The following guide will explain what value investing is, how it differs from other main investing strategies, and determining how stocks become undervalued compared to their trading price. We’ll also include key metrics to analyze when buying discounted stocks, their key characteristics, and the risks involved.

What is value investing?

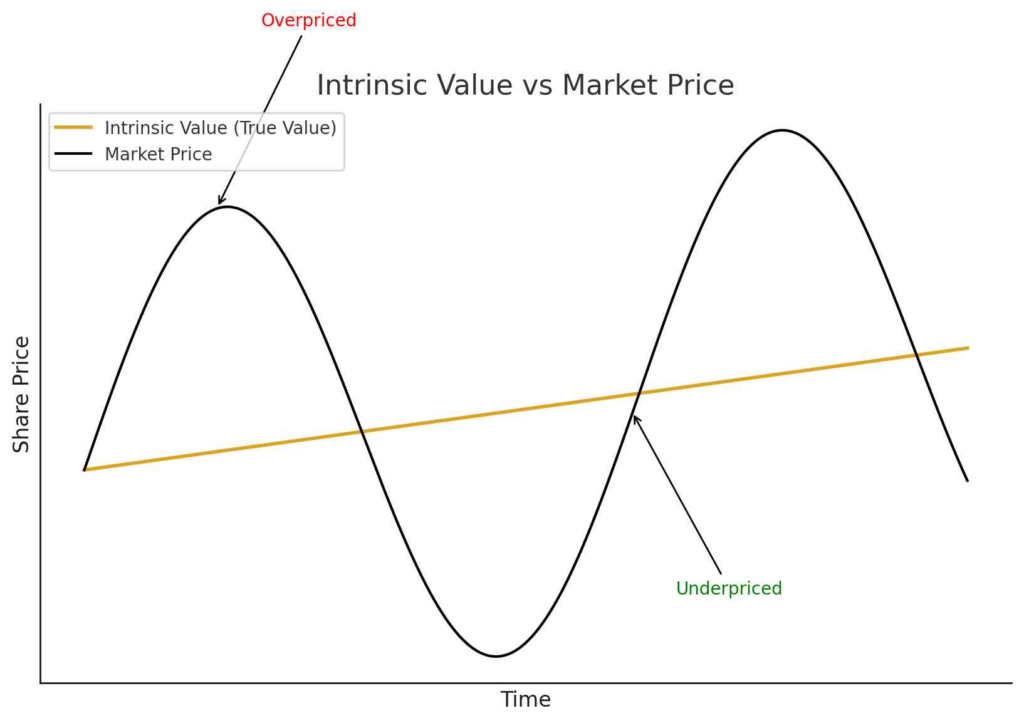

Value investing is a long-term investment strategy of buying stocks that appear undervalued and seem to be trading for less than their intrinsic value. It means purchasing stocks that are sold for less than their intrinsic value and therefore getting them at a highly discounted price, with the potential to earn higher than average profits.

Instead of following the general market trends, value investors go against the consensus and instead look for stocks that the rest of the market might be underestimating. It is a long-term strategy that can take several years before generating profits, as stocks may take a while to reach their intrinsic value.

Value investing is one of the four main investing strategies besides growth, momentum, and dollar-cost averaging.

4 main types of investing strategies

Value investing is one of the main four investing strategies. To get a complete picture of how value investing works, let’s first go through and briefly explain each one.

