As Nvidia (NASDAQ: NVDA) made the news for climbing to the top of the list of most valuable companies by market capitalization, some small-cap stocks, particularly those between $300 million and $3 billion, are showing potential to become mega-sized and bring their investors massive profits.

Indeed, there are quite a few of these currently low-valued, up-and-coming companies that are growing in size and increasing their earnings as their stock prices appreciate alongside, with analysts expecting them to continue doing so and presenting good investment opportunities for this year.

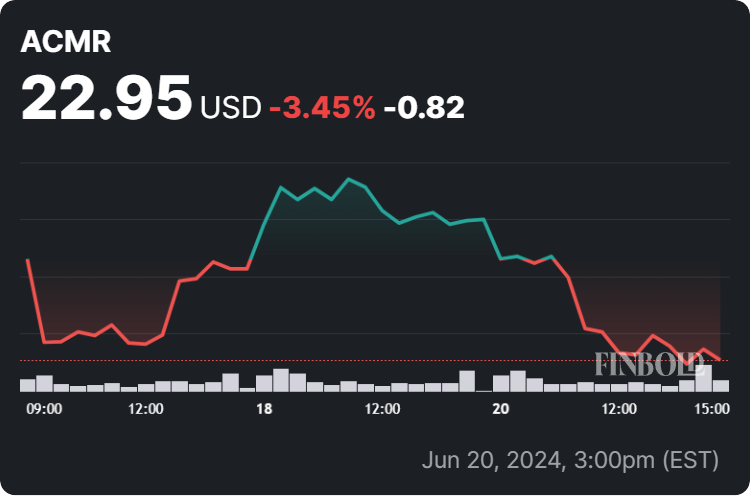

#1 ACM Research (ACMR)

One of the lesser-known participants in the semiconductor industry, the work that ACM Research (NASDAQ: ACMR) does is nonetheless essential – manufacturing cleaning and other kind of equipment for sensitive microchips – and is one of the fastest-growing small-cap stocks, according to Forbes Advisor.

Specifically, its earnings have increased 67.8% per year on average in five years, with the expected earnings per share (EPS) to grow 6% this year and 13.6% next year. Its market cap is $1.43 billion, and its stock price stands at $22.95, down 3.45% this week, up 1.08% on the month, and gaining 22.52% this year.

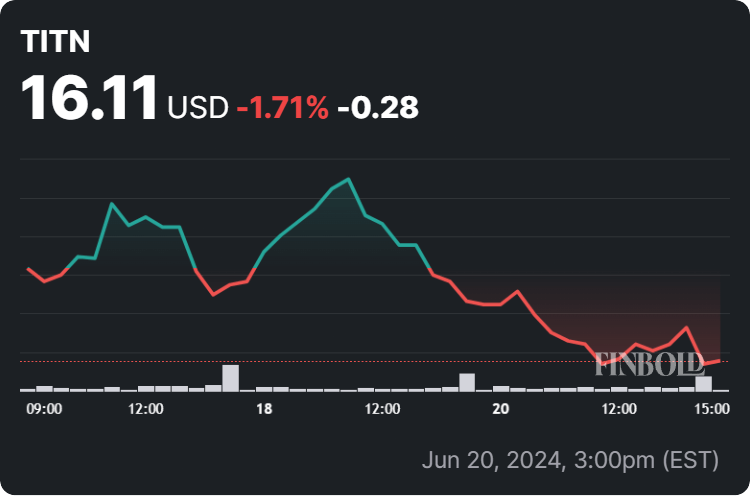

#2 Titan Machinery (NASDAQ: TITN)

At the same time, Titan Machinery (NASDAQ: TITN), an operator of construction and agricultural equipment stores with over 100 locations across the United States and Europe, has had an average EPS growth of 69.5% per year in the last five years, beating ACMR and expecting an 8.4% EPS growth in 2024.

Currently, the market cap of TITN is $367.59 million, with the price of TITN shares at $16.11, down 1.71% across the week, making a more significant drop of 30.44% on its monthly chart, as well as accumulating a loss of 43.81% year-to-date (YTD), according to the most recent information on June 21.

#3 Stride (NYSE: LRN)

The next on the list is Stride (NYSE: LRN), an online education platform for alternative schooling from kindergarten through grade 12 in coordination with school districts in the US and in alignment with state and national standards, which has recorded a 30.8% per year EPS growth in the five-year span.

