The semiconductor industry has become a hotbed of innovation, driven by surging demand for artificial intelligence (AI) and high-performance computing (HPC).

According to the Semiconductor Industry Association, Global semiconductor sales reached a record-breaking $55.3 billion in September 2024, marking a 10.2% quarterly growth—the fastest pace since 2016.

Against this backdrop, Taiwan Semiconductor Manufacturing Company (NYSE: TSM) and Intel (NASDAQ: INTC) stand out as key players, albeit with vastly different trajectories.

While TSMC continues to cement its position as the market leader, Intel grapples with challenges, including a significant leadership shakeup in 2024.

With Intel’s stock trading at decade-low levels, investors are left wondering whether this is a “buy the dip” moment or if TSMC offers a more secure growth trajectory, prompting Finbold to turn to OpenAI’s latest AI tool, ChatGPT-4o, for an in-depth analysis of both semiconductor giants.

Taiwan Semiconductor: The market leader

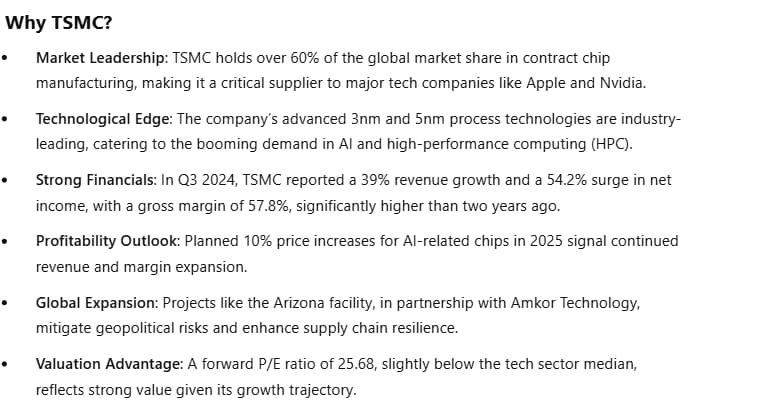

TSMC is the world’s biggest contract chip manufacturer, boasting over 60% market share. Its advanced technology, particularly in 3nm and 5nm processes, has solidified its role as a critical supplier to tech giants like Nvidia (NASDAQ: NVDA) and Apple (NASDAQ: AAPL). In Q3 2024, TSMC’s revenue soared by 39%, while net income jumped 54.2%, underscoring its robust operational efficiency.

The company’s gross margin reached an impressive 57.8%, up from 43.4% two years ago, thanks to strong pricing power and high utilization rates.

Notably, according to Morgan Stanley, TSMC plans to increase prices for AI-related chips by up to 10% in 2025, further boosting its profitability. The forward P/E ratio of 25.68, slightly below the tech sector median, suggests it offers solid value given its growth trajectory.

Globally, TSMC is expanding its footprint with projects like its Arizona facility in partnership with Amkor Technology. This collaboration will enhance its advanced packaging and testing capabilities, catering to high-performance computing and communications markets

However, challenges loom. The company’s reliance on sustained AI infrastructure spending leaves it vulnerable to potential slowdowns in capital expenditures.

Additionally, its Taiwan-based operations face geopolitical risks, including tensions with China, which claims the territory. The geopolitical landscape, coupled with uncertainties tied to the incoming U.S. presidential administration, adds further complexity.

Intel: Betting on a turnaround

Intel has endured a tumultuous period, with its stock plunging nearly 50% year-to-date. Its foundry business, launched in 2021, has underperformed, with Q3 revenue falling 8% year-over-year to $4.4 billion.

Meanwhile, its data center and AI segment posted a modest 9% growth, a stark contrast to AMD’s 122% surge in the same space.

Intel is attempting to claw back market share with next-gen processors like Panther Lake, slated for release in late 2025. Additionally, the company plans to restructure its foundry division into an independent subsidiary to attract external funding and better serve customers.

Despite its challenges, Intel’s lower valuation, reflected in a P/E ratio of 32.96, makes it an intriguing prospect for value-focused investors.

However, the company’s reliance on Taiwan Semiconductor Manufacturing Company for critical components shows its vulnerabilities. Intel’s domestic fabs are unlikely to generate meaningful revenue before 2027, delaying its turnaround potential.

Still, if Intel executes its strategy effectively, it stands to benefit from a broader recovery in the U.S. semiconductor sector. Citi analysts anticipate a rebound in the global semiconductor market, providing a potential tailwind for Intel’s ambitions

Verdict: TSMC or Intel for 2025?

According to OpenAI’s ChatGPT-4o, TSMC’s robust market leadership, strong financials, and pivotal role in the AI boom position it as the top pick for growth-focused investors.

Intel, while a speculative bet, offers a potential “buy the dip” opportunity for those confident in its turnaround and leadership overhaul.

For 2025, TSMC’s consistency and global expansion make it a safer and more compelling investment.

Featured image via Shutterstock