While the United States Department of Justice (DOJ) has promised to crack down on illicit behavior on cryptocurrency exchanges and the Securities and Exchange Commission (SEC) is in no rush to establish regulatory clarity on cryptocurrencies, the US Congress seems to be making progress on stablecoin legislation.

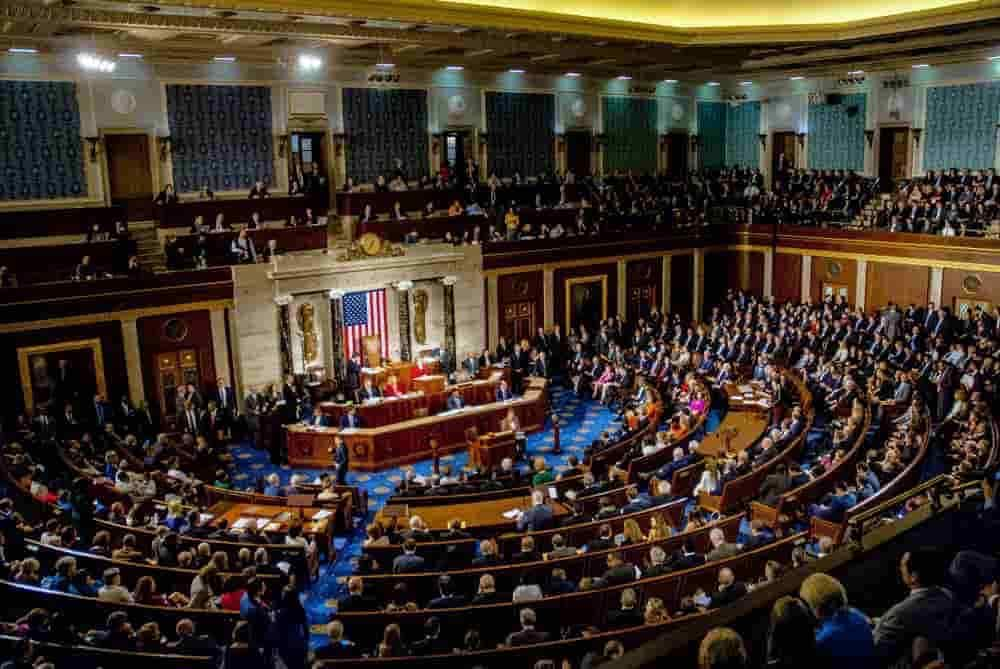

Indeed, the bipartisan ‘McHenry/Waters stablecoin bill’ is back on the table as Congress has revived the 2022 legislative draft in April, and now it has moved to the House of Representatives, according to a Twitter thread by Ron Hammond, Director of Government Relations at a non-profit crypto advocating group the Blockchain Association, on May 15.

Bipartisan crypto efforts

As Hammond specified, “the stablecoin bill has deep roots in bipartisan collaboration starting with the scrutiny of Facebook’s Libra program,” as “policymakers on both sides were skeptical of the social media giant dipping into financial services,” which resulted in Libra folding after several hearings.

“Post-Libra, much of the conversation on Capitol Hill focused on reserves. A large part of this concern was due to foreign-based Tether (USDT) and questions around the transparency of reserves. Both sides feared this lack of transparency given their large market presence.”

Meanwhile, he explained that the Biden Administration had consulted with banking regulators, including the SEC, the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), the Commodity Futures Trading Commission (CFTC), and the Federal Reserve, on the prerequisites for stablecoin regulation, concluding in 2021 that Congress should pass legislation as soon as possible or the regulators would step in.

With this in mind, “House leaders Patrick McHenry and Maxine Waters spent a large majority of 2022 holding hearings, engaging stakeholders, and drafting a bill,” but ran out of time before they could finish it because of the election. In the meantime, the implosion of the Terra ecosystem has renewed the pressure on Congress to act soon.

Regulators lose patience

In early 2023, the House held a few hearings on the issue, but some regulators (such as the SEC) have lost patience and begun to act, bringing more confusion and further strengthening the need for clear rules from Congress. After the FTX crash, the main concerns shifted to custody and segregation of customer funds.

More recently, multiple Republican and Democrat representatives have offered separate drafts including many of the same provisions in the earlier bipartisan draft, although the bone of contention is the role of the state versus federal regulators, and while Hammond wonders if both sides would come together, he is certain that it’s possible.

In conclusion, he believes that many Democrats and Republicans “agree on principles, and while there are political and substantive hold ups,” they will most likely resolve them as the House holds more hearings on stablecoins.” However, the question remains if the Senate would even take up the bill.

SEC refuses to clarify

Interestingly, the SEC has recently begun to argue that legislation is not necessary for crypto and stablecoins, moving away from its 2021 position, other banking watchdogs, and both parties in Congress. In its response to the request by the crypto exchange Coinbase for clarification on crypto regulation, it said:

“Neither the securities laws nor the Administrative Procedure Act impose on the Securities and Exchange Commission an obligation to issue the broad new regulations regarding ‘digital assets’ Coinbase has requested.”

Paul Grewal, Coinbase’s chief legal officer, expressed regret with the response, calling it a “resounding maybe” and stating that the SEC had argued its position that rulemaking might take years and that it was no rush, but that it would continue to use enforcement actions instead.

In light of this most recent development, the question remains whether such a response would elicit a stronger and faster course of action by the decision-makers on both sides of the US Congress and Senate.