Microsoft (NASDAQ: MSFT) is looking to end 2024 on a strong note, ranking among the top five companies by market capitalization, a position sustained by a dynamic group of shareholders.

As of December 15, 2024, five diverse groups controlled the technology giant, with public companies and individual investors accounting for the largest share, 41.86%.

Mutual funds account for 22.18%. Exchange-traded funds (ETFs), with a 19.73% stake, are in third place. Other institutional investors, such as pension and hedge funds, control 16.19% of the company, while insiders make up a mere 0.04% of ownership, highlighting the company’s heavy reliance on external shareholders.

Picks for you

Microsoft top shareholders

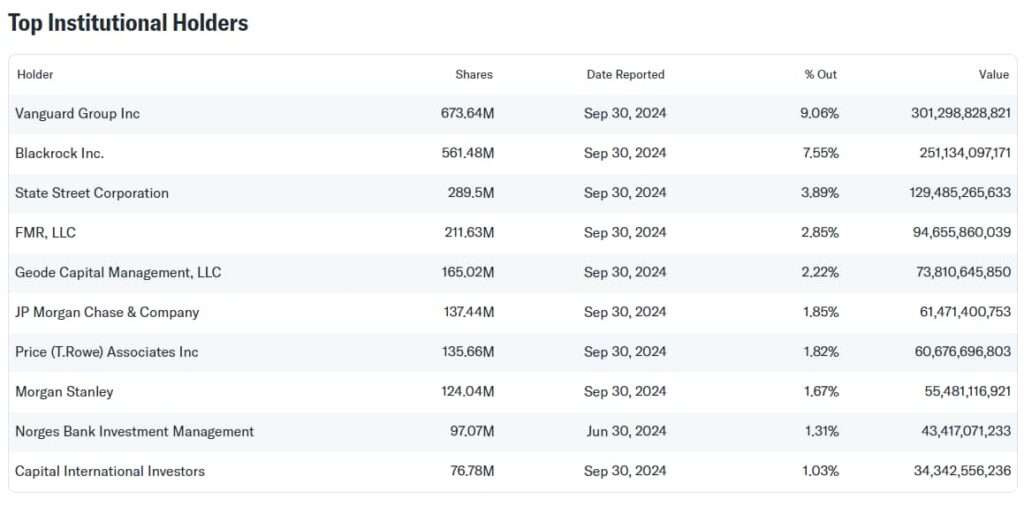

For institutions, regulatory filings for the quarter ending September 2024 show that Vanguard Group is leading the pack with 673.64 million shares, representing 9.06% of Microsoft’s outstanding shares, valued at approximately $301.3 billion. BlackRock (NYSE: BLK) follows closely with 561.48 million shares (7.55%) worth $251.1 billion.

State Street Corporation comes in third, holding 289.5 million shares (3.89%), valued at $129.5 billion. Other notable institutions include FMR LLC (2.85%) and Geode Capital Management (2.22%).

MSFT stock ownership is also highlighted within diversified portfolios, as highlighted by holdings among mutual funds. For this group, recent filings show that the Vanguard Total Stock Market Index Fund holds the top spot with 235.61 million shares, representing 3.17% of Microsoft’s outstanding shares and valued at over $105.3 billion. The Vanguard 500 Index Fund is close behind, with 194.67 million shares (2.62%) worth $87.07 billion.

Other prominent holders include the Fidelity 500 Index Fund, which reported 91.22 million shares as of October 31, 2024, and the SPDR S&P 500 ETF Trust, holding 90.27 million shares (1.21%). Notable ETFs such as the iShares Core S&P 500 ETF and Vanguard Growth Index Fund also feature prominently, with holdings of 80.88 million and 69.38 million shares, respectively.

Microsoft stock insider holdings

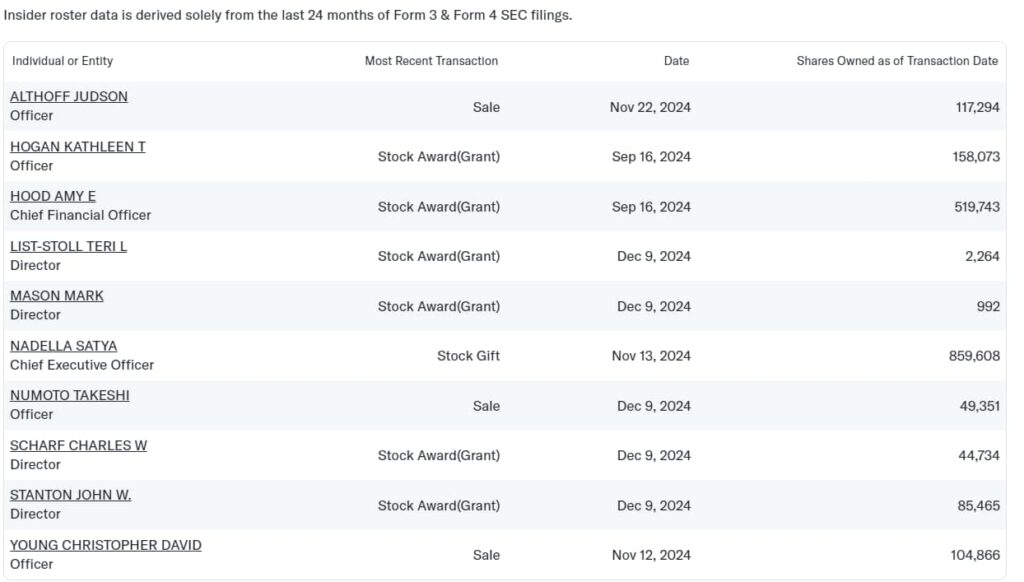

Finally, the insider Microsoft roster shows a blend of reward-based grants and strategic sales has influenced ownership. Filings before the Securities and Exchange Commission (SEC) show CEO Satya Nadella gifted shares on November 13, 2024, retaining 859,608 shares. Officers Judson Althoff and Takeshi Numoto sold shares, holding 117,294 and 49,351, respectively, after their transactions.

Stock awards were granted to CFO Amy Hood, Officer Kathleen Hogan, and several directors, including Teri List-Stoll, Mark Mason, Charles Scharf, and John Stanton, between September and December 2024.

Numoto, the company’s Executive Vice President and Chief Marketing Officer, has been a notable name in a recent selling spree among the insiders.

For instance, he sold 2,500 shares worth $1.12 million on December 9 at an average price of $447.41. This marked his fourth sale transaction in a month, totaling $2.44 million in December and $414,720 in November. Overall, Microsoft insiders have sold $38.7 million in shares in the past three months.

MSFT stock price analysis

At the close of the December 13 trading session, MSFT stock was valued at $447, ending the day with a modest 0.5% decline. On the weekly timeframe, the stock is up 1%, while year-to-date, MSFT is in the green at 20%.

Microsoft’s artificial intelligence (AI) ventures will likely see further stock gain, provided the sector maintains its current growth.

This sentiment is shared by some Wall Street analysts, such as Wedbush’s Daniel Ives, who reiterated an ‘Outperform’ rating with a $550 price target, highlighting AI advancements as key growth drivers.

In conclusion, Microsoft’s stock growth hinges not only on key elements such as AI advancements but also on external factors like competition and regulatory challenges.

To this end, the FTC’s reported antitrust investigation into the company’s software licensing and cloud computing businesses is a factor that points to potential hurdles that could impact its future performance.

Featured image via Shutterstock