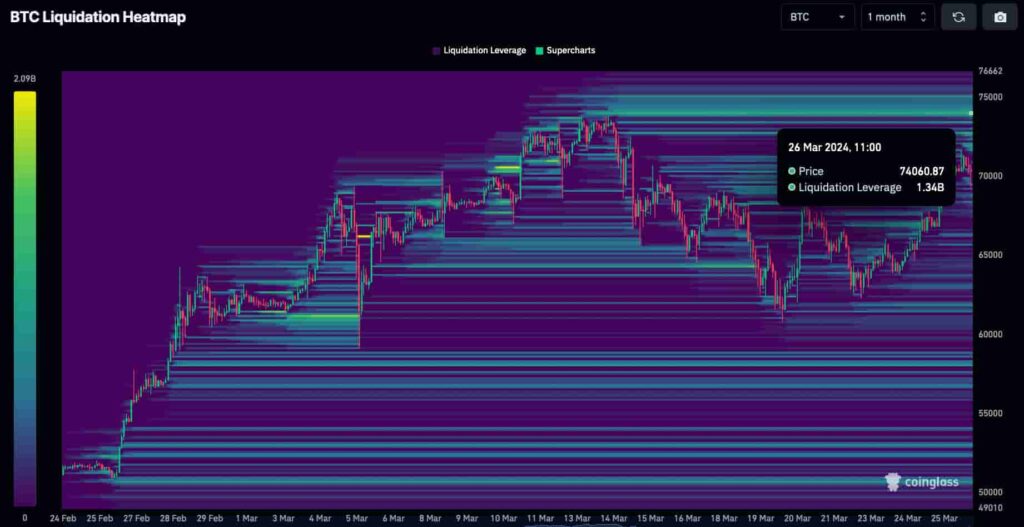

In this context, the Bitcoin liquidation heatmap starts to show relevant liquidity pools above the $74,000 region. BTC could skyrocket and make new highs at $75,000 if a short squeeze liquidates these positions.

Such a bull run would hypothetically result in 7% gains from the leading cryptocurrency’s current price, slightly below $70,000. Finbold retrieved this data from CoinGlass on March 26.

However, the heatmap suggests these liquidity pools could grow more before a short squeeze takes place. On that note, Bitcoin might see lower levels first, encouraging traders to open more short positions, for a larger prize.

Bitcoin’s halving expected on April 20 could trigger the first liquidations through a sudden price increase.

Short squeeze alert for Ethereum (ETH)

On the other hand, Ethereum has proportionally higher liquidity pools in the monthly time frame. Therefore, its native token, ETH, is an even stronger candidate for a short squeeze in early April.

The final target for the second-largest cryptocurrency is at nearly $4,150. This is a 17% potential rally from the slightly above $3,550 by press time.

Notably, BlackRock’s (NYSE: BLK) interest in starting a tokenization fund on Ethereum could fuel this movement for the token. Yet, market makers could still decide to hold ETH at these levels to increase their profit in a future short squeeze.

In summary, both Bitcoin and Ethereum have relevant odds of going through a short squeeze in April. As of current data, a short squeeze could reward investors with 7% and 17% gains respectively. Nevertheless, the cryptocurrency market is uncertain and other factors could come into play for short-term losses.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.