Tuesday witnessed further decline in Tesla’s (NASDAQ: TSLA) stock. The drop brought the company’s shares down by nearly 9% over the course of a week.

There are many reasons for pessimism surrounding Elon Musk’s electric vehicle (EV) maker. Firstly, it was reported that Tesla wanted to lay off more than 10% of its employees on April 15. This news came shortly after two key executives, Drew Baglino and Rohan Patel, announced their departure from the company.

These occurrences have rattled investor confidence and cast doubt on where Tesla is headed next.

To make matters worse, GLJ Research analyst Gordon Johnson held his “sell” rating on Tesla. However, Johnson even went ahead to reduce TSLA’s target price from $23.53 to $22.86.

Why does Johnson foresee a major crash for Tesla?

Johnson, a longtime Tesla bear, reveals that he worries about the company’s financial position.

His forecast is that Tesla will report its first negative free cash flow quarter since 2020, a serious sign of economical distress. Apart from the immediate financials, Johnson flags a disturbing triad consisting of excess supplies, weakening consumption, and surging stock of goods.

This suggests that Tesla may be producing vehicles quicker than it can sell them, potentially leading to price reductions or stagnant sales numbers.

In addition to this, Johnson presents several worrying trends in China which is a vital market for Tesla.

Weak insurance registration data suggests a potential slowdown in Chinese consumer interest for Tesla vehicles. These combined factors could culminate in a huge drop in its stock price.

Besides Johnson latest warning, Tesla has reportedly abandoned plans for an affordable Model 2 priced at around $25,000, shifting its focus to a new Robotaxi initiative while also facing issues with both Cybertruck deliveries and production.

What is the analyst consensus for TSLA?

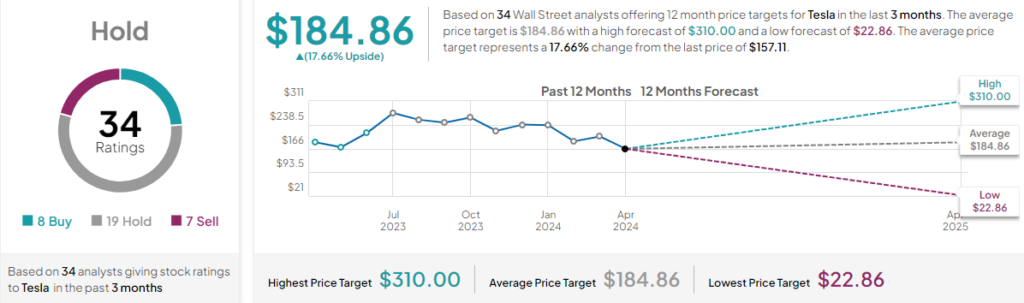

While it is difficult to tell at this point whether Johnson is right or wrong, based on the opinions of 34 Wall Street analysts taken into account by TipRanks, he still appears to be an outlier with his forecast.

On average, experts foresee a notable 17.77% upside for Elon Musk’s EV maker and set the 12-month price target at $184.86.

As of the time of publication, Morgan Stanley remains the analyst with the highest price target – $310 – and Johnson with the lowest – $22.86.

Most analysts – 19 of them – recommend investors and traders hold Tesla stock. Another 8 believe it is the right time to buy, while 7 believe selling is the right call.

On Monday, Wedbush’s analyst Dan Ives stated:

“We need to hear the rationale for the cost cutting, the strategy going forward, product roadmap, and an overall vision from Musk otherwise many investors might head for the elevators during this Category 5 perfect storm of weak demand Tesla is seeing globally in 2024,” Ives said in a note to clients.

Even with his worries about Tesla’s current situation, Ives remains bullish. He maintains an “outperform” rating for the stock, meaning he expects it to perform better than the overall market.

Furthermore, his price target of $300 is nearly double the recent trading price of around $157.

TSLA price analysis

At press time, TSLA stands at $156.97, indicating a significant loss of 7.86% over the past five days, along with a larger decline of 8.97% over the past month.

The year-to-date (YTD) performance shows the most substantial decrease, with a decline of 36.30%.

According to technical analysis, TSLA’s stock price is expected to remain flat in the coming days, possibly with a short-term bearish reversal.

Momentum is currently neutral, but there are signs that it could swing either way.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.