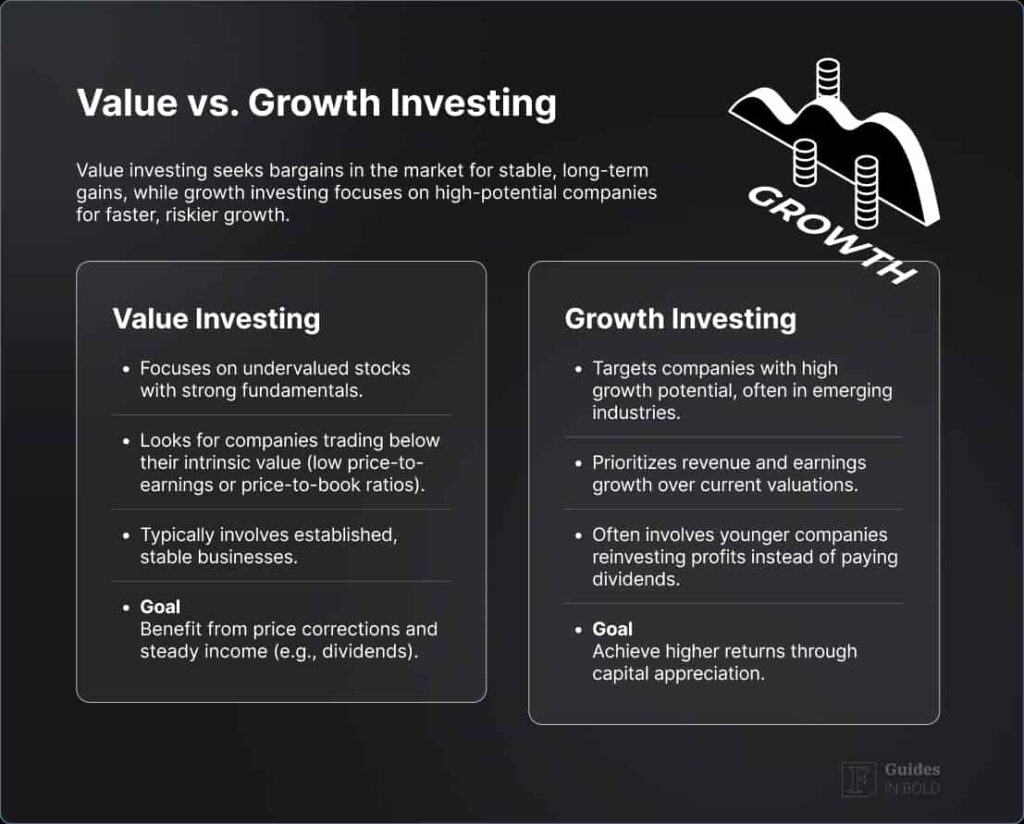

1. Value Investing: Seeks to identify undervalued stocks compared to the market prices, with the aim to earn above-average profits due to discounted prices, by measuring their intrinsic value through fundamental analysis, like financials or a business model.

2. Growth Investing: As the name suggests, growth investing is a strategy where investors check if the company’s revenues, earnings, and cash flow are showing high growth. Among other metrics, the main measurement is the future growth potential and the current overall growth rate.

