The previous financial quarter report proved pivotal for Nvidia (NASDAQ: NVDA), with significant implications for the overall stock market sentiment, particularly within the AI industry.

Fortunately, Nvidia lived up to expectations, surpassing projections with its performance.

This success has spurred one trader to place a $21 million bet that Nvidia will once again outperform expectations when it reports its first-quarter financial results at the end of May.

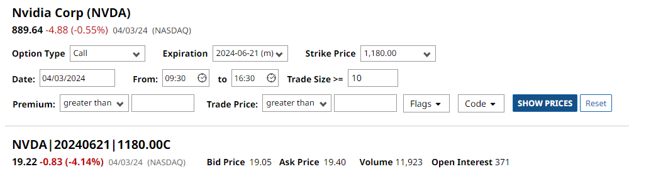

Option strategists at Susquehanna drew attention to this move, noting that an initiating investor purchased 10,000 June $1,180 NVDA call options, paying between $20.70 and $21.75 per call. Each call represents 100 shares of the underlying stock, amounting to a total premium of $21 million for the trade.

The $1,180 strike price represents about 32.63% upside from the current levels of about $889.64 per share.

What do analysts predict for NVDA stock?

The continuous performance of Nvidia’s stock prompts ongoing monitoring and adjustments of price targets for NVDA, with analysts closely considering daily developments and financial projections.

Adding to the positive sentiment, UBS analyst Timothy Arcuri raised the price target for NVDA stock to $1,100 on March 21, up from his previous target of $800. In a research note, Arcuri highlighted Nvidia’s potential for significant new demand from global enterprises.

On March 20, Citigroup also increased its NVDA price target to $1,030. While Oppenheimer raised Nvidia’s price target from $850 to $1,100 in a report issued on March 19.

Analysts’ predictions seem to be a little off compared to trader’s bet, which hopefully will be boosted by additional positive developments.

Previous Nvidia earnings report garnered over $200 billion worth of attention

Nvidia investors had nearly $200 billion in market value riding on the previous company earnings report, as indicated by options positioning.

Fortunately, the report exceeded expectations, driving NVDA stock up by 16.40%. This surge propelled it to reach the $800 threshold, a milestone it had not previously attained.

In two months, we’ll discover whether this trader successfully cashed in on his bet, securing a handsome profit, or whether his gamble fell short, resulting in potentially tens of millions in losses.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.