After reporting its fourth-quarter earnings that have beaten analysts’ estimates and posting high expectations for the next year, one of the largest stock assets held by Warren Buffett is looking at massive price increases and profits for the famous investor and Berkshire Hathaway (NYSE: BRK.A) CEO.

Specifically, the stocks of Coca-Cola (NYSE: KO) might be looking at recovery in their price following a positive earnings report for the final quarter of 2023, which included higher-than-expected revenue of $10.85 billion (as opposed to $10.68 billion predicted) and an optimistic full-year organic revenue outlook.

Indeed, Coca-Cola occupies a prominent spot in Buffett’s Berkshire Hathaway portfolio, accounting for 6.4% of his assets and bringing in $736 million in annual dividend income. It has also been his longest continuously held asset, considering he has held it for 36 years – since 1988.

Outstanding results

Despite a sales volume decline in North America, higher prices of its products have helped Coca-Cola offset the obstacles and post expected earnings and sales that topped experts’ estimates, according to the company’s report published on February 13.

Commenting on the latest report, Coca-Cola’s CEO James Quincey said in an interview that the prices of commodities and other inputs in the majority of countries, which have led to a 24% increase in his company’s prices across the mix of goods in Europe, the Middle East, and Africa, would normalize in 2024.

Furthermore, he highlighted Coca-Cola’s promotional and innovational efforts, including offering more sugar-free beverages and adjusting container sizes, as well as plans for keeping its customer base under its wing. As he explained in more detail:

“We’ve been investing in our marketing and our innovation and our execution with bottlers. That’s what we see carrying us into 2024. (…) A section of US consumers came under pressure in 2023. We are making sure we have affordable options that allow people to stay within the franchise.”

Coca-Cola stock price analysis

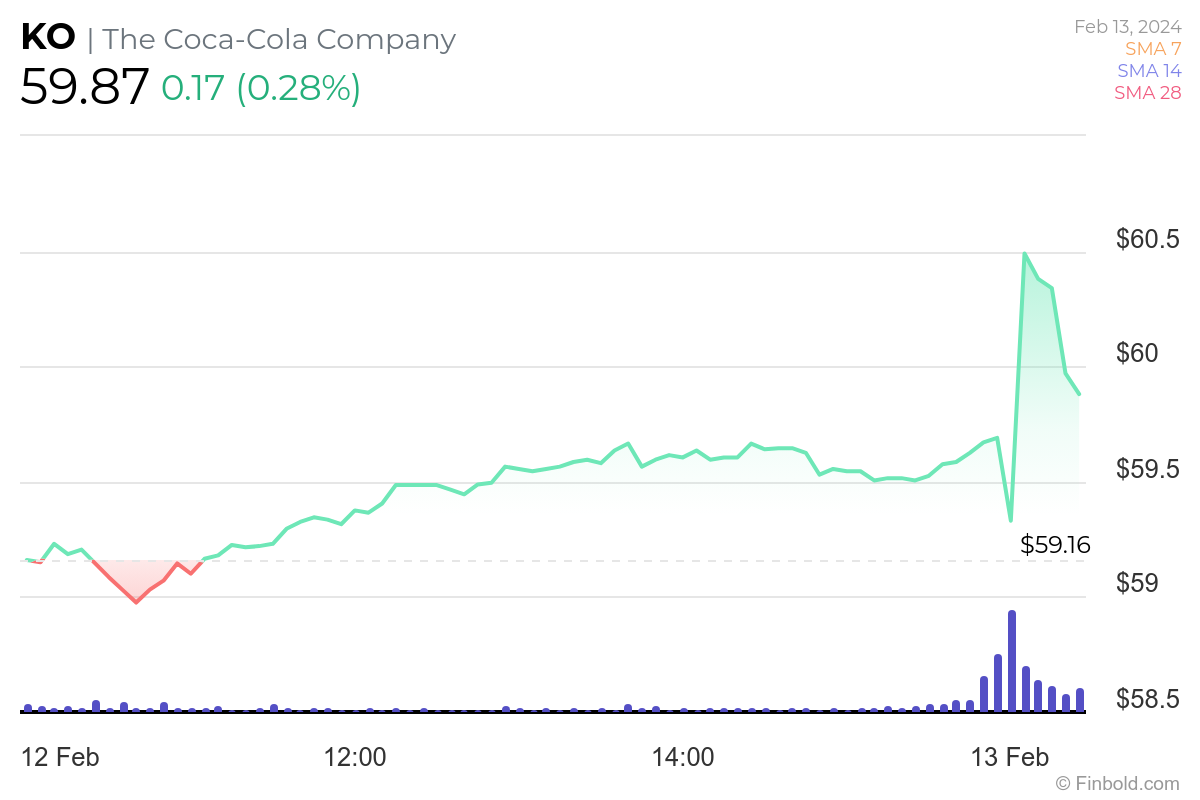

Meanwhile, the price of Coca-Cola stock at press time stood at $59.87, which suggests an increase of 0.28% on the day while declining 0.57% across the previous seven days and losing 1.14% on its monthly chart, as per the latest information retrieved on February 13.

At the moment, KO stock represents a nice setup opportunity considering the latest consolidation and an increase following the positive earnings report, with the current pullback presenting a chance to ‘buy the dip’ before the price fully responds to the recent developments.

Should the price of Coca-Cola shares grow further, they will continue reaping profits for Buffett and his company, justifying his reputation as one of the best investors among his peers. However, it is important to remember that things in this sector could change rapidly, and doing one’s own research is critical.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.