After GameStop (NYSE: GME) and AMC Entertainment (NYSE: AMC) made headlines with significant price increases in a short time during a massively bullish rally, another short-squeezed meme stock is back in town, and its name is BlackBerry (NYSE: BB).

As it happens, BlackBerry stock has joined GameStop and AMC shares in recording unusually high options trading activity, with stock traders buying over 75,000 call options of BB stock, over 350% above its average daily volume, preceding an impressive increase in the price of BlackBerry shares.

Reddit hype triggers hike

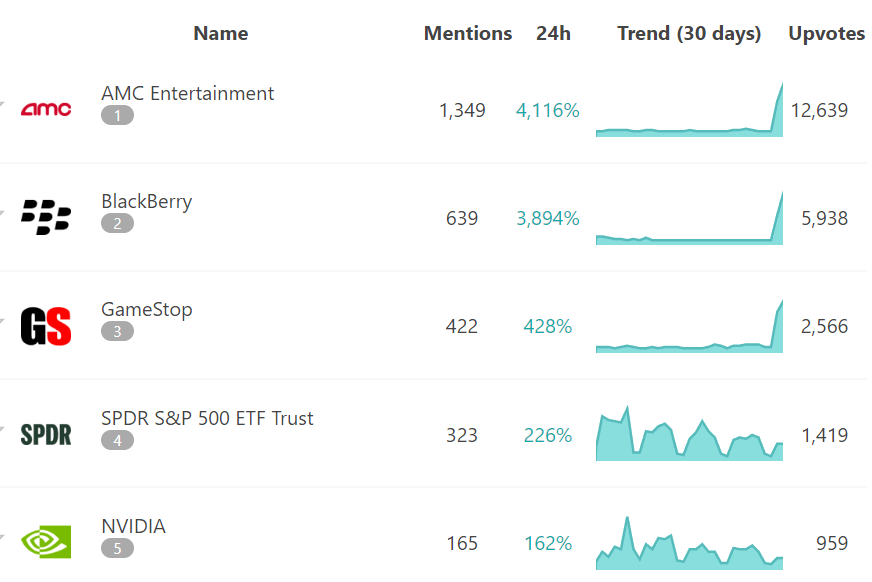

Specifically, BB shares are another example of meme stocks or stocks elevated by social media hype rather than traditional business fundamentals like growth and profits, witnessing a short-squeeze this week as it becomes one of the top three trending stocks on Reddit.

Notably, BlackBerry has recorded 639 mentions on the social media platform’s most popular stock and cryptocurrency subreddits in the last 24 hours, which suggests an increase of a whopping 3,894% in a single day, according to the data retrieved by Finbold from ApeWisdom on May 14.

As a reminder, AMC and GameStop stocks, which have added over 100% in their value in just one day, are also trending on Reddit in the past 24 hours, taking the first and third position, respectively, with AMC mentions soaring 4,116%, and GameStop 428%.

BlackBerry stock price analysis

Indeed, with premarket gains of 24.19%, BB stock appears ready to hit $3.85 before markets open after closing the day at $3.10, which indicates an increase of 3.33% on its weekly chart and a 12.32% advance across the past month, as per data on May 14.

Much like the GameStop situation, a large number of retail investors, in agreement on social media, seem to be betting against the hedge funds and other traders shorting the BB stock, with the short percentage of BlackBerry shares outstanding presently amounting to 8.24%.

All things considered, the practice in which retail traders are trying to ‘stick it’ to major short-sellers like hedge funds and other traders who bet that the stocks of the once-dominant smartphone maker would decline, so far seems to be fruitful and eerily reminiscent of the similar occurrence in 2021.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.