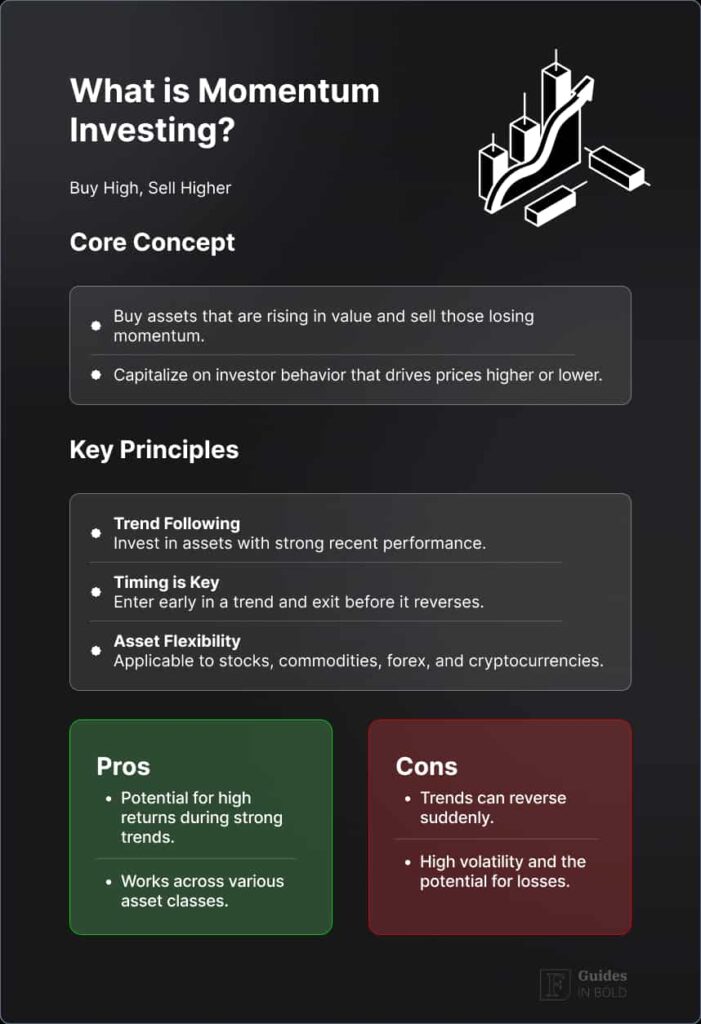

3. Momentum Investing: Momentum investing means buying stocks that have had high returns in the past, usually tracking increased returns from over the past three months to a year, and selling the ones that have had a bad performance and low returns over the same three to twelve month period.

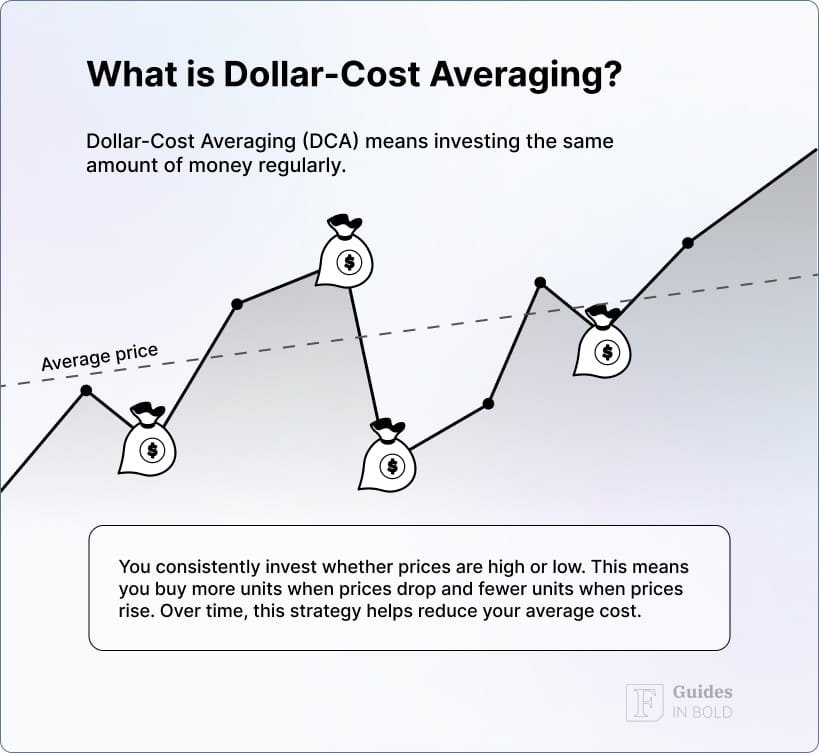

4. Dollar-Cost Averaging (DCA): Is when investors split their purchases across specific periods without investing the total amount all at once. To reduce the impact of price volatility on the acquisition, smaller investments are done in frequent intervals, whether the price goes up or down.

How are value stocks analyzed?

To investigate whether stocks are undervalued or simply cheap, and to determine which stocks have the most future potential, investors use financial and fundamental company analysis.

It is also important to note that fundamental analysis is never conclusive and fully accurate, and it can happen that these stocks never reach their intrinsic value, one of the main risks of value investing strategy.

What is the intrinsic value of a stock?

