After three U.S. servicemen were killed in a drone strike, and more than 30 others were injured in Jordan, President Biden vowed to retaliate in a move that could put additional strain on already tense relations between the U.S. and Iran, albeit without direct evidence linking Iran to the incident presented at this juncture.

Amid the ongoing Israel-Hamas war that is driving the price of commodities up, especially oil and gold, the additional conflicts in the region might present opportunities for some sectors, notably companies within the U.S. defense industry. However, it’s crucial to consider the broader economic and humanitarian impacts of such escalations.

Finbold compiled a list of three stocks that could benefit from another conflict in the Middle East.

Lockheed Martin (NYSE: LMT)

Lockheed Martin (NYSE: LMT) stands as the globe’s premier defense company and is the largest contractor for the U.S. government. Additionally, it serves as the principal contractor for the F-35 Joint Strike Fighter, recognized as the world’s most costly aircraft.

The company’s prominence in advanced fighter planes, sophisticated missiles, and state-of-the-art electronics comes from its utilization of robust research capabilities.

At the time of press, LMT stock was trading at $431.26, showcasing a gain of 0.31% in the pre-market trading since January 26. In the past five trading sessions, this stock lost -6.15% of its value.

Boeing (NYSE: BA)

With a series of incidents that have troubled Boeing (NYSE: BA), with the door panel being blown out mid-flight on one of its aircraft being the most serious one, Boeing might look at the current world events with a sigh of relief.

Boeing’s defense division is a formidable entity within the industry, achieving a status among its giants. The company is actively engaged in producing various aircraft and helicopters for the Pentagon, as well as participating in space-related endeavors. Furthermore, Boeing’s defense portfolio has expanded to include autonomous submarines and various other innovative products.

At the time of writing, BA stock was trading at $207.62, with a gain of 1.05% in the pre-market trading in the past five trading sessions. However, this stock lost -3.62% of its value.

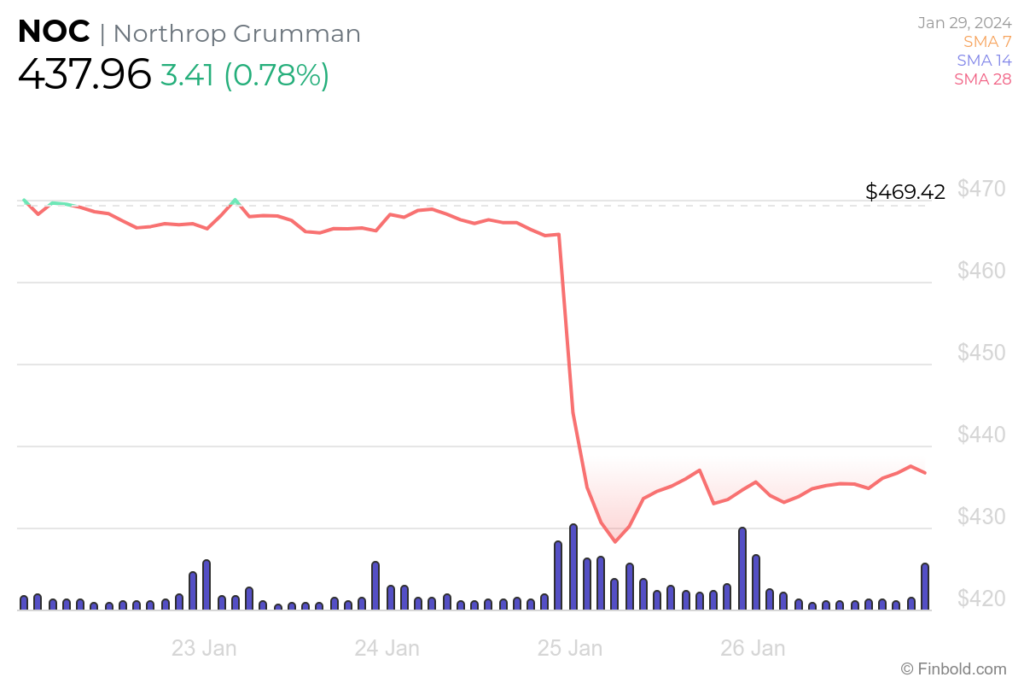

Northrop Grumman (NYSE: NOC)

Well-versed in the defense industry, Northrop Grumman (NYSE: NOC) acts as one of the largest suppliers of the U.S. Army with an extensive portfolio of different weapons and vehicles.

Northrop Grumman plays a pivotal role in the development of stealth bombers and boasts a substantial portfolio in the realm of space. The company is intricately connected to the nuclear triad, which encompasses a fusion of nuclear missiles, bombers, and submarines.

At the time of reporting, NOC stock was trading at $437.96, with an increase of 0.61% in the pre-market trading, while losing -6.47% in the past five trading sessions.

It is interesting to see that all three stocks have recorded gains in the pre-market trading, showcasing the immediate impact of news on the defense industry’s market dynamics.

Readers are encouraged to conduct their research and consider the ethical implications of their investment choices.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.