In a series of posts on X (formerly Twitter), The Kobeissi Letter reported market data following the June 27 U.S. presidential debate between Donald Trump and Joe Biden.

According to the page, different market indicators have favored a potential victory for Trump while pricing Biden out. This drastic market reaction has sparked intense speculation about the upcoming election’s outcome and potential economic implications.

Market sentiment over the U.S. presidential debate

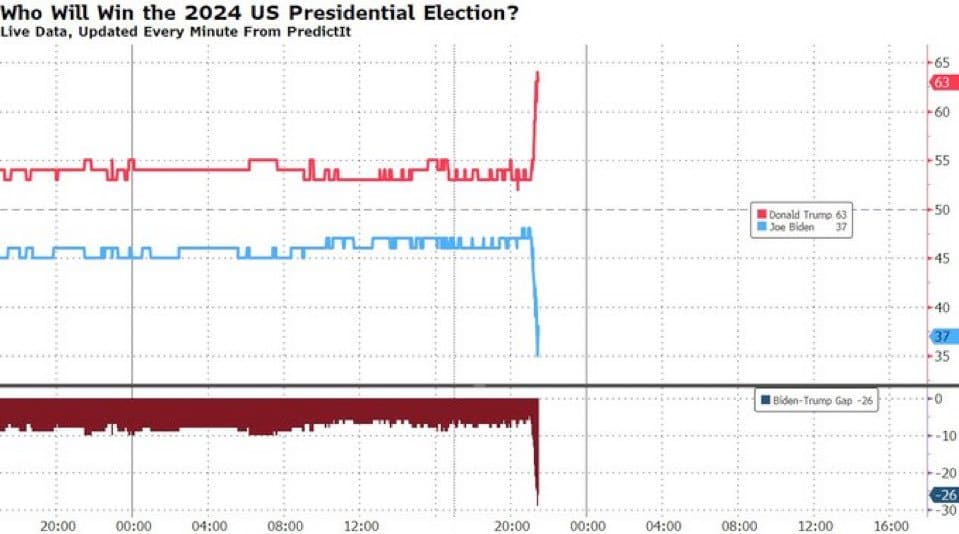

The debate’s aftermath saw a significant market reaction, with odds favoring a Donald Trump victory climbing to 63%. Simultaneously, President Biden’s chances of securing a second term plummeted by 15 percentual points since the debate began. The Kobeissi Letter‘s post highlights the market betting strongly on Trump.

This sudden change in perception has sent shockwaves through financial markets, prompting investors to reassess their strategies.

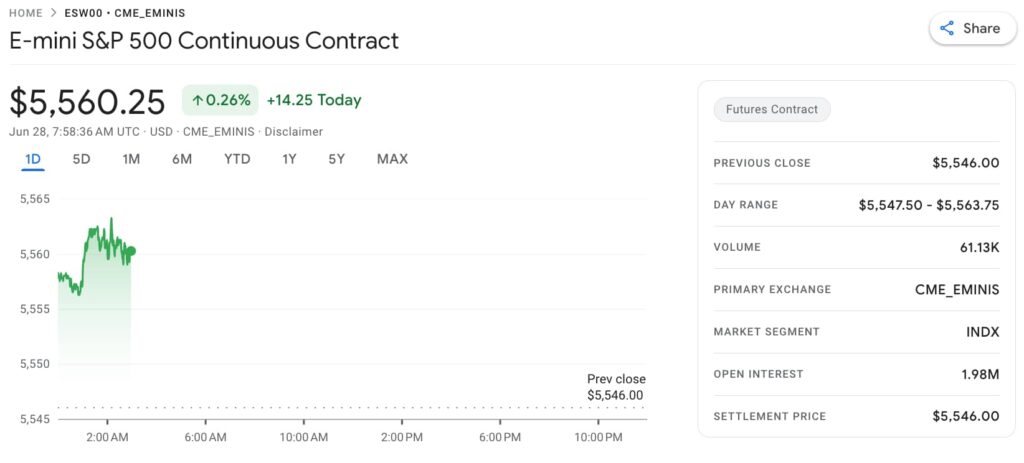

Moreover, the S&P 500 index inched closer to its all-time high, reaching within 15 points of breaking new ground. This surge reflects growing investor confidence in a potential Trump administration and its projected economic policies. As a result, market volatility is expected to spike by over 25% in the coming months leading up to the November election.

