Bitcoin (BTC) mining is a highly competitive and high-cost business activity directly reliant on the leading cryptocurrency price action. Miners can often see themselves operating underwater amid extended bearish or consolidation periods, forcing some to capitulate from mining.

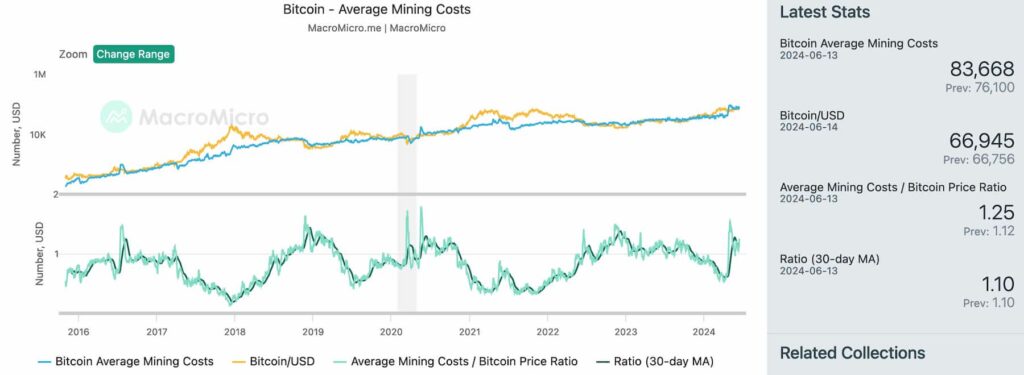

In particular, data retrieved from MacroMicro indicates this is happening right now, with an average cost of $83,668 per mined Bitcoin.

Furthermore, two CryptoQuant researchers identified two signs of capitulation from Bitcoin miners this week, suggesting a non-favorable scenario.

OTC sell-offs and hashrate weakening: Bitcoin mining researchers highlight two capitulation signals

First, Julio Moreno spotted the largest daily miner selling volume since late March, with 1,200 BTC sold over the counter (OTC). OTC refers to deals settled in a peer-to-peer manner instead of selling in crypto exchanges‘ spot market.

Second, Ki Young Ju highlighted Bitcoin’s hashrate breaking an 18-month uptrend, showing signs of weakness. Usually, hashrate weakens during bear markets as miners unplug mining machines to save on costs amid unfavorable forecasts.

Bitcoin supply held by miners at 2-year lows

On a related matter, Finbold retrieved data from Santiment’s Sanbase Pro on June 14 that validates the signs of capitulation.

Notably, the Bitcoin miners’ reserves dropped aggressively to June 2022 levels when BTC was trading below $20,000.

As of this writing, miners hold 1.8 million BTC, while Bitcoin trades at $66,800. This represents a relevant contrast from the 2.01 million BTC held a few weeks before March’s all-time high of $73,000, evidencing a sell-off as the maiden cryptocurrency consolidates in a 4-month price range.

Bitcoin mining benefits from economies of scale

According to multiple sources familiar with the matter, Bitcoin miners will operate underwater most of the time, and the activity is not profitable for medium and small players.

Interestingly, these entities often hedge their business with energy futures contracts or leverage themselves by borrowing or selling shares. Others will rely on side activities to remain relevant, like selling ASICs to miners or collecting mining pool fees. Moreover, these structures could generate heat for households or industries.

These dynamics can highly favor economies of scale, where big miners get higher rewards from the network and become bigger. Meanwhile, small and medium players could be forced to capitulate from the activity by selling BTC reserves or mining infrastructure.

In the long run, these events could contribute to an increased centralization of a few big entities, as Finbold reported.