Apple Inc. (NASDAQ: AAPL), the world’s largest company by market capitalization, continues to attract significant interest from major institutional and individual investors.

Despite stagnant revenue growth since 2022, the company’s strong digital ecosystem, unmatched brand loyalty, and ongoing innovation ensure that it remains a top choice for shareholders.

As the year winds down, the makeup of Apple’s shareholder base reflects the faith of both individual and institutional investors in its long-term success.

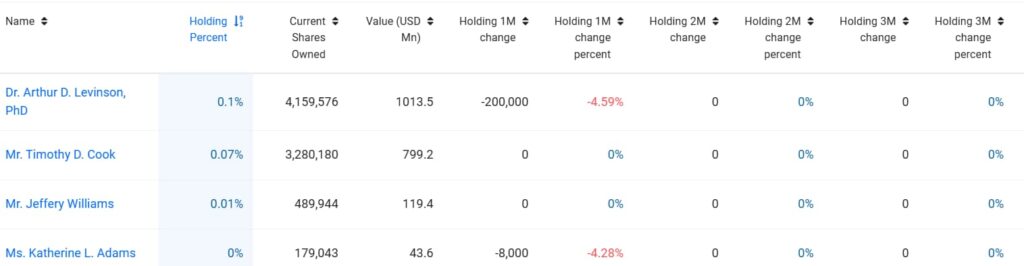

Individual shareholders hold billions in Apple stock

Among its top individual shareholders are key executives and board members, each holding substantial stakes. Dr. Arthur D. Levinson, Apple’s Chairman, leads the pack with 4,159,576 shares valued at $1.013 billion. Despite reducing his stake by 200,000 shares in November 2024, Levinson’s holdings remain significant.

Apple CEO Tim Cook follows closely, retaining 3,280,180 shares worth $799.2 million. His stake has remained unchanged in recent months, signaling strong confidence in Apple’s trajectory.

Jeffrey Williams, Apple’s Chief Operating Officer, comes next, owning 489,944 shares valued at $119.4 million. Katherine L. Adams, General Counsel, holds 179,043 shares worth $43.6 million, despite reducing her holdings by 8,000 shares last month.

Collectively, these insiders hold stakes worth over $1.975 billion, further solidifying investor trust in Apple’s leadership team.

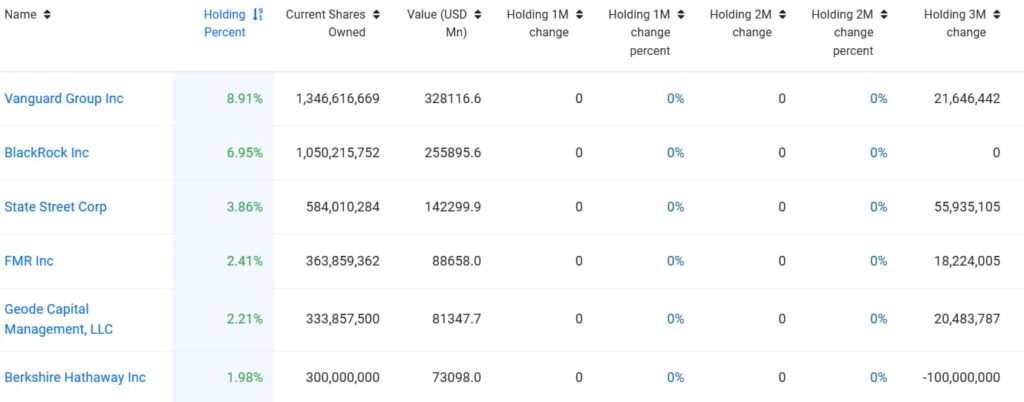

Institutional investors dominate Apple’s ownership

Institutional investors dominate Apple’s shareholder base, controlling 61.93% of total shares and 63.23% of floating shares. These stakes are distributed among 6,485 institutions, underscoring immense confidence in Apple’s long-term growth potential.

Vanguard Group Inc. leads as Apple’s largest institutional shareholder, owning 1.35 billion shares valued at $328.1 billion, representing 8.91% of the company. Over the last quarter, Vanguard added 21.6 million shares, marking a 1.63% growth in its stake.

BlackRock (NYSE: BLK). follows as the second-largest institutional shareholder with 1.05 billion shares worth $255.9 billion, accounting for 6.95% of Apple.

State Street Corp. ranks third with 584 million shares worth $142.3 billion, representing 3.86% ownership. Notably, State Street’s holdings increased significantly by 55.9 million shares over the last quarter, marking a 10.59% rise.

FMR Inc. holds 363.9 million shares valued at $88.7 billion, showing a 5.27% increase over the past three months. Meanwhile, Geode Capital Management, LLC, rounds out the top five with 333.9 million shares worth $81.3 billion, growing its position by 6.54%, or 20.4 million shares, during the same period.

Even Berkshire Hathaway’s (NYSE: BRK.A), helmed by Warren Buffett, holds a significant position with 300 million shares worth $73.1 billion, despite reducing its stake by 25% in Q3 2024.

Investor takeaway

Investors considering Apple should focus on the company’s ability to sustain its digital ecosystem, strengthen customer loyalty, and explore new growth opportunities.

While growth in core revenue segments has been stagnant, Apple’s deep integration into consumer habits and its strong brand value provide a significant competitive advantage.

Ultimately, Apple’s future success will depend on its capacity to expand into new profit centers, and maintain its leadership in consumer technology.

This will shape shareholder returns in the years to come, making it a stock worth considering even during uncertain times.

Featured image via Shutterstock