While the cryptocurrency market decides its next move, liquidation pools in the two leading cryptocurrencies threaten a potential short squeeze. Bitcoin (BTC) and Ethereum (ETH) could pump next week if the market liquidates short positions betting against these finance giants.

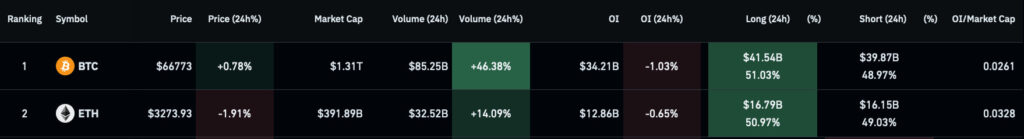

Bitcoin lost a trading range support on April 1 and is down nearly 7% month-to-date, at $66,773. Meanwhile, Ethereum had a similar pattern, down nearly 10% month-to-date, trading at $3,273 by press time.

In this context, cryptocurrency Futures traders have favored opening short positions against the two most valuable cryptocurrencies. Therefore, Finbold retrieved data from CoinGlass on April 5 to understand the risks and potential of a short squeeze pump.

Will Bitcoin (BTC) short squeeze next week?

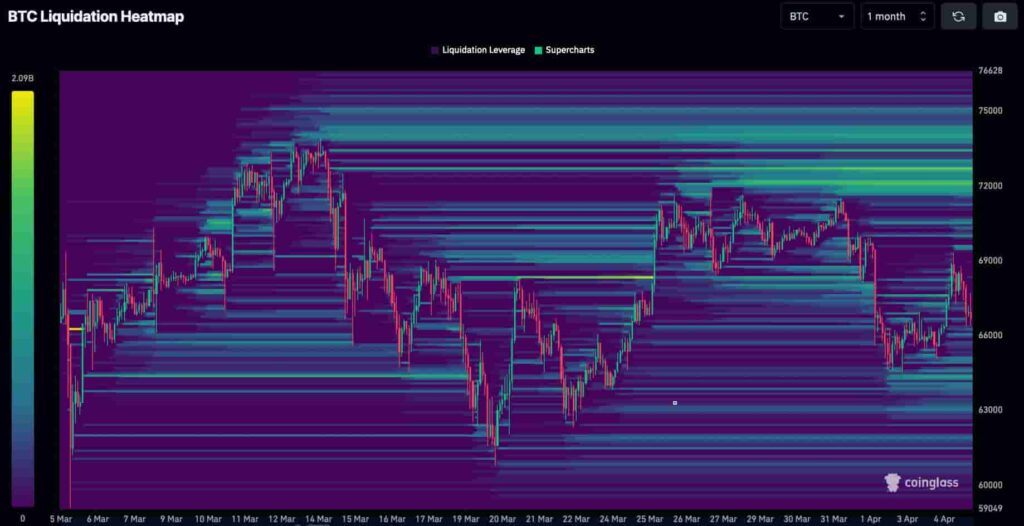

In particular, liquidation data for the maiden cryptocurrency suggests market makers could target Bitcoin short-sellers in the following days. There are billions of dollars in leveraged liquidity pools above the $72,000 level to as high as $75,000.

The Bitcoin halving, expected on April 20, could act as fuel for a potential pump that might liquidate these traders. Moreover, Finbold reported a buy signal for an oversold Bitcoin early this week, which could ignite this movement.

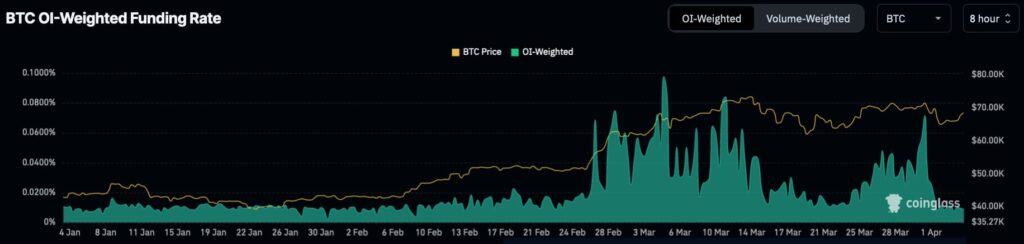

However, derivatives market data for Bitcoin is not conclusive in the occurrence of a short squeeze. That is due to BTC displaying relatively low funding rates, which indicates Bitcoin’s open interest is balanced among short and long positions. Thus, market makers and professional traders could wait for a higher imbalance before making the big move.

Pump potential for Ethereum (ETH) next week

As for Ethereum, the leading Web3 and DeFi cryptocurrency, has two relevant margin liquidity pools. First, at slightly below the $3,700 mark, ETH displays one of the highest accumulated short liquidations in one month. Next, aiming at a target of around $4,100 per Ether.

Nevertheless, Ethereum’s funding rate hints at the same as Bitcoin’s. The low-weighted imbalance suggests it might take a bit longer for a short squeeze to occur. On that note, a dominating bearish sentiment amid increased volume could potentially accelerate this event.

In summary, Bitcoin and Ethereum have considerable potential to face a short squeeze and a price surge next week. Moving to the aforementioned most optimistic targets would result in over 12% and 25% gains for BTC and ETH, respectively.

Still, traders should wait for higher funding rates for both cryptocurrencies to increase the odds of such a liquidation event.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.