Warren Buffett’s time-tested investment strategy has turned Berkshire Hathaway (NYSE: BRK.A, BRK.B) from a modest textile operation into a $1 trillion conglomerate anchored in value investing principles.

The legendary investor’s portfolio is packed with what many describe as ‘forever‘ stocks—companies boasting strong fundamentals, solid valuations, and durable competitive advantages, capable of weathering economic headwinds while delivering steady long-term returns.

As the broader stock market struggles to find stability in 2025, weighed down by inflation concerns, trade tensions, and looming recession fears, Berkshire Hathaway stands out as one of the few consistently performing giants. Two of Buffett’s holdings—Nu Holdings (NYSE: NU) and VeriSign (NASDAQ: VRSN) stand out with year-to-date gains exceeding 15%.

Nu Holdings (NYSE: NU)

Nu Holdings has delivered over 15% year-to-date gain, climbing to $11.95, even after facing a sharp correction in February. While the stock remains around 25% below its 52-week high, the company’s growth trajectory and financial performance continue to highlight its long-term potential.

In Q4 2024 alone, Nu added 4.5 million new customers, ending the year with 114.2 million customers across Brazil, Mexico, and Colombia, a 22% increase year-over-year.

In Brazil, the company now serves 58% of the adult population, consolidating its position as the third-largest financial institution by customer count.

Expansion in Mexico and Colombia also accelerated, with Nu surpassing 10 million customers in Mexico, where deposits soared 438% to $4.5 billion, and deposits in Colombia reaching $1.3 billion within two quarters of launching checking accounts.

The company’s deposit base also expanded 55% to $28.9 billion, and its total lending portfolio grew 45% year-over-year, driven by secured lending growth in Brazil. Average revenue per active customer (ARPAC) also rose 23% to $10.7, highlighting the effectiveness of Nu’s cross-selling strategy.

Still, despite these strong results, the stock has faced pressure earlier this year. Investors are weighing Nu’s aggressive expansion strategy, particularly in Mexico and Colombia, where customer activity rates still lag behind Brazil.

Analysts also note potential margin pressures as Nu continues investing in long-term initiatives such as Nu Travel, NuPay, and its telecom service NuCel, which could weigh on short-term profitability.

Moreover, Brazil’s macroeconomic environment marked by interest rate volatility and inflation concerns adds another layer of uncertainty to Nu’s credit expansion strategy. Yet, for long-term investors following Warren Buffett’s strategy, its scale, customer loyalty, and low-cost digital model offer plenty of reason to stay optimistic.

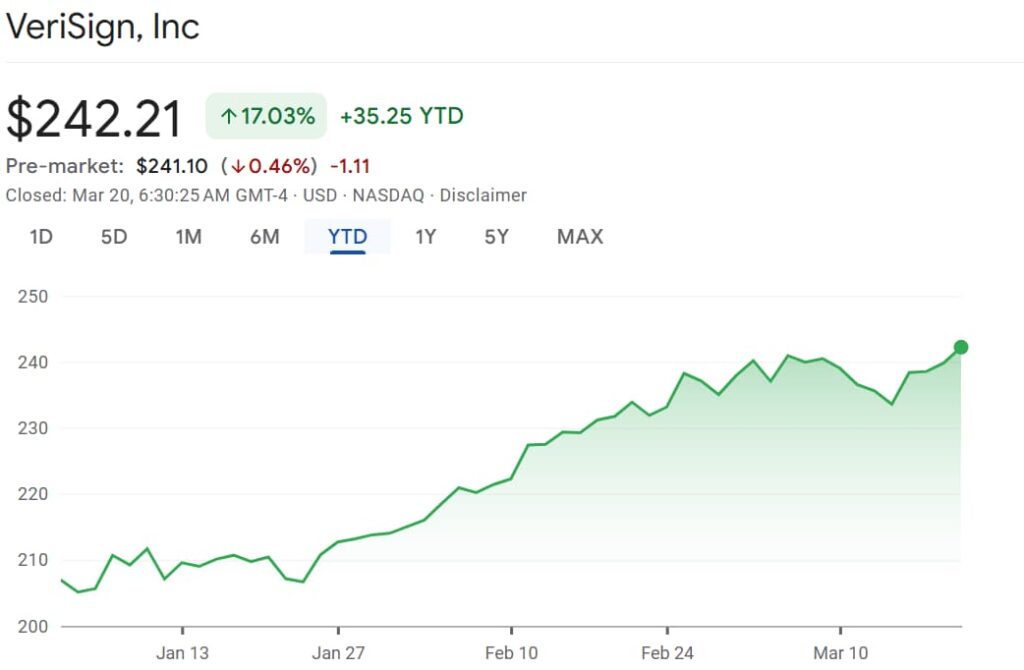

VeriSign (NASDAQ: VRSN)

Another Buffett-favored stock performing well is VeriSign, currently trading at $242.21 with a 17% year-to-date gain. The conglomerate first initiated a position in VeriSign back in Q4 2012, acquiring 3.69 million shares at an average price of $41.62.

After steadily increasing its stake through mid-2014, Berkshire paused its buying activity until recently.

VeriSign fits well into Warren Buffett’s value-investing philosophy. The company manages the .com and .net domains under long-term contracts extending through 2030 and 2029, respectively, consistently renewing these rights since 2000.

Moreover, VeriSign’s performance has remained relatively steady, with revenue growing 4% year-over-year in 2024 to $1.56 billion. Net income has shown more volatility rising 21% in 2023 to $818 million before declining 4% in 2024 to $786 million.

While some investors may question VeriSign’s long-term growth prospects, its blend of modest but stable growth and market dominance makes it a reliable long-term investment.

For risk-averse investors looking to align with Buffett’s approach, holding Berkshire Hathaway stock itself offers diversified exposure to these and other value-driven picks with Berkshire’s own stock still up 15% year-to-date.

Featured image via Shutterstock