The influence of semiconductor giant Nvidia (NASDAQ: NVDA) continues to be felt throughout the stock market, particularly in the artificial intelligence (AI) space. Notably, Nvidia is recording increased investments within the AI sector with substantial stakes in related companies.

A noteworthy instance is the disclosure made on February 14, where Nvidia unveiled a $3.67 million investment in SoundHound (NASDAQ: SOUN), a company specializing in AI software for vocal recognition. It’s worth mentioning that Nvidia had previously invested in SoundHound in 2017.

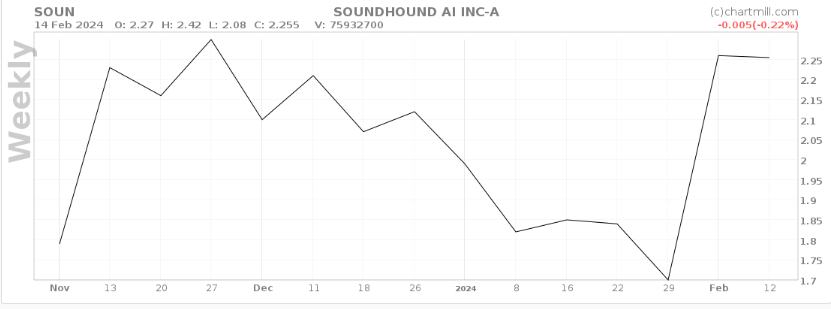

Subsequently, in response to Nvidia’s announcement, SoundHound’s stock price exhibited a positive reaction, reaching $2.26 at the time of writing. This translates to a weekly gain of approximately 31%, with an 8% increase on a year-to-date basis.

Additionally, by pre-market on February 15, SoundHound’s stock had surged by almost 70%.

SoundHound fundamentals

In the wake of the AI growth over the past year, SoundHound AI is strategically positioning itself to capitalize on the market. The company’s Voice AI platform facilitates developing and deploying various AI-enabled voice features, including automatic speech recognition, natural language understanding, text-to-speech, and custom wake commands.

Indeed, the company’s AI offering demand is evident as reflected in its third-quarter results, where revenue increased by 19% year over year, reaching $13.3 million. Its product offering has also impacted its general financials, with the AI firm recording earnings of $29 million in the first three quarters of 2023.

Projections indicate a combined revenue of $165 million for 2024 and 2025, reflecting the company’s strong financial position. The existence of a substantial backlog also suggests the potential for growth and delivering significant gains to investors.

SoundHound’s market position is further enhanced by its strong client base that features prominent names such as Stellantis and Qualcomm (NASDAQ: QCOM). Additionally, the company seeks to bolster its position after recently merging with SYNQ3, a key player in voice AI within the restaurant industry. This merger creates revenue synergies by leveraging complementary opportunities within the same space.

On the flip side, SoundHound faces the challenge of financial losses, a concerning trend for the company. In the third quarter of 2023, it reported an operating loss of $14.5 million, exceeding double its revenue. Nevertheless, the concern is mitigated by the fact that SoundHound is still experiencing growth.

Analysts offer SoundHound stock projection

Meanwhile, three Wall Street analysts at TipRanks are projecting an upside for SoundHound over the next 12 months. Based on the stock’s performance in the last three months, the analyst providing the projection anticipates that the equity is likely to trade at an average price of $4.67, with a high forecast of $5 and a low forecast of $4. The average price target represents a 107.10% change from the last recorded price of $2.26.

Looking forward, the prospects for SoundHound appear promising, especially considering the company’s foray into the AI scene. With the company exploring new target products, it is possible to be acquired by a major tech giant lacking a credible audio analysis platform. Overall, SoundHound shows potential for growth and substantial returns for investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.