Palantir Technologies (NASDAQ: PLTR) has caught the stock market’s attention with its meteoric rise in 2024, driven by the inroads into artificial intelligence (AI).

This AI venture and subsequent stock growth have attracted diverse investors, from institutions to individuals, who are betting on the company’s future growth.

The stock is currently aiming to reclaim its all-time high above $80. At close of the last trading session, PLTR was valued at $76.07, up nearly 4% for the day. Year-to-date, the PLTR share price has spiked 358%.

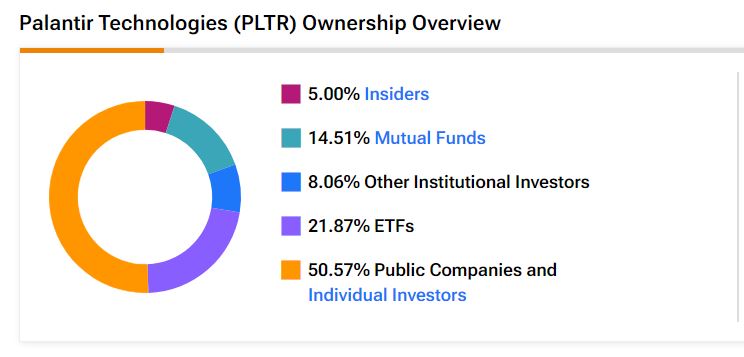

As of December 14, 2024, the technology giant’s share ownership is dominated by public companies and individual investors, who hold 50.57%. Exchange-traded funds (ETFs) account for 21.87%, while mutual funds hold 14.51%. Other institutional investors control 8.06%, and insiders, including executives and key stakeholders, maintain 5% ownership.

Top Palantir shareholders

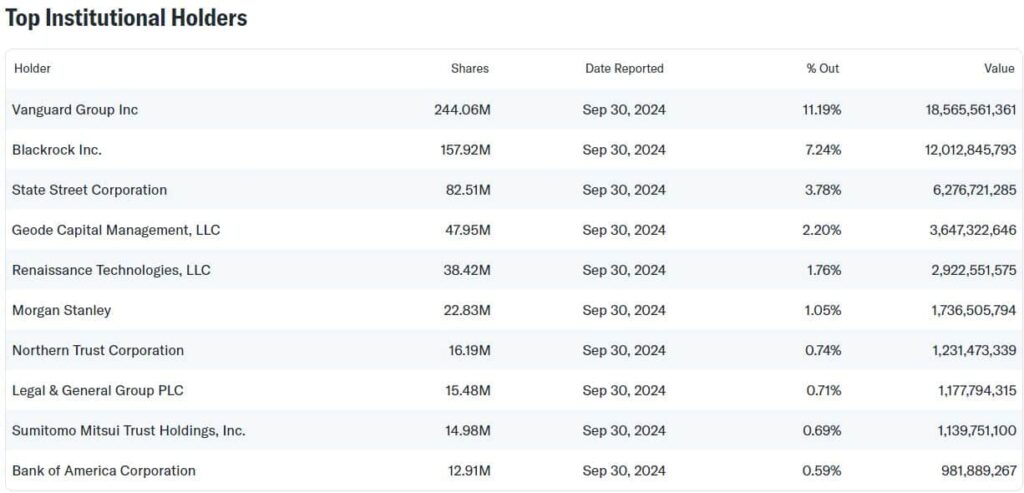

As of the latest quarterly filings on September 30, Vanguard Group held the top spot among institutions with 244.06 million shares (11.19% ownership, valued at over $18.56 billion). BlackRock (NYSE: BLK) follows with 157.92 million shares (7.24%). State Street Corporation holds 82.51 million shares (3.78%), and Geode Capital Management manages 47.95 million shares (2.20%).

New York-based hedge fund Renaissance Technologies owns 38.42 million shares ($2.92 billion). Other notable institutional stakeholders include Morgan Stanley (NYSE: MS) and Bank of America (NYSE: BAC).

