An analyst has declared that Tesla’s (NASDAQ: TSLA) technological advancement has elevated the company to rank among key artificial intelligence (AI) players, whose potential is yet to be fully tapped.

Particularly, Dan Ives, Managing Director at Wedbush Securities, termed Tesla ‘the most undervalued AI name in the market,’ stating that the firm is poised to revolutionize the future of autonomous driving, he said in a post on X on October 1.

Ives, a Tesla bull, noted that its potential lies in its efforts to unveil products serving full self-driving (FSD). To this end, he stressed that Tesla’s progress in AI and FSD technologies could contribute to driving the Texas-based firm’s valuation to $1 trillion.

“We believe Tesla is the most undervalued AI name in the market and we expect Musk & Co. to unveil some “game changing” autonomous technology next week in LA. We continue to believe AI/FSD represents a $1 trillion of value alone for Tesla,” he said.

Tesla will likely showcase its inroads into the AI space during the October 10 Robotaxi event. The Elon Musk-led firm is expected to demonstrate advancements in autonomous driving.

Tesla’s AI potential

Notably, Ives’s view was initially echoed by Mark Newton, a technical analyst at Fundstrat Global Advisors, who noted that Tesla might be an undervalued AI stock due to developments in areas such as humanoid robots. According to Newton, the undervaluation has been overshadowed by Musk’s social media activities.

Overall, Robotaxi is expected to have a notable impact on the stock. William Blair analyst Jed Dorsheimer noted that the unveiling might have a historical impact, as Tesla tends to surge following such events.

As analysts maintain bullishness around Robotaxi, others are of a contrary opinion. For instance, Emmanuel Rosner from Wolfe Research suggested that the event’s impact might not be immediate, as the company still needs to prove itself in the space.

Rosner indicated that it would be a good starting point if Musk and his team provided a timeline for deployment and the business model.

As October progresses, the Robotaxi unveiling is among the short-term bullish sentiments surrounding the stock, especially considering that the company is also anticipating growth in other fundamentals, such as Q3 deliveries.

In this line, while most consensus indicates that the deliveries will align with market expectations of around 460,000 units, the prediction market platform Kalshi foresees the figure coming in at 467,000 vehicles.

To put this into perspective, if the company records 467,000 unit deliveries, it will highlight an increase from Q2 2024’s figure of 443,000 cars—a 4.8% decline compared to the same quarter in 2023.

Such an impressive delivery figure would be central to helping Tesla overcome the slowdown in the EV space earlier this year.

Tesla price analysis

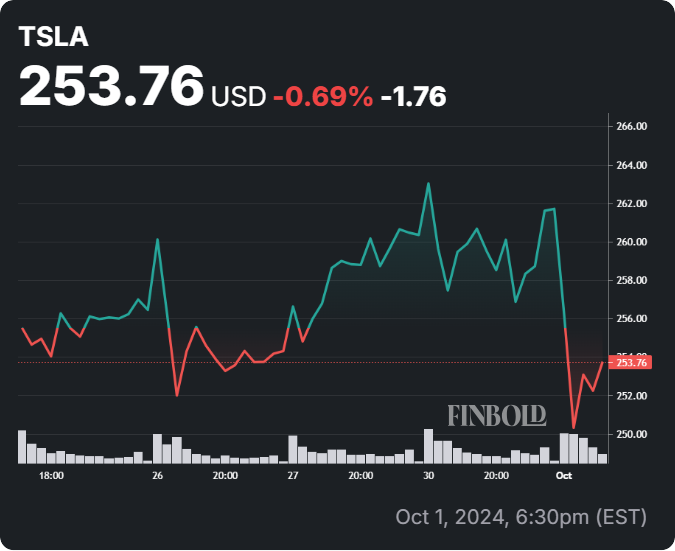

In the meantime, Tesla stock has recently reacted positively to the bullish sentiment moving into the fourth quarter, with the equity outperforming most of the market.

As of press time, the stock was trading at $253, correcting in line with the general market. It was down over 3% in the last 24 hours, and on the weekly chart, it is down 0.6%.

Considering all factors, Tesla’s technological advancements, particularly in AI and autonomous driving, are positioning the company for significant growth. While short-term challenges remain, Tesla’s long-term potential in the electric vehicle and AI sectors will likely attract investor optimism.