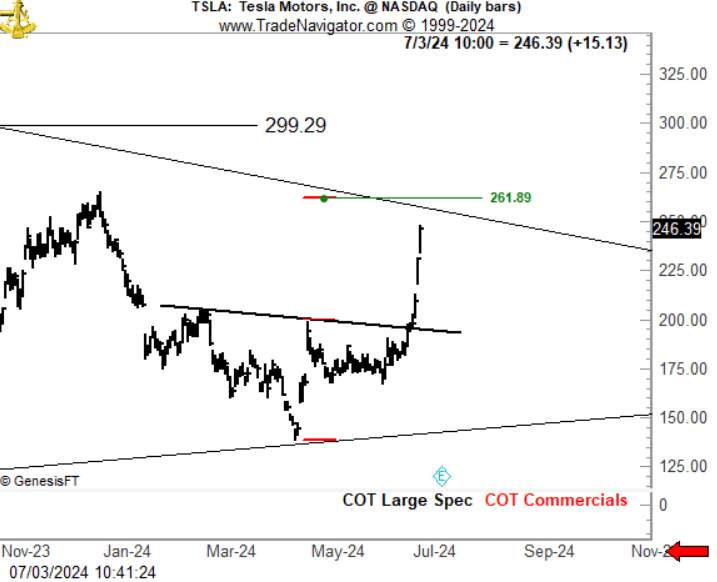

As the price of Tesla (NASDAQ: TSLA) stocks begins to make a significant move upward, renowned markets expert Peter Brandt has observed that the initial target of the current chart pattern in formation is ‘within reach,’ with shares eyeing the $262 level.

Specifically, the veteran trader has pointed out that Tesla shares have created a ‘head & shoulders’ pattern, and after hitting the bottom of this pattern, which was around $142, TSLA stock was now getting closer to the initial target of $262, as Brandt wrote in his analysis on July 3.

Furthermore, according to the legendary trader, the concerns that the price-to-earnings (P/E) ratio in Tesla stock, which currently stands at 63, with a forward P/E ratio of 73, was too high (possibly indicating that the stock is overvalued), were not worth considering.

Tesla stock price analysis

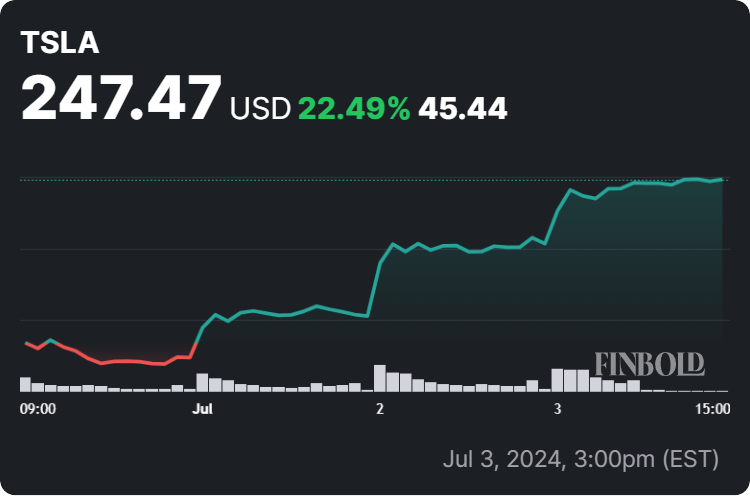

At the moment, the price of Tesla shares stands at $247.47, recording a gain of 4.10% on the day, climbing 22.49% across the week, as well as accumulating an increase of 40.98% on its monthly chart, as it reduces the year-to-date (YTD) loss to 0.82%, as per data on July 4.

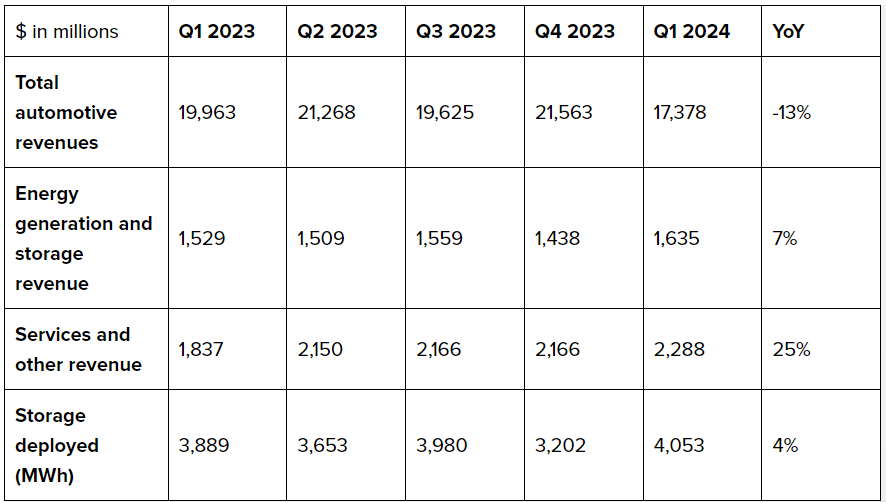

So, why is Tesla stock going up? Notably, the recent advances might be the stock finally catching up with the consistent growth of Tesla’s energy business, which has steadily increased over the last decade, or as a reaction to analysts raising their Tesla stock prediction 2025 targets.

Indeed, despite representing a small part of Tesla’s overall profits, the revenue of its energy generation and storage business has grown last quarter year-over-year (YoY), with the popular electric vehicle (EV) maker deploying 9.4 GWh of energy storage in Q2, its highest quarterly deployment yet.

What experts say

Elsewhere, Bank of America (NYSE: BAC) and Wedbush Securities analysts have raised their Tesla stock price prediction targets to $260 and $300, respectively, up from previous projections of $220 and $275, after the manufacturer’s Q2 vehicle deliveries surpassed expectations.

As a matter of fact, as Wedbush analyst Dan Ives opined, the “Tesla demand story has made a significant turn for the positive heading into 2H/2025,” and he also highlighted the company’s artificial intelligence (AI) efforts:

“Tesla AI story could be worth $1 trillion+ and is the most undervalued AI name in our view. (…) The key for Tesla’s stock is the Street recognizing that Tesla is the most undervalued AI play in the market in our view, with a historical Robotaxi Day ahead for Musk and Tesla on August 8th that will lay the yellow brick road to FSD and an autonomous future.”

At the same time, the team of analysts at BofA wrote in a recent note to investors that “the increasing number of more affordable offerings this year and going forward should drive EV volumes higher,” while Cantor Fitzgerald analyst Andres Sheppard set a price target of $230 for TSLA shares.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.