Bitcoin (BTC) has started another run above $71,000 this week, potentially leading the cryptocurrency market to record highs. Despite the positive landscape, some cryptocurrencies still offer the possibility of a short squeeze.

Essentially, a short squeeze is the opposite of a long squeeze, happening when short positions are liquidated in series. When traders open shorts, they create liquidity pools to the upside that can become targets for whales and market makers.

If the price skyrockets, reaching these liquidity pools, the platform forces these positions to close through liquidation. The closures force traders to buy the underlying asset, creating more demand.

On March 11, Finbold turned to CoinGlass data, which shows that most cryptocurrencies have a short-squeeze potential in the short term.

Cardano (ADA)

First, Cardano (ADA) is one of the few top cryptocurrencies with a strong potential for a short squeeze. This is due to having meaningful liquidity pools to the upside while not much in the opposite direction.

Notably, ADA suffered a long squeeze last week, liquidating bullish traders with a massive crash to the $0.55 zone. A similar occurrence against bearish traders could drive Cardano’s token above $0.8.

Essentially, the previous movement could have encouraged cryptocurrency traders to open short positions. This movement is ongoing, with $555.86 million in shorts opened in the last 24 hours. A domination of 52.95% of Cardano’s daily volume in the derivatives market, while ADA trades at $0.732.

Ripple (XRP)

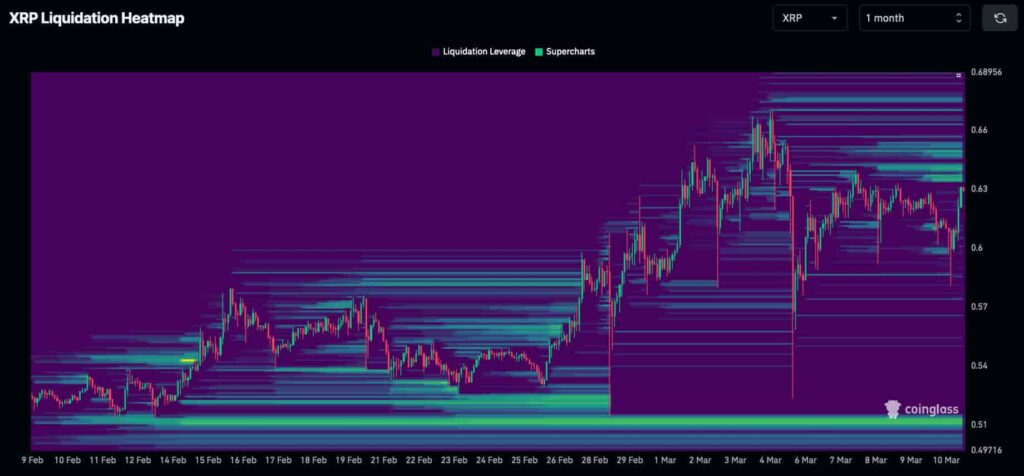

Similarly, XRP is one of the few cryptocurrencies with remaining liquidity to a short squeeze, although significantly lower than Cardano. On that note, the XRP token has some relevant short liquidations from its current price towards the $0.66 level.

However, the most relevant concentration of open interest is to the downside. Unlike ADA, XRP’s crash was not enough to liquidate a massive liquidity pool down to $0.51. Therefore, this region still consists of a possible target for the following days.

Yet, a short-squeeze to $0.66 could encourage more long positions, increasing the downward liquidity pool and the likelihood of a future long squeeze in a sell-off to $0.5. Currently, XRP trades slightly above $0.63.

In summary, a short squeeze for these two cryptocurrencies could result in 9.5% and 4.75% gains for ADA and XRP, respectively. Nevertheless, if Bitcoin continues rising, both tokens might surpass these expectations.

On the other hand, a dominating positive sentiment favors the opening of long positions and creates opposite liquidations. These liquidity pools can be further exploited in the following weeks for a long squeeze. Thus, traders must remain cautious and weigh their risks well while speculating in the crypto market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.