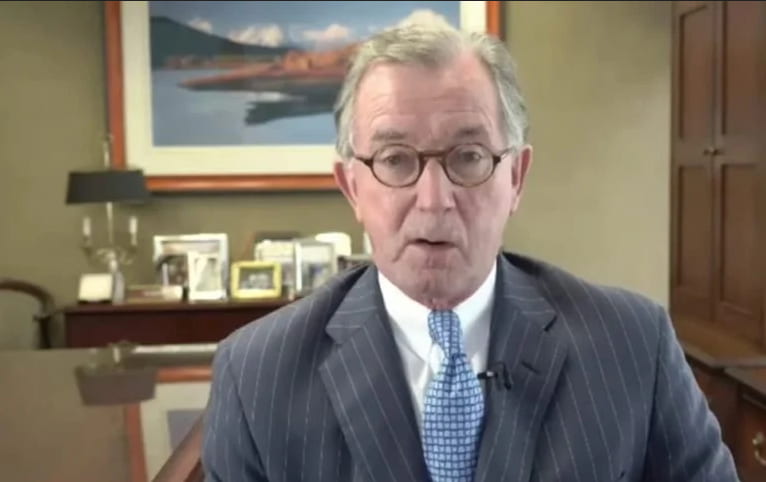

The founder of investment advisory firm Oxbow Advisors, Ted Oakley, has said the stock market would likely experience a bear market within the next two years.

Speaking to Kitco news, Oakley indicated that the biggest risk facing investors right now is the unsustainable stock market valuations that will eventually revert.

According to Oakley, the valuation risk will continue to push the stock market to correct by about 50%, which he says won’t be a surprise.

“If you look at your standard deviations of valuation, relative to where the market is, and you just go back to an average of where it should be, that’s probably right now, somewhere between 40% and 50% break and I’m not predicting, it’s going to be 50%. It might not be this year, next year, but that’s what happens in investing,” said Oakley.

He further warned that despite the bear market experienced last year, investors had not felt the exact effect of the situation because it was short-lived.

Investors lack experience for prolonged bear market

Oakley stated that most investors had not experienced a prolonged bear market, and if the projected correction lasts for too long, it will have serious consequences. He believes that most current fund managers lack the relevant experience to handle such an environment.

On the bear market over the last year, Oakley acknowledged that it has been cruel to the market for taking down the best stocks. He stated that the situation had worn investors down, which might impact new investors with a prolonged bear market. Consequently, Oakley believes the situation will result in zero liquidity.

While acknowledging that the stock market is a high risk, he warned that investors should practice balance in what they invest in.

For instance, he said that investors need to hold for a while recommended owning inflation-sensitive products. According to Oakley, if investors manage to keep an eye on the inflation situation, they will easily maneuver the stock market.

Earlier, Oakley said despite widespread expectations, a stock market crash was not imminent, but investors should focus on warning signs.

He suggested that there is also a possibility the markets can hit the lows witnessed in the first quarter of last year in the wake of Covid-19. He warned that if the markets are not prepared for inflation, they might go back into a slowdown.

Related video: 50% stock market crash ‘wouldn’t surprise me’; This is the biggest risk today – Ted Oakley

[coinbase]