As the stock market hits record highs, equities in the technology space are exhibiting a concerning spike in selling activity.

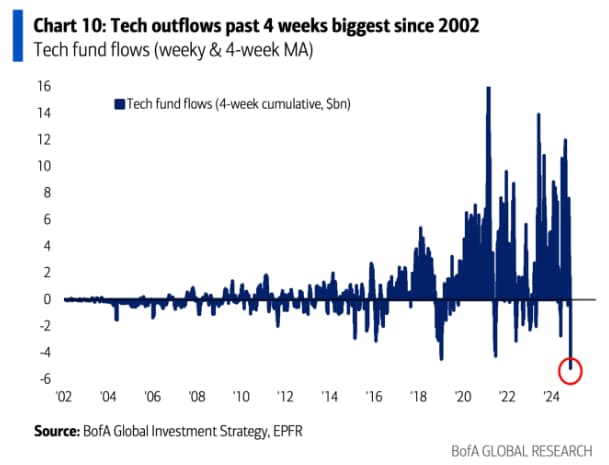

This concern is highlighted by the fact that tech stocks have seen outflows exceeding $4 billion over the past four weeks, according to Bank of America Global Research, marking the largest exodus since 2002.

Analysis of the data shows that the tech sector fund flows follow a cyclical pattern, and capital outflow has typically coincided with market corrections. For instance, in 2008 and 2020, when there was notable outflow, the sector later saw a decline in stock prices.

Therefore, the current trend could signal caution among investors, with the potential of a ‘rug pull’ scenario, where investors might face unexpected and sharp declines on the cards.

Key tech stocks show weakness

On the other hand, technology stocks, as tracked by the Technology Select Sector SPDR Fund (XLK), have struggled to sustain momentum, according to data shared by technical analyst Mark Newton in a post on X on November 9.

Newton noted that key technology players like Apple (NASDAQ: AAPL) and Microsoft (NASDAQ: MSFT) have shown limited technical progress in recent sessions, signaling possible weakness in a sector that has been a significant driver of market growth in recent years. For instance, Apple, Microsoft, and Nvidia (NASDAQ: NVDA) ended the latest trading session down by 0.12%, 0.68%, and 0.84%, respectively.

It is worth noting that this weak performance in the technology sector coincided with a period when the S&P 500 index hit a new high above 6,000 for the first time in history.

This rally was mainly fueled by Donald Trump’s re-election, whose proposed policies, such as corporate tax cuts, are considered bullish for the economy and stocks in general.

Therefore, although the index has reached a new high, it may face challenges sustaining its gains if the capital outflow continues.

Explaining tech stock’s outflows

Although there is no specific driver for the bearish outlook on tech stocks, it can be assumed that investors are taking a cautious stance in anticipation of a possible market downturn.

The technology sector, led by companies venturing into Artificial intelligence (AI), has faced concerns regarding a potential AI bubble.

Concerns of a possible crash have been elevated because prominent players, such as Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A), have offloaded a significant portion of their Apple holdings. Analysts believe Buffett might be preparing for a possible downturn.

As reported by Finbold, the S&P 500’s technical setup signals a potential crash despite the current highs.

Considering that the outflow comes at a time of bullishness in the market, it can also be argued that the movement is due to the rotation of funds in different sectors.

Despite this weakness in technology equities, Wall Street analysts foresee the sector’s leading gains heading into 2025, banking on AI’s potential. For instance, Dan Ives of Wedbush Securities expects the industry to grow by 20% in 2025, inspired by the “AI revolution.”

With all factors considered, technology stocks are seemingly on a rollercoaster. It remains to be seen how the outflow affects specific equities in the long term.

Featured image via Shutterstock