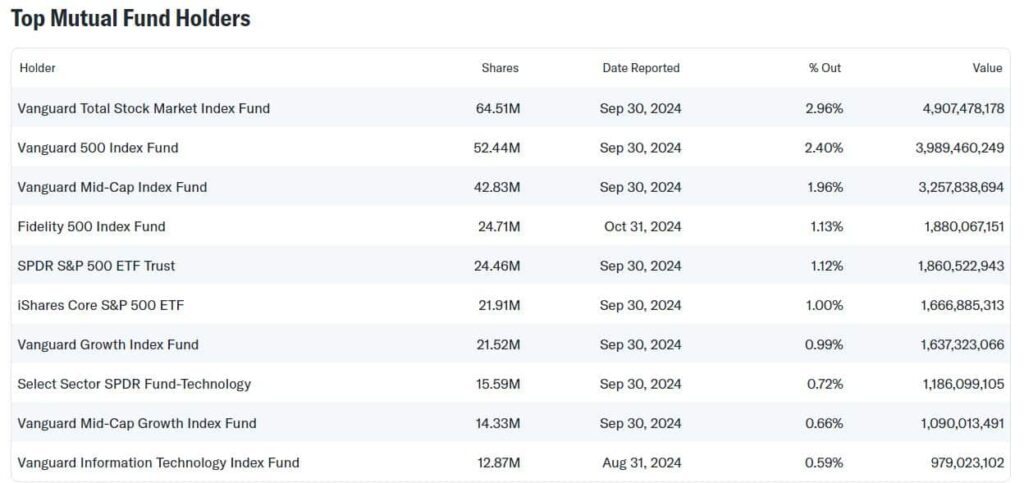

For mutual funds, the Vanguard Total Stock Market Index Fund leads with 64.51 million shares (2.96% ownership, valued at nearly $4.91 billion). The Vanguard 500 Index Fund is close behind, with 52.44 million shares (2.40%). The Vanguard Mid-Cap Index Fund holds 42.83 million shares (1.96%).

The Fidelity 500 Index Fund owns 24.71 million shares ($1.88 billion), while the SPDR S&P 500 ETF Trust holds 24.46 million shares (1.12%). Other funds betting on PLTR include iShares Core S&P 500 ETF and Vanguard Growth Index Fund.

Palantir stock insider holding

Although Palantir insiders have recently engaged in notable selling activity, which aligns with the stock’s rise, they still maintain a massive stake in the company. CEO Alexander Karp, after a sale on November 22, 2024, now holds 6,432,260 shares, while CFO David Alan Glazer’s stake stands at 293,411 shares following his sale on November 21, 2024.

CTO Shyam Sankar retains 1,502,680 shares as of December 3, 2024, and Officer Heather Planishek holds 534,027 shares after a sale on December 4, 2024.

President Stephen Andrew Cohen has significantly reduced his holdings, with only 592 shares remaining after his sale on November 21, 2024.

Impact of insider selling

It is worth noting that although PLTR shows a diverse ownership structure, insider activity has been of interest, with a majority opting to sell their stakes when the stock is rallying.

While legal, the timing of sales during a stock rise may signal executives capitalizing on gains, raising questions about their confidence in the company’s near-term outlook. Investors often view insider behavior as a market signal, with continued selling potentially fostering bearish sentiment, while retained stakes could reassure the market.

This comes as Wall Street continues to share varied views on Palantir’s outlook. Analysts like Wedbush Securities’ Dan Ives view Palantir as a future leader in software AI, while others remain skeptical regarding its valuation.

In this case, as reported by Finbold, analysts at Jefferies have warned that the stock might crash on the grounds of overvaluation. One concern about Palantir’s rise is that the stock is likely pricing in future growth. If these targets are not met, the equity faces the challenge of tumbling, especially as technical indicators suggest possible buyer exhaustion.

However, Palantir continues to be backed by strong fundamentals that are likely to spur continued growth. For example, it has inked partnership deals with the government and gained exposure to potentially more capital from listing on the technology-heavy Nasdaq.

Featured image via Shutterstock