To understand the influence of artificial intelligence on the S&P 500, look no further than the story of Super Micro Computer (NASDAQ: SMCI) stock. It is a prime example of how AI advancements have boosted the semiconductor industry.

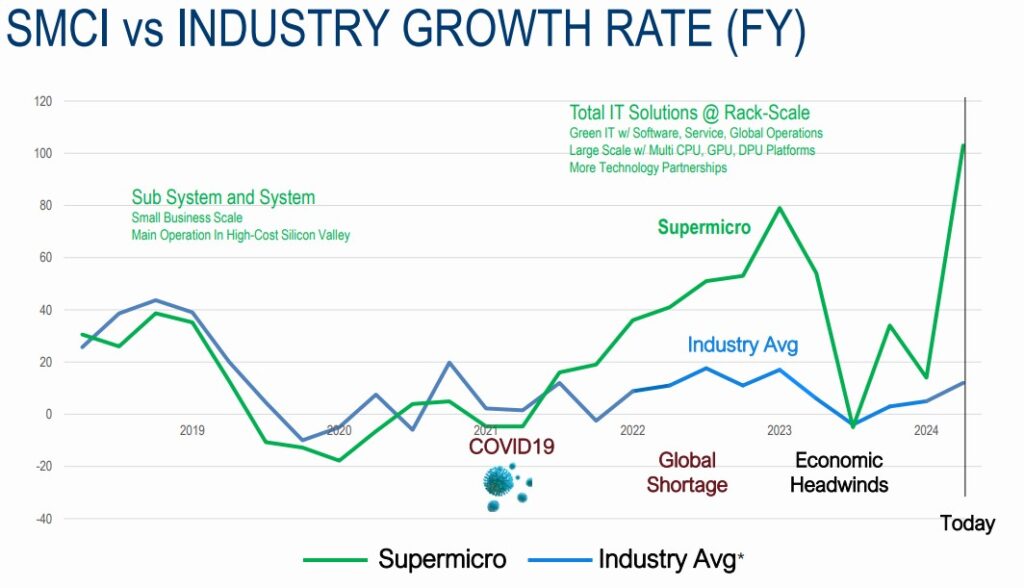

In 2024 alone, Super Micro Computer’s stock has soared by over 270%, marking an almost 1,000% increase over the past year. With a market capitalization of $64 billion, the company now stands as the 138th largest in the US, a remarkable ascent considering its absence from the top 1,000 just two years ago.

This surge underscores the significant impact of artificial intelligence, which has contributed trillions of dollars to market capitalization since 2022.

Picks for you

Inclusion in the S&P 500 could drive SMCI stock even higher

Super Micro Computer’s stock skyrocketed after its inclusion in the S&P 500 index by S&P Dow Jones indices.

On March 4, after the announcement, the 31-year-old server and computer infrastructure company experienced an unprecedented surge, with shares jumping by over 18% in trading, adding over $220 per share.

Currently, SMCI boasts a market capitalization of approximately $63 billion, significantly surpassing the median market cap of S&P 500 companies, which stands at $33.7 billion.

AI hype positions SMCI to answer an increasing demand

Super Micro Computer focuses on delivering comprehensive servers and storage systems to data centers and major corporations. Unlike Nvidia (NASDAQ: NVDA), which specializes in manufacturing specific components like GPUs and RAM, Supermicro integrates these components into complete server racks customized for large enterprise clients.

With the rise in corporate AI budgets, the California-based company is witnessing strong demand, as its servers serve as the foundation for executing AI projects. While catering to various market sectors, SMCI’s GPU-powered AI server solutions have become increasingly vital to its revenue.

SMCI’s recent inclusion in the S&P 500 and the growing demand for AI solutions from industry giants are setting the stage for potentially unpredictable profits for its stock. The company’s remarkable growth has led analysts to repeatedly revise their targets, with each new target surpassing the previous one.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.