Rather than just using the current trading price, value investing requires a more in-depth analysis to determine the stock’s intrinsic worth. For example, if the company’s overall financial health and growth trajectory are positive but the market price is low, the stock might be undervalued.

Financial analysts use technical and fundamental analysis to predict future price movements of stocks. If technical analysis looks at the current price of an asset and attempts to forecast price movements based on that, then value investing looks beyond that through fundamental analysis.

Fundamental analysis involves examining a business’s financial statements, market competition, additional external market factors, and the overall state of the economy, including GDP, interest rates, and unemployment rates.

The discrepancy between the market price and the estimated intrinsic value is determined through fundamental analysis and becomes a measure to assess and recognize a discount stock investment opportunity.

Rather than trusting the current market price, the intrinsic value of a company is calculated through fundamental company analysis to estimate, as accurately as possible, the underlying factors and the overall health of the company. Value investors can then take action based on this assessment.

Fundamental analysis can include qualitative: business model, target markets, governance, and quantitative factors: financial ratios and financial statements, that refers to how well the business is currently operating and doing financially.

However, it is essential to note that there is no general or unified standard for calculating the stock’s intrinsic value and that the results of these calculations are always estimated. Qualitative and quantitative measures can help measure, but not conclude, the intrinsic value of a company.

Value stocks characteristics

Value stocks have some specific characteristics – value investors believe that the market sometimes overreacts to recent trends and short-term company financial troubles. For instance, lower than expected earnings for one or two consecutive quarters or negative publicity.

Discounted stocks are a long-term investment strategy, which is why it is better suited for investors who won’t expect gains in the short-term and have higher risk tolerance.

Compared to growth stocks, where earnings growth is above-average despite bad economic conditions, value stocks tend to remain stable and keep a steady growth, stable profits and revenues.

- Steady growth rates;

- Mature businesses;

- Pay out dividends;

- Lower priced than the wider market;

- Stock price is below competitors in industry;

- Carry less risk than the wider market.

Value investing key metrics

When company shares are undervalued in the stock market, they can come at a deeply discounted price. Due to this reason, historically, value investing has returned higher than average profits compared to other investing strategies.

Investors can assess the intrinsic value through various metrics using a combination of financial and competitor analysis from revenues and earnings, profitability, the company’s overall brand image, its target market, and business model.

Some metrics to estimate the intrinsic value of the stock include:

P/B ratio is calculated by dividing a company’s stock price per share by its book value per share (BVPS). If the stock price is lower than the company’s assets value, one could presume that the stock is undervalued.

The P/E ratio reflects the track record of earnings, and it can indicate if the company is undervalued or not. A low P/E ratio can reveal that the stock is undervalued because its price is considered low compared to the expected earnings. The ratio varies largely across industries, but a P/E ratio below 15 is usually considered cheap, and anything above 20 is considered expensive.

Stable sales and revenue growth can indicate a company’s good financial health, so checking these metrics always makes sense. Stable revenues can be a good indicator of an undervalued stock if they have remained steady over several years.

For example, if the company is paying out dividends it can be a good sign and indication that the company is doing well financially, and also a sign the stock might be undervalued.

Additionally, several other metrics are used in the analysis, like debt or equity ratio, and investment decisions shouldn’t be based on just these few metrics. Instead, a complete picture and in-depth research are necessary to determine the intrinsic stock value and whether the investment is attractive enough.

A brief history of value investing

The value investing concept was developed by an American professor and investor, Benjamin Graham, in 1934. His strategy became widely popular after Graham’s book “The Intelligent Investor” was published. He was also the mentor for one of the most famous value investors in the world today, Warren Buffett.

The idea is that investors can identify stocks trading lower than their intrinsic value through fundamental analysis, like measuring the earnings potential, value of a company’s assets, or its ability to pay dividends.

Benjamin Graham’s value investing principles

Graham’s book “The Intelligent Investor” pointed out some key indicators to check when investing in discounted stocks. These fundamentals show how to analyze and calculate the stocks’ intrinsic value rather than take it at its market price.