U.S. Dollar strengthens amidst political uncertainty

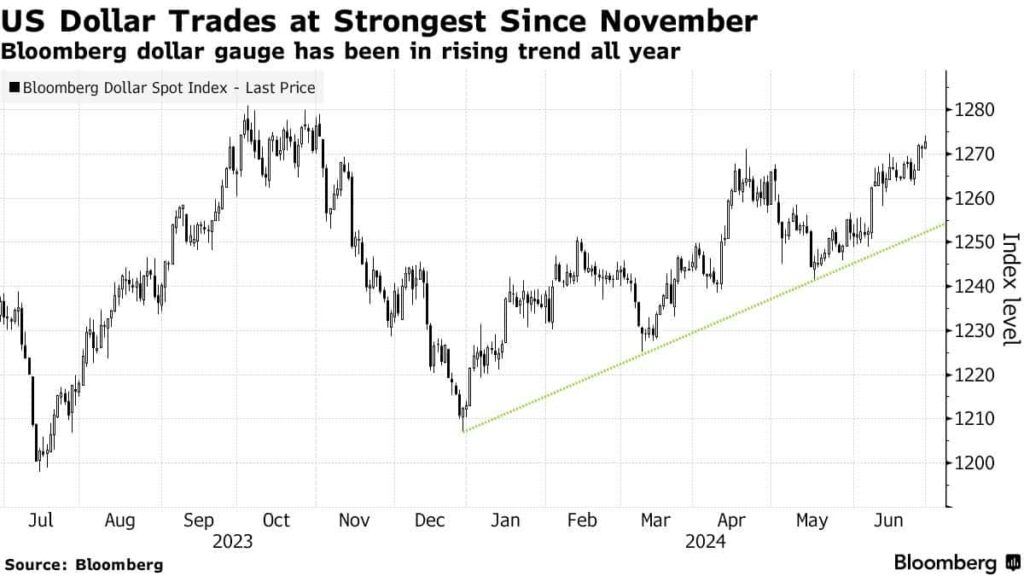

The ripple effects of the U.S. presidential debate extended beyond the stock market. The Kobeissi Letter also reported that the dollar surged to its strongest level since November. This simultaneous rise in both the S&P 500 and the U.S. Dollar underscores the complex interplay between political events and financial markets.

With the S&P 500 on the brink of a new high and the USD up approximately 6% year-to-date, investors are closely monitoring both the election developments and potential Federal Reserve actions. These factors are likely to play crucial roles in shaping market trends in the coming months.

Notably, the E-mini S&P 500 continuous contract traded at $5,560 by press time, while futures contracts’ previous close was $5,546. The index went as high as $5,562 in the pre-market, foreshadowing a volatile day for stocks.

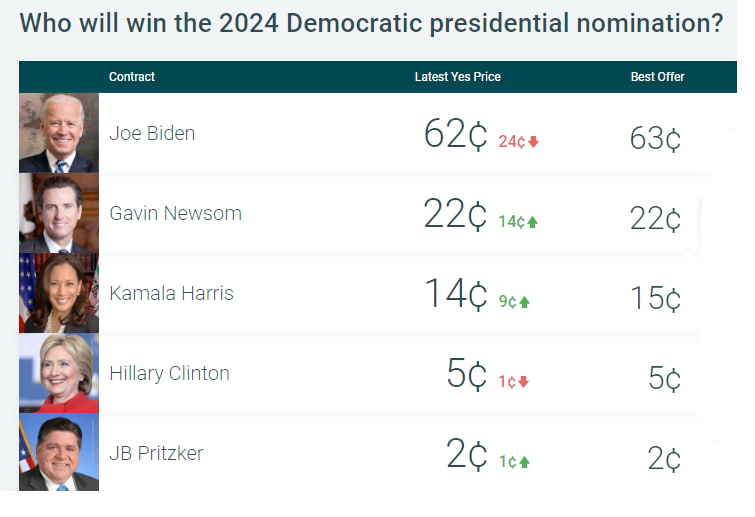

Democratic nomination odds in flux, prices out Biden

Perhaps the most surprising development following the debate was the dramatic shift in odds for the Democratic nomination. Within just two hours, the likelihood of President Biden securing his party’s nomination plummeted by 24%. This unprecedented change has opened the door for other potential Democratic candidates to enter the race.

Currently, markets are pricing in a 38% chance that Biden will not be nominated as the Democratic candidate. Alternative contenders such as Gavin Newsom and Kamala Harris have seen their odds increase, with a 22% and 14% chance of winning the nomination, respectively.

Looking ahead: A volatile election season

As the U.S. presidential debate hints and the election draws nearer, market analysts anticipate a period of heightened volatility. The unexpected shifts in both party nominations and general election odds have created an atmosphere of uncertainty that is likely to persist until November.

Investors and political observers alike are bracing for what promises to be a tumultuous four months. With the potential for further surprises and market fluctuations, all eyes remain fixed on the evolving political landscape and its impact on global financial markets.

In conclusion, the recent US Presidential debate has triggered a seismic shift in market sentiment, reshaping expectations for both the upcoming election and its economic consequences. As the situation continues to unfold, market participants must remain vigilant and adaptable in the face of rapidly changing circumstances.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.