Tether minted another $1 billion worth of USDT on April 16, as the cryptocurrency market accumulated significant losses. The billionaire issuance raised criticisms and questions about its legitimacy, while Tether’s CEO disclosed the issuance as “inventory replenishment.”

In particular, WhaleWire called Tether out a few minutes after the mint occurred through a post on X (formerly Twitter).

“JUST IN: Another $1,000,000,000 worth of unbacked Tether USDT has been printed out of thin air.”

– WhaleWire

Notably, Tether minted the $1 billion USDT through a smart contract on the Tron Network (TRX). The issuer sent the tokens to the Tether Treasury account labeled by TronScan. As of writing, the account holds $1.19 billion in its stablecoin.

Tether $1 billion USDT inventory replenishment

However, Paolo Ardoino, Tether’s CEO, made a public service announcement on X right after the mint. On that announcement, the CEO disclosed this activity as “inventory replenish,” while explaining this was “authorized but not issued transaction.”

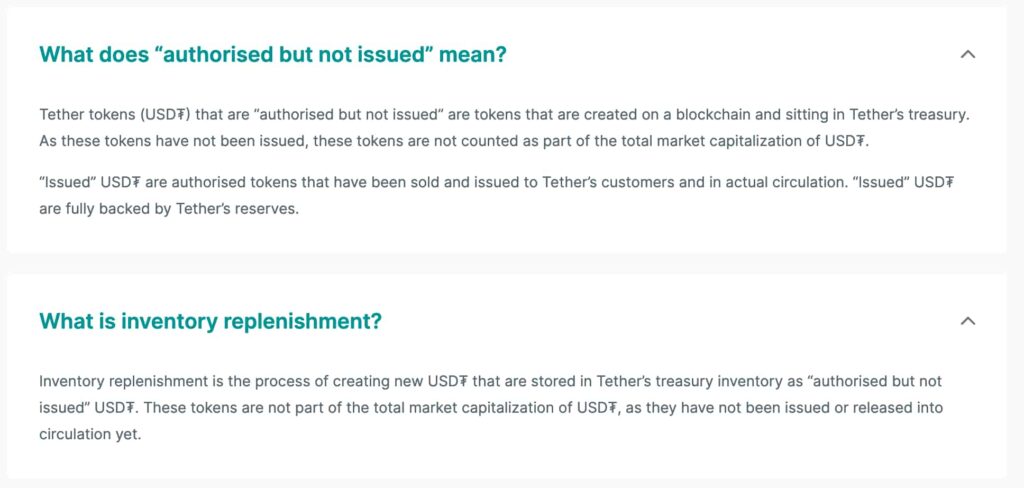

According to Tether’s website, this means that the company reserves do not yet back this amount, explaining WhaleWire‘s “unbacked” criticism.

“Tether tokens (USD₮) that are “authorised but not issued” are tokens that are created on a blockchain and sitting in Tether’s treasury. As these tokens have not been issued, these tokens are not counted as part of the total market capitalization of USD₮.

“Issued” USD₮ are authorised tokens that have been sold and issued to Tether’s customers and in actual circulation. “Issued” USD₮ are fully backed by Tether’s reserves.”

– Tether’s FAQ

Tether’s ability to easily create billions of dollars worth of unbacked tokens with a few lines of code has raised many controversies around the company. Interestingly, BlackRock (NYSE: BLK) mentioned significant risks related to the crypto market’s high exposure to USDT on its ETF filings.

Furthermore, Circle, the USDC issuer, in partnership with Coinbase, publicly encouraged the U.S. Congress to “go after” Tether.

As a result, these minting activities and the lack of further disclosure on burns and issuance sums up the uncertainties surrounding the company and the stablecoin responsible for the vast majority of cryptocurrencies‘ liquidity in exchanges.