1. Quality rating – no trending stocks

Value investing isn’t about trending stocks or companies widely discussed in the media; it is about picking the average yet stable ones that can have the potential to go up in value in the future.

A good indication is to check the S&P “Earnings and Dividend Quality Rank,” which has a letter grade assigned to companies based on the consistency of their earnings and dividends over the past ten years. Businesses graded with A-, A or A+ are ranked as “above average”, and the ones with B, B- or C as “average” or “below average”.

According to his principle, investors should choose a company with a rating of “B” as a safe yet good value stock. Still, it is also essential to check if the company has had a good track record and shows some signs of growth and future improvement plans.

2. Company’s liquidity – margin of safety

Margin of safety means a sufficient price difference, when the trading price is sufficiently below your estimation of its intrinsic value. It is common for investors to set their margin of safety according to their risk tolerance to manage expectations.

This value investing principle encourages checking the company’s current Assets versus Liabilities to make sure assets are at least 1.5 times more than the company’s current liabilities, which would indicate that the business can pay its short-term liabilities.

3. Financial leverage – low debt

Companies with low debt over an extended period of time are generally more sustainable and less risky. That’s because the company wouldn’t need to sell any fixed assets to get rid of debt in case of unexpected troubles, which would decrease the value of the stock.

Graham advised choosing companies where debt does not exceed 110% of current assets, with the total debt to current assets ratio being less than 1.10.

4. Stable earnings growth

Another one of Graham’s points was selecting companies with positive earnings per share growth and using at least five past years of track record. Checking for companies with stable revenues over several years in a row is a safer choice and helps to minimize risk.

5. Price-to-earnings (P/E) ratio

Another criterion is to check that the P/E ratio is 9.0 or less, as companies with low price-to-earnings ratios are often undervalued and indicate that the price should increase in the future.

It is important to note that this depends mainly on the sector and the industry the company is operating in, and one should always check competitors and industry benchmarks when deciding.

6. Price-to-book (P/B) ratio

According to this principle, companies whose P/B ratio is less than 1.20 provide a good indication of the actual underlying value of a company, as these companies appear to be selling near or below their book value.

7. Dividends

If companies give back and pay out dividends regularly, it is a good sign that they have funds and free cash flow to pay out dividends to investors.

What makes stocks undervalued?

Several aspects can make stocks become undervalued. The efficient market hypothesis argues that the markets are efficient, meaning that the trading price always reflects the accurate cost of the company stock with no room for extra margins.

However, value investing goes against this hypothesis, implying that some factors can drag down the prices and make them valued lower at the market.

Herd mentality

Herd mentality is a behavior where people act the same or in a similar way to other people around them, completely ignoring their own opinions and thoughts. Meaning that investors would often irrationally base their investment decisions on others, rather than looking into the company fundamentals.

When more people buy, the demand goes up, making the stocks go up in value and vice versa. This sort of behavior affects the effective prices of each stock in the market and creates excessive market movements, making some stocks become either undervalued or overvalued.

Economic downturns

During recessions and economic downturns, for example, the dot-com bubble in the late 1990s and the Financial Crisis of 2008, investors start panic selling which brings down the prices. Although the demand goes down along with the prices, the company’s intrinsic value might not be affected and can bounce back again during upswing.

Businesses aren’t immune to the economic cycles, meaning prices go down during down or bear markets and up during ups or bull markets. All of this doesn’t necessarily affect the company’s intrinsic value, which is why an in-depth fundamental analysis is necessary.

Trending stocks

Consumer companies like Apple (NASDAQ: AAPL), Tesla (NASDAQ: TSLA), or Meta (NASDAQ: META) are usually more affected by consumer and investor sentiment and the general trends in the market, and the high and increased demand can push up the market prices, making them overvalued.

However, for example, consumer staples such as Procter & Gamble (NYSE: PG) or the unfashionable conglomerate Bayer can still have stable earnings and healthy financials, just fewer people are buying them at the time, making them seem cheaper than their intrinsic value.

