The cryptocurrency market slightly retraced this week following the Federal Reserve’s hint on March’s interest rate decision. In response, cryptocurrencies saw an increase in opened short positions, creating short-squeeze opportunities for next week.

A short squeeze happens when short-sellers are liquidated, facing a price increase. These liquidations force traders to buy the cryptocurrency back, increasing the price surge, triggering further liquidations, and potentially making it soar.

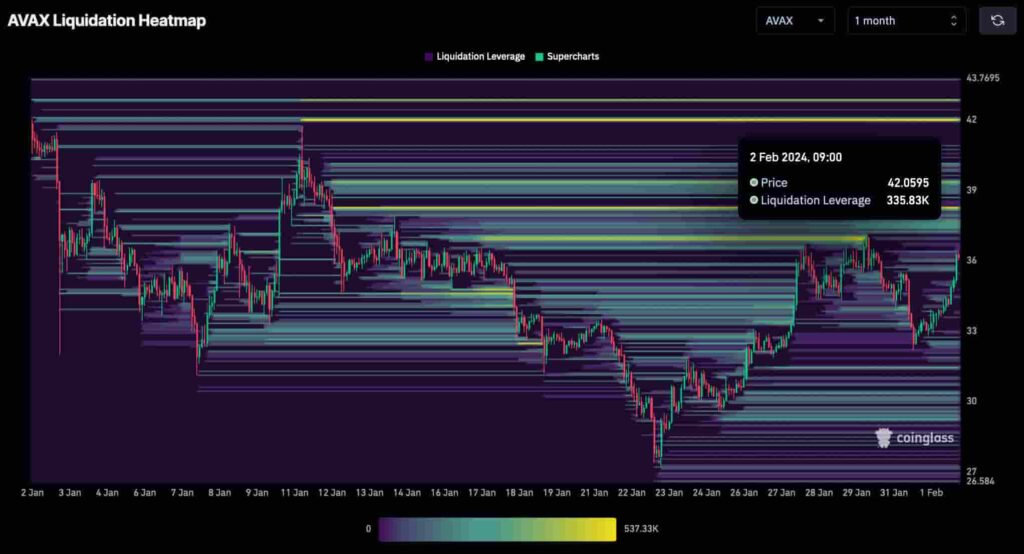

Looking for insights, Finbold gathered data from CoinGlass’s liquidation heatmap on February 2. In particular, we spotted cumulated short liquidations on XRP Ledger (XRP) and Avalanche (AVAX) in the monthly time frame.

XRP could skyrocket, facing a short squeeze

Notably, XRP saw losses of nearly 7% this week after the $112 million hack that affected Chris Larsen’s personal accounts. Larsen is the Co-founder and Executive Chairman of Ripple, XRP’s largest holding entity and sell-off source for the token.

Therefore, this event led to a dominating bearish sentiment, encouraging traders to bet against XRP. However, this downtrend created meaningful liquidity pools to the upwards, now threatening a short squeeze.

The highest amount of short liquidations is at the $0.6 price zone. A move to this target would result in 20% gains for current buyers at $0.5 per XRP.

Short squeeze alert for Avalanche (AVAX)

In the meantime, Avalanche is another likely cryptocurrency to experience a short squeeze next week. The layer-1 blockchain native token has four notable upward liquidity pools.

First, at $38.3, followed by a smaller one at $39.4, the largest at $42.05, and finally, at $42.9. Short squeezing to the largest liquidations would result in 16.8% gains from AVAX’s price of $36.0 by press time.

Nevertheless, an initial trigger is still necessary for this forecast to happen. Having large liquidity pools does not guarantee the price will reach them, which is needed for a short squeeze.

Moreover, this analysis helps to educate traders on how their positions could become attractive targets for whales and market makers. Trading cryptocurrencies requires good knowledge and risk management, as the market is uncertain and volatile.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.