As troubles for Nvidia (NASDAQ: NVDA) continue, exacerbated by the recent United States Department of Justice subpoena as part of its investigation into alleged antitrust practices, a renowned trading expert has recently said he would not be buying Nvidia stock as he views it as a “debt-driven bubble.”

Specifically, expert markets trader Michaël van de Poppe warned that the semiconductor giant was “literally the example of this debt-driven bubble with speculators assuming that NVDA should moon even more, watching earnings from a pub,” in an X post published on September 3.

Indeed, he was alluding to the earlier post by Bloomberg’s Joe Weisenthal, which featured a video of what looked like an Nvidia earnings watch party, with people at a pub eagerly waiting for the televised report of the artificial intelligence (AI) behemoth’s profits in the last quarter.

Additionally, van de Poppe said that “the last thing I’d be buying is NVDA” stock and that “we’re on the far end of this cycle, and this stock shows it,” referring to the widespread belief that the stock market has, indeed, reached its peak and that a bear market is about to begin.

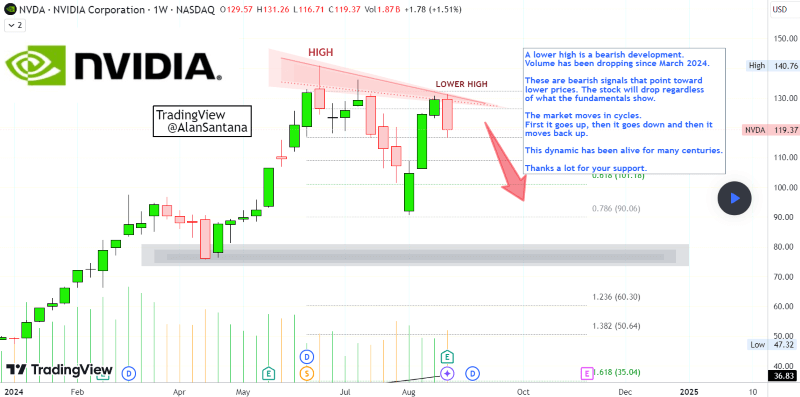

On top of that, trading expert Alan Santana recently identified a lower high as a bearish development for Nvidia stock, alongside trading volume that has been dropping since March 2024, with technicals pointing toward lower prices and a drop “regardless of what the fundamentals show.”

Nvidia stock price history

For now, the price of Nvidia stock stands at $108, reflecting a decline of 9.53% on the day, adding up to the 13.61% dip across the past week and reducing to 7.52% the advances on its monthly chart, as well as its year-to-date (YTD) gains to 124.21%, as per data obtained by Finbold on September 4.

So, why is Nvidia stock going down today? Notably, one of the answers to the question of ‘why did Nvidia stock drop lately?’ is the recent subpoena by the DoJ, but it can also lie in the fact that investors are bracing for the upcoming worrying jobs report by the U.S. Department of Labor.

Furthermore, concerns are intensifying that China might invade Taiwan, especially considering the territory’s critical role in the semiconductor and AI industries and its status as the headquarters for Taiwan Semiconductor Manufacturing (NYSE: TSM) – one of the leading Nvidia suppliers.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.