Following a significant price target increase by analysts at JP Morgan (NYSE: JPM), the shares of EVgo (NASDAQ: EVGO), an electric vehicle (EV) fast-charging network in the United States, have reacted with a massive price increase, soaring over 60% in a matter of hours.

As it happens, JP Morgan upgraded EVgo’s shares from ‘neutral’ to ‘outperform’ and reinstated its $7 price target, as well as placing them on the ‘Positive Catalyst Watch,’ arguing they would outshine their industry rivals’ stocks over the next few years, thanks to the company’s scalable model.

Bullish catalysts for EVgo stock

In fact, according to JP Morgan’s analyst Bill Peterson:

“Unlike hardware-software peers, EVgo’s fast charging owner-operator model has been scaling well with higher utilization and charge rates in the current muted EV environment.”

Furthermore, he believes that “EVGO, which generates revenue on every kW of electricity dispensed to an EV driver,” could “continue benefitting from higher utilization on every charger on its network, especially if competitor charging networks are unable to deploy chargers due to lack of demand.”

Moreover, EVgo recently secured a conditional $1.05 billion loan guarantee from the U.S. Department of Energy to install public EV charging stations, and the company expects to place 7,500 fast-charging stalls around the country by 2030, which Peterson identified as another bullish trigger.

EVgo stock price analysis

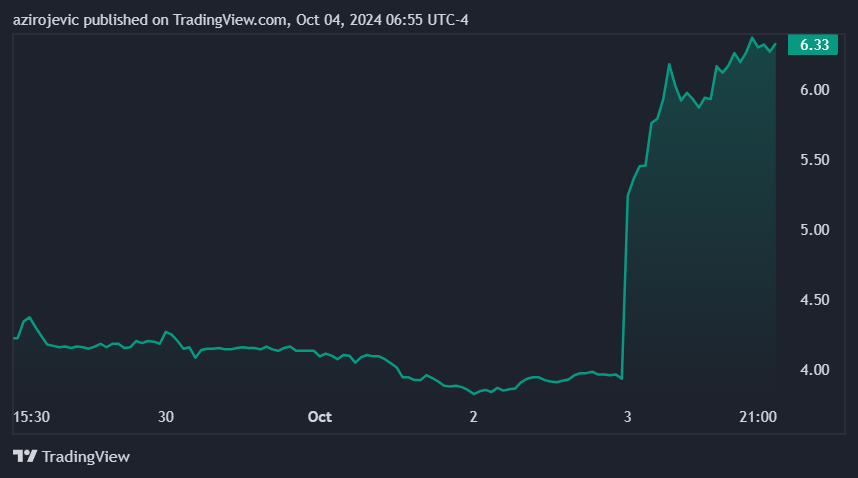

Indeed, following JP Morgan’s upgrade, EVgo stock has skyrocketed to $6.33, which indicates an increase of 60.81% on the day, adding up to the gain of 41.70% across the week, accumulating an advance of 51.92% across the week, as well as growing 80.06% year-to-date (YTD).

In pre-market trading, EVGO shares have somewhat retraced and are presently changing hands at the price of $6.25, which suggests a 1.11% decline from its previous closing price, according to the most recent chart information retrieved by Finbold on October 4.

It is also worth noting that analysts at TD Cowen are bullish on EVgo shares as well, shifting their stance from a ‘hold’ to a ‘buy’ and increasing their price target for the next 12 months from $5 to $7 in response to the U.S. DoE’s recent loan agreement and a more favorable operating model compared to rivals.