More controversy looms over Solana’s (SOL) decentralized finance (DeFi) as the crypto community discusses Maximum Extractable Value (MEV) tactics.

According to sources, a single Solana validator has extracted over $60 million from “Sandwich Attacks” in a month. This was done using Solana’s blockchain architecture – which facilitates MEV activities like sandwich attacks – to its benefit and users’ harm.

The onchain and DeFi analyst, core developer of DefiLlama, 0xngmi, commented on the matter, highlighting the $60 million profit. “And that’s only profits,” he added. “Total user losses are higher because you need to include validator bribes,” the transaction priority fees users have to pay.

Arsc: The Solana validator profiting from MEV sandwich attacks

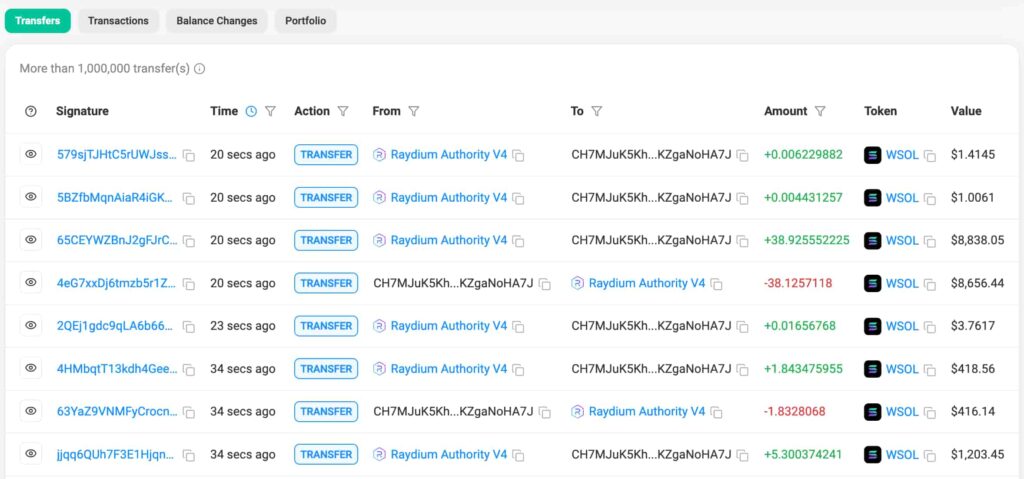

Essentially, the discussion gained traction once Ben, the core developer of Temporal (@temporal_xyz), posted about the matter on December 10. Ben revealed three accounts linked to Arsc that are actively used to carry out the attacks and stake the profits.

According to the post, Arsc is a Solana validator that uses its block-producing privileges to front-run users with a sandwich attack bot, aiming to increase its revenue from Maximum Extractable Value tactics.

As a solution to the problem, Ben proposes either whitelisting/blacklisting “good/bad” validators or using a Public mempool. Both solutions, however, involve some sort of centralized coordination and received criticism from other experts and commentators.

“Whitelist/blacklist just leads to censorship, centralization, and backroom deals,” said Viktor Bunin, Protocol specialist at Coinbase. “The way to decrease sandwiching is through better slippage parameterization, intents/solvers, better dex design, or a rebate solution like Flashbots Protect.”

What is an MEV sandwich attack, and why Solana?

An MEV Sandwich Attack in Solana involves malicious actors exploiting transaction ordering to profit at the expense of regular users. This manipulation ensures the user always gets the worst price while the attacker reaps the benefits.

These actors, typically validators or those with access to private mempools, place two transactions around a target user’s transaction: one before buying the asset at a low price and another after selling it at a higher price, thus “sandwiching” the user’s trade.

Essentially, this practice harms users by increasing their transaction costs and reducing the fairness of the trading environment. Only a few validators benefit, as they control the transaction order in Solana’s leader-based block production system.

Interestingly, Solana’s architecture makes it particularly conducive for such attacks due to its high-speed transaction processing and absence of an in-protocol mempool. Instead, some validators use private mempools which allow them to see and manipulate transactions before they are finalized. This scenario has led to significant MEV revenue for these validators, often at the direct cost of user experience and network integrity.

Moreover, Solana’s architecture makes it difficult for external observers to spot MEV tactics like sandwich attacks, raising concerns about data obscurity and questions on how much of Solana’s Real Economic Value (REV) is actually coming from predatory value extraction.

This is especially relevant as SOL supporters often mention REV as a leading metric that puts Solana ahead of competitors like Ethereum (ETH). However, Mert—CEO of Helius Labs, Solana’s largest RPC provider—explained that Sandwich Attacks only amount to a small share of the chain’s REV.

“The last piece of data on this [sandwich attacks] is that it’s a single digit of total rev, this is what im referencing — the vast majority of revenue is via prioritizing [transactions] to land faster,” Mert said in a thread.

As things develop, traders, investors, users, and enthusiasts discuss the MEV sandwiching attacks and potential solutions. For now, users who do not want to fall victim to such attacks could use Helius tools or opt for chains with built-in MEV protection like MultiversX (EGLD).

Featured image from Shutterstock.