The stock market trades made by U.S. politicians have become a contentious topic in the last couple of years. Sitting members of the United States Congress tend to make a significant return on their investments — far outpacing the gains seen by their constituents.

As high-ranking public servants, House representatives and Senators have a unique edge — they are privy to information that the public is not, and that information tends to be of the market-moving kinds. Worse still, members of Congress regulate the very industries that they often have a vested interest in.

While some measures have been taken to curb the practice, they have had little success. Penalties for not complying with congressional stock trading regulations are minor — and disclosure rules are set up in a way that obscures the true value of the investments being made.

Picks for you

One of the pioneers in bringing this controversial practice to light has been Quiver Quantitative, which maintains a regularly updated database of trades made by U.S. politicians. Going a step above and beyond, the firm also released a trading bot that copies these trades in 2022 — in a bid to level the playing field.

Finbold has analyzed the trading bot’s portfolio performance in 2024 — and the results might very well surprise you.

Quiver’s trading bot has underperformed the S&P 500

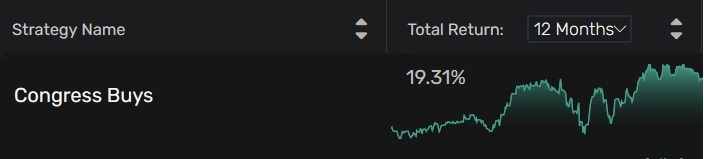

Over the last 12 months, the ‘Congress Buys’ trading bot has netted investors a return of 19.31%, according to data retrieved by Finbold from Quiver Quantitative.

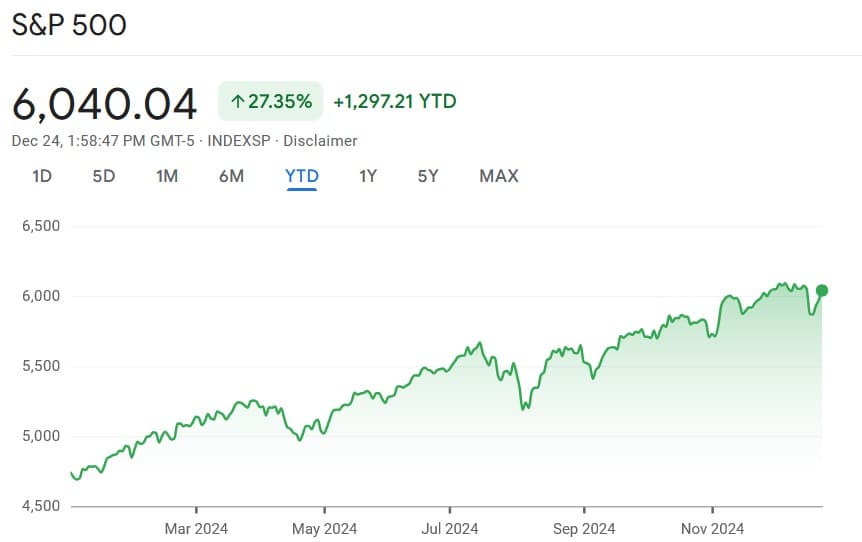

While that isn’t bad by any stretch of the imagination, the S&P 500 index has returned 27.35% in the same timeframe — outperforming the bot’s performance by a significant margin.

So, does this dispel the controversy surrounding congressional stock trading? Not at all — for one, this was the company’s first trading bot, and it simply invests in the 10 most-bought stocks by U.S. politicians. The returns seen by lawmakers vary quite a bit — while some, like Nancy Pelosi, Josh Gottheimer, or Tommy Tuberville generally see outsized gains, others, like Marjorie Taylor Greene, haven’t had as much luck up to now.

If anything, these results lead to a simple, yet actionable conclusion — blindly following the trades made in Congress isn’t generally a winning strategy. However, honing in on those lawmakers who do have a ‘mysterious sixth sense’ for the markets, and copying their trades seems to be much more promising.

Thankfully, that doesn’t have to be a time or labor-intensive process — it can be as simple as making a shortlist of the best-performing traders on Capitol Hill, and making use of Finbold’s congressional trading radar to keep track of the moves they are making.

Featured image via Shutterstock