Negative news and events

Investors often start to panic sell if the company reports disappointing figures in one or two consecutive quarters. Although the business may be doing well overall, negative news and setbacks such as product recalls and legal issues can happen. These events are often out of the company’s control and can often be temporary.

The idea is that the stock price can bounce back – value investing is about checking and analyzing beyond this and digging deeper to get a complete picture of whether the stock is undervalued and can recover to generate profits in the future.

Risks of value investing

Even though value investing is often considered a low-risk investment due the fact that the stocks are among more established companies with a long operating history, as with any investing strategy, there are still some significant risks involved.

Unexpected gains and or losses

Unexpected events such as lawsuits, natural disasters, or restructuring are often normal occurrences beyond the company’s control. Most of the time, a business can bounce back in the long run and gain value again in the future, having a temporary blip in the market price during the time.

However, if these reoccur way too often or nearly every year, then there might be an issue, so make sure to study any unusual patterns that may become a problem in the long run. Recurring write-offs can be a red flag that heightens the risk.

Inaccurate financial analysis

The key to value investing is fundamental analysis and digging deep into the financials to complete a full breakdown of the company’s underlying health. If this is done incorrectly, for example, if the estimations are wrong, or if the earning ratio in financial reports is defined pre-, or after-tax, it can lead to miscalculations. Being wary of mistakes or miscalculations like that in your analysis can decrease the risk of overpaying.

Paying over the value of stocks

One of the main risks of value investing is overpaying for an undervalued stock, which is why it is essential to pay attention to and set your margin of safety into your strategy.

Buying an overpriced stock, you’re at the risk of losing money if the company doesn’t do well in the future. To avoid overpaying for seemingly undervalued stocks, make sure to buy stocks at least a recommended two-thirds or less from their intrinsic value.

Not diversifying

Some value investing experts believe it is best to keep your portfolio small to benefit from more significant gains; however, diversifying is still a good idea to offset the risk. According to the value investing concept founder Benjamin Graham, choosing 10 – 30 stocks is a good amount to diversify your holdings.

As long as stocks represent various sectors, for example, consumer staples and pharma industries, it would already help manage and lower the risk.

Tacticalcity

Another risk is letting your emotions get to you – for example, when the price of your bought undervalued stock keeps dropping, fear creeps in and can cause a moment of panic and make people sell prematurely.

In value investing, investors need to be sure of themselves and believe that they’re right and others are wrong. Make sure you have done an in-depth, thorough analysis to determine that the stock you are buying is undervalued or cheap for a reason.

Conclusion

The value investing approach requires a contrarian mindset, readiness to make long-term investments, and research and analysis of company fundamentals. But there are different and easier approaches – for example, you can still invest in value stocks through mutual or exchange-traded funds as a passive value investing strategy.

All in all, value investing is a long-term strategy that requires patience and high risk tolerance, and one shouldn’t expect any short-term gains.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about value investing

What is value investing?

Value investing is a long-term investment strategy that involves buying stocks that appear to be trading for less than what they are worth, meaning that their market price appears to be much lower than its intrinsic value, which is calculated after in-depth analysis and looking into company fundamentals.

How to analyze value stocks?

In order to determine if stocks are undervalued or whether there is a valid reason they are cheap, investors use fundamental company analysis to help them assess their intrinsic value. By using a combination of financial and market analysis one can calculate the intrinsic value of the stock to evaluate if it is worth more than it is selling for.

What are the key risks of value investing?

As undervalued stocks tend to be more from established companies, value investing is considered a more low-risk investment, however, still comes with its own risks. Incorrectly calculating the intrinsic value can result in overpaying, as the company might never grow in value and generate profits. Not diversifying or selling prematurely can also result in losses.

What makes stocks undervalued?

The efficient market hypothesis argues that stocks are always trading at their true cost, value investing implies there are often factors that can still drag down the prices. Things like herd mentality or market trends can contribute to higher demand and therefore higher, overvalued, prices. Economic downturns and negative publicity that might drag down the values only temporarily, thus making them undervalued.