Although the majority of assets in the stock market are crashing, certain defense stocks are doing the exact opposite – rallying amid the rising geopolitical tensions that have seen new war fronts arise or threaten to appear in multiple regions as the now already ‘old’ wars continue raging.

As it happens, these defense stocks, which are among the favorites of many United States politicians, some of whom sit on committees overseeing defense budgets or creating geopolitical policies, are increasing in price, demonstrating curious behavior amid the widespread stock market decline.

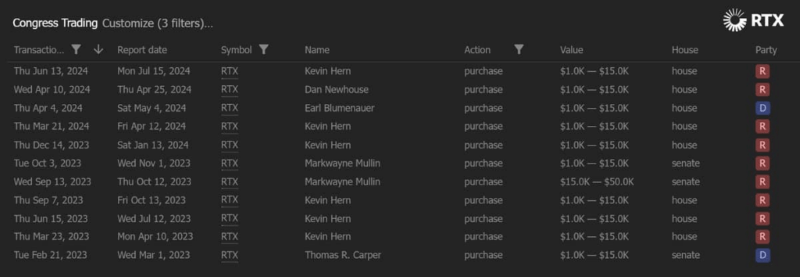

#1 Raytheon (RTX)

Specifically, these include the shares of Raytheon Corporation (NYSE: RTX), which have been a favorite pick of many Congress, Senate, and House members in 2024, and who have been buying them as opposed to selling by a much wider margin than last year, as Finbold reported on July 31.

Currently, the price of RTX stock, owned by Representative Kevin Hern, Senator Markwayne Mullin, Rep. Dan Newhouse, and others, stands at $114.35, recording a modest 0.09% advance across the past week but nonetheless growing 14.24% in the past month and gaining 34.08% since the year’s turn.

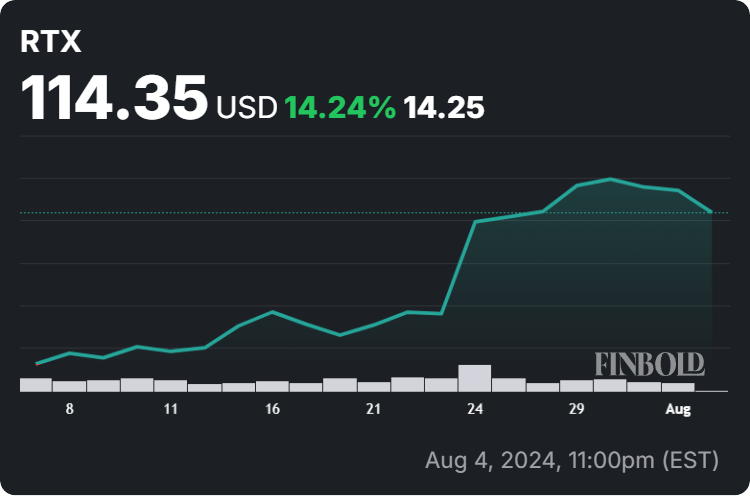

#2 Lockheed Martin (LMT)

Furthermore, next are the stocks of Lockheed Martin (NYSE: LMT), which secured a $1.5 billion deal with the U.S. government in June and is profiting from the announced increase in American military presence in the Middle East after the deaths of Hamas leader Ismail Haniyeh and Hezbollah commander Fuad Shukr.

Meanwhile, after reaching a new all-time high (ATH) of $547.10, the LMT stock, which is also among Rep. Hern’s possessions, is now recording a price of $553.97, up 3.88% on its weekly chart, as well as moving upwards by 19.97% across the past month as it accumulates an increase of 21.45% in 2024.

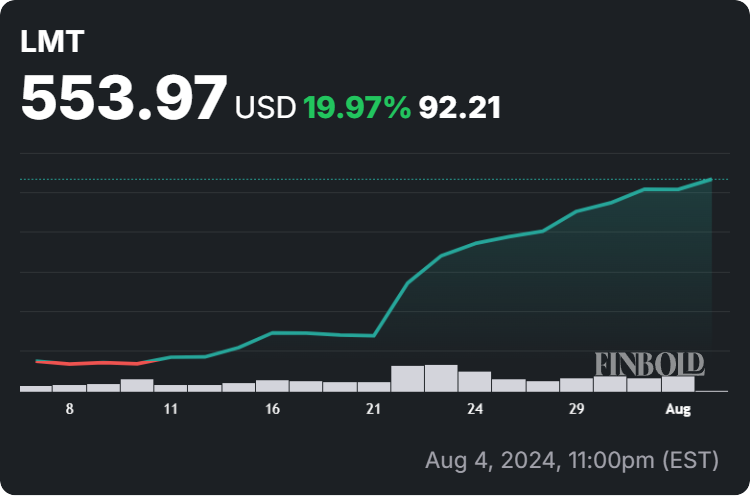

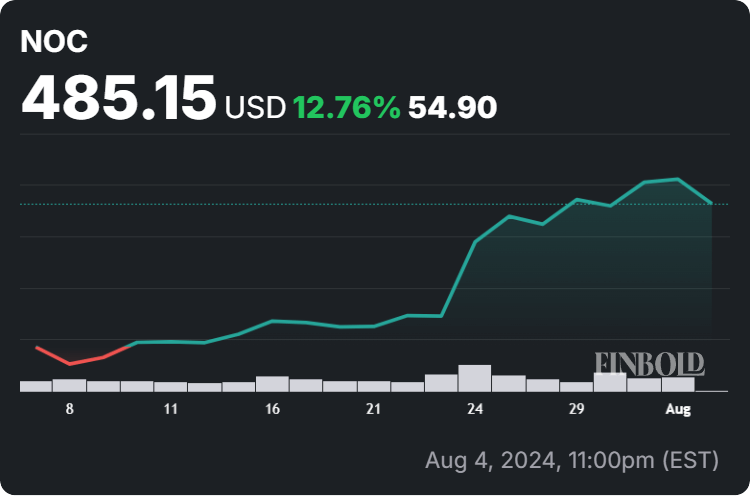

#3 Northrop Grumman

Finally, Northrop Grumman (NYSE: NOC) relies on stable revenue streams thanks to steady government spending even during economic downturns, which could be one of the reasons why Rep. Josh Gottheimer – a member of the House Select Committee on Intelligence – purchased it in September 2023.

At press time, the stock of the company that has just carried out a cargo resupply mission to the International Space Station alongside SpaceX is trading at $485.15, an increase of 3.09% on its weekly chart, advancing 12.76% across the month and making a more modest 3.20% gain year-to-date (YTD).

Conclusion

Ultimately, it seems that investors in the above defense stocks might profit generously from the ongoing tensions and military activity around the world, particularly thanks to their backing from the U.S. government. However, trends can easily change, so doing one’s own research is critical.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.