The Federal Open Market Committee (FOMC) meets today, July 31, to decide on the Federal Reserve’s interest rate target. This decision, followed by Jerome Powell’s speech, can impact all finance markets, including commodities and silver prices.

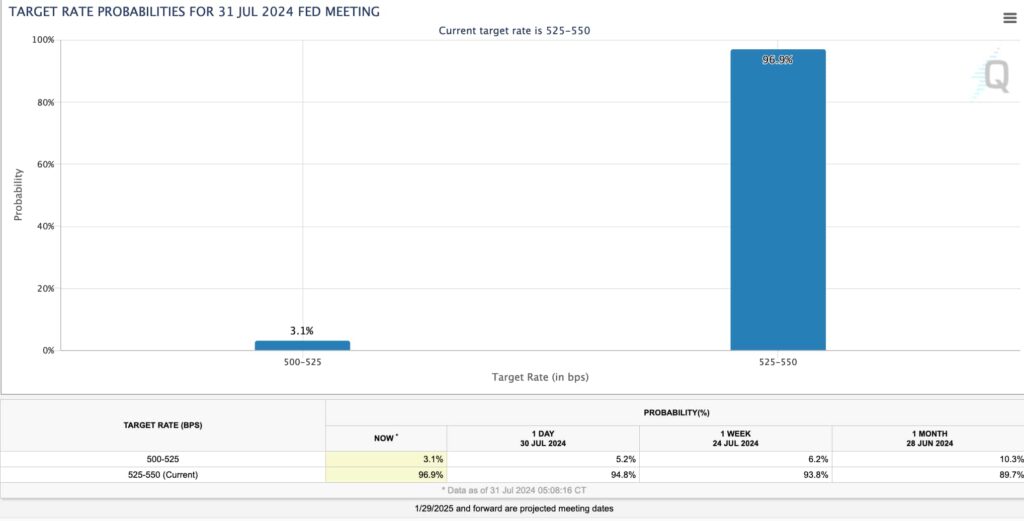

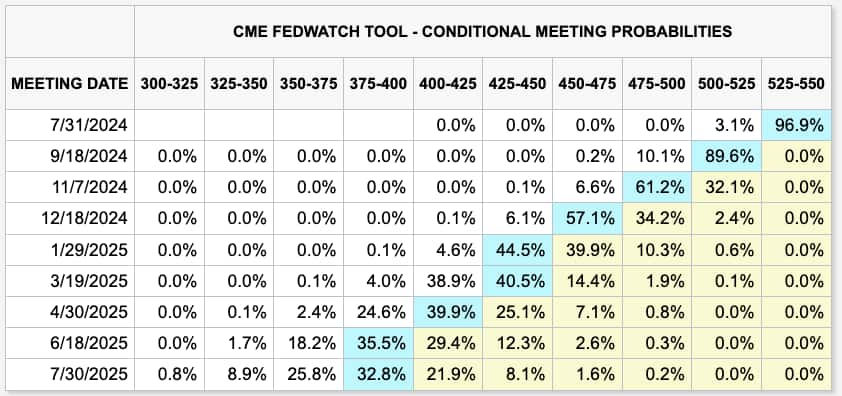

Notably, the market is 97% certain the Fed will leave interest rates uncut at 525 to 550 basis points (bps). Data from CME FedWatch shows how the bond market has gradually priced another neutral FOMC decision, reflecting on risk assets.

However, investors’ attention will not be on the expected interest rate decision but on the following speech. Jerome Powell will make the FOMC’s statement and answer media inquiries after the meeting, which could hint at the outcomes of the next meeting.

Right now, the same market prices a nearly 90% chance of an interest rate cut on September 18. Thus, Powell’s words could send waves to the finance market, and leading commodities like silver could react accordingly.

Silver (XAG/USD) price analysis

By press time today, silver (XAG/USD) was trading at around $28.55, testing previous price support – now a resistance.

Interestingly, this key level matches silver’s 100-day exponential moving average (1D 100-EMA). As of this writing, XAG/USD struggles slightly above the 100-EMA on the daily chart.

A confirmation above this level would be perceived as a bullish signal, targeting the range’s top at around $32.51. Analysts seem to believe that a dovish speech could trigger this breakout and upcoming confirmation, while a hawkish speech would do the opposite.

Moreover, increasing industrial demand can highly impact silver’s performance moving forward.

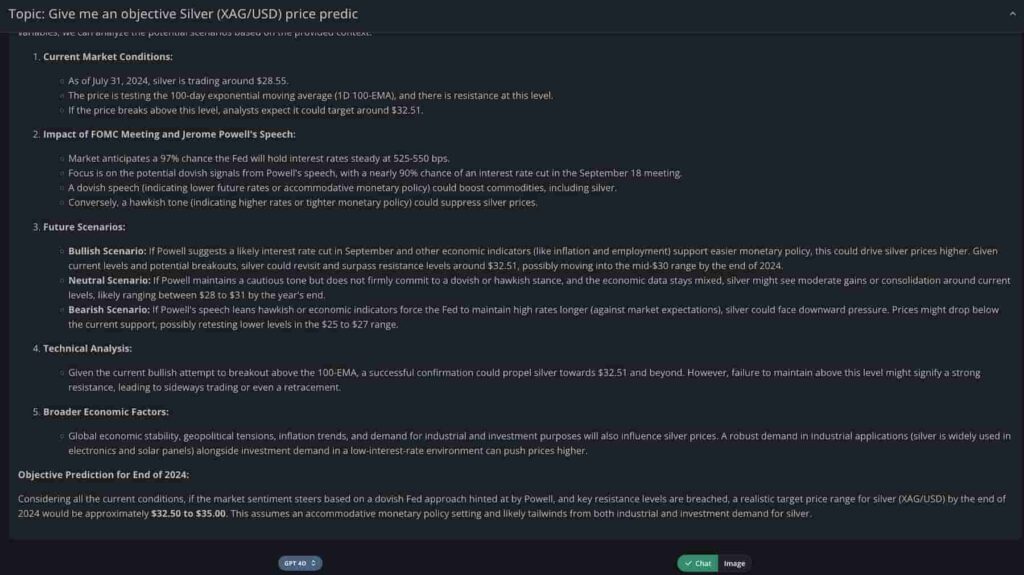

ChatGPT-4o predicts silver price after today’s FOMC meeting

In this context, Finbold turned to OpenAI‘s most advanced artificial intelligence (AI) model, ChatGPT-4o, for insights.

After providing the AI with the above report, ChatGPT-4o returned an objective forecast of silver’s price after today’s FOMC meeting.

In summary, if the observed trends continue, silver is expected to trade between $32.5 and $35.0 by the end of 2024.

Nevertheless, nothing is guaranteed, and traders should apply proper risk management while speculating on precious metals and other assets.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.