Ethereum (ETH) is up 25% in 15 days, and it could be just the beginning of a massive bull run as it consolidates as the “second best” cryptocurrency. Analysts believe the spot Ethereum ETFs have fueled this performance, and they start trading today, on July 23.

Notably, it has been a volatile ride for ETH investors in 2024. Ethereum’s native token went from $2,140 earlier this year to as high as $4,091 in mid-March.

Currently, the second-largest cryptocurrency by market capitalization trades at $3,525, waiting for the United States market to open. It marks a 25% rally in 15 days since the local bottom on July 29 at $2,827. Analysts weigh in as this could be the first impulse of a larger run.

In particular, this happens amid high expectations related to the first trading day of the recently approved exchange-traded funds.

BlackRock promotes Ethereum to retail investors and institutions

The Securities and Exchange Commission (SEC) has approved Ethereum ETF issuers to start trading the eagerly awaited investment vehicle. This important milestone will give traditional finance U.S. retail investors and institutions exposure to the leading Web3 and decentralized finance (DeFi) asset, opening doors for education and future adoption.

In this context, financial titan BlackRock (NYSE: BLK) has released an educational video promoting its fund ETHA. The ETF expert, Eric Balchunas, shared the video on X, highlighting “BlackRock’s Ether pitch to normies.”

Balchunas weighed in and explained the importance of this exposure, considering over $15 trillion in assets under management by TradFi. According to him, a fraction of this capital could inflow into Ethereum and into the Ethereum ecosystem at one point.

ETH is trending

As things develop, ETH is trending on Santiment‘s social index, with a mostly positive sentiment. With 59.45% positive mentions and discussions on social platforms, the market broadcasts a strong bullish bias toward Ethereum.

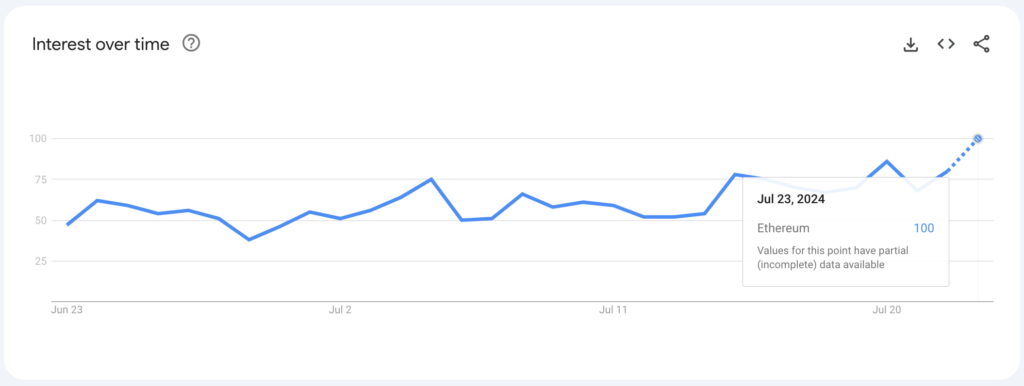

Moreover, interest in “Ethereum” on Google is also rising as people start searching more about the cryptocurrency.

Overall, things look positive for Ethereum, and analysts expect further growth as the ETH ETFs start trading today. BlackRock and other issues are actively promoting the token, which can attract fresh capital from traditional finance. Nevertheless, cryptocurrencies are highly volatile and risky assets, demanding caution from investors looking for exposure.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.