With a market cap of $3 billion, analysts project that the EPS metric will continue to grow 12.3% this year and 9.2% in 2025, whereas LRN stocks are trading at the price of $69.38, up 1.85% on the weekly chart, down 0.46% this month, and making an accumulated advance of 14.72% since the year’s turn.

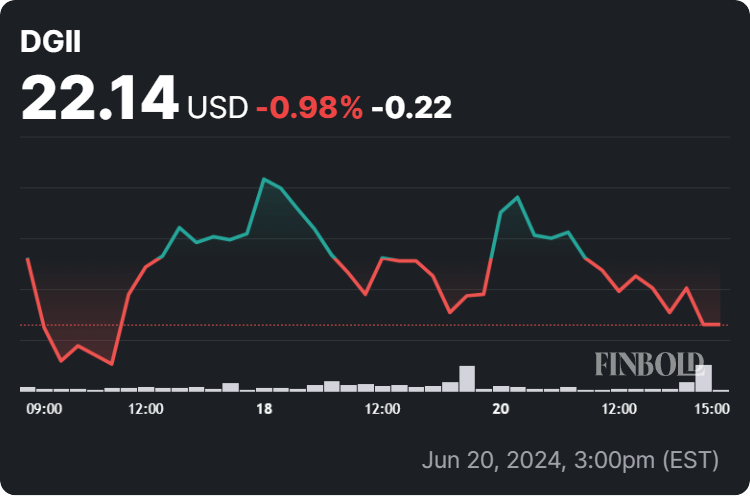

#4 Digi International (NASDAQ: DGII)

Meanwhile, Digi International (NASDAQ: DGII), a global technology firm focusing on wireless communication and devices, has grown its EPS by an average of 60.6% per year in the past five years, and experts believe it will continue to increase by 16.99% in 2024 and 16.5% in 2025.

As for its market cap, it stands at $805.33 million, and DGII is changing hands at $22.14, down 0.98% on the week, dipping 14.55% in the last 30 days, and adding up to the drop of 13.80% in 2024, during which it had managed to sustain a positive price performance in the period between February and May.

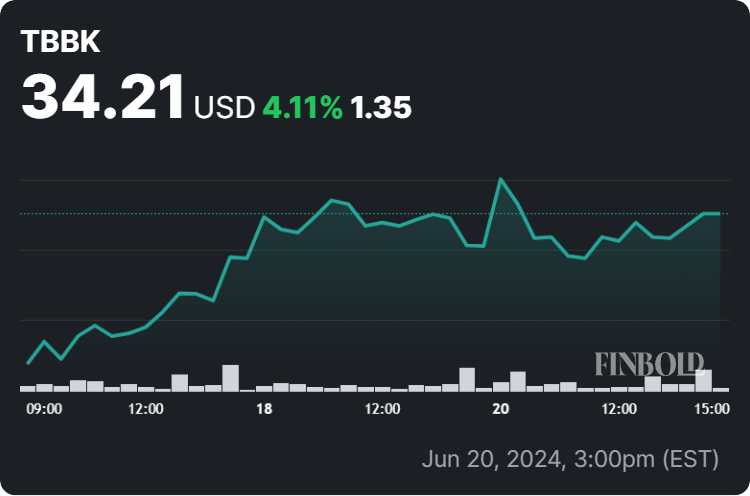

#5 The Bancorp (NASDAQ: TBBK)

Finally, The Bancorp (NASDAQ: TBBK), a financial company specializing in debit and prepaid card services, institutional banking, and commercial lending, has grown its EPS by 61.6% per year in the previous five-year period, expecting a further 60.4% growth in 2024 and 14.3% in 2025.

In terms of stock price action, TBBK is trading at $34.21, which represents an increase of 4.11% on its weekly chart, a 2% advance across the past 30 days, while making an accumulated decline of 10.84% since the start of this year, with a market cap of $1.77 billion.

Conclusion

Overall, the above small-cap stocks have massive potential to succeed in reaching stellar highs in the near future, perhaps, in time, even getting closer to their respective industry giants like Microsoft (NASDAQ: MSFT), Advanced Micro Devices (NASDAQ: AMD), Duolingo (NASDAQ: DUOL) and others.

However, trends in the stock market can sometimes do a 180 without any warning, resulting in losses for those traders who fail to do their own research, keep up with the relevant developments, and understand all the risks involved when investing in similar assets.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.