Trump Media and Technology (NASDAQ: DJT) has been one of the most volatile stocks of 2024, mirroring the unpredictable trajectory of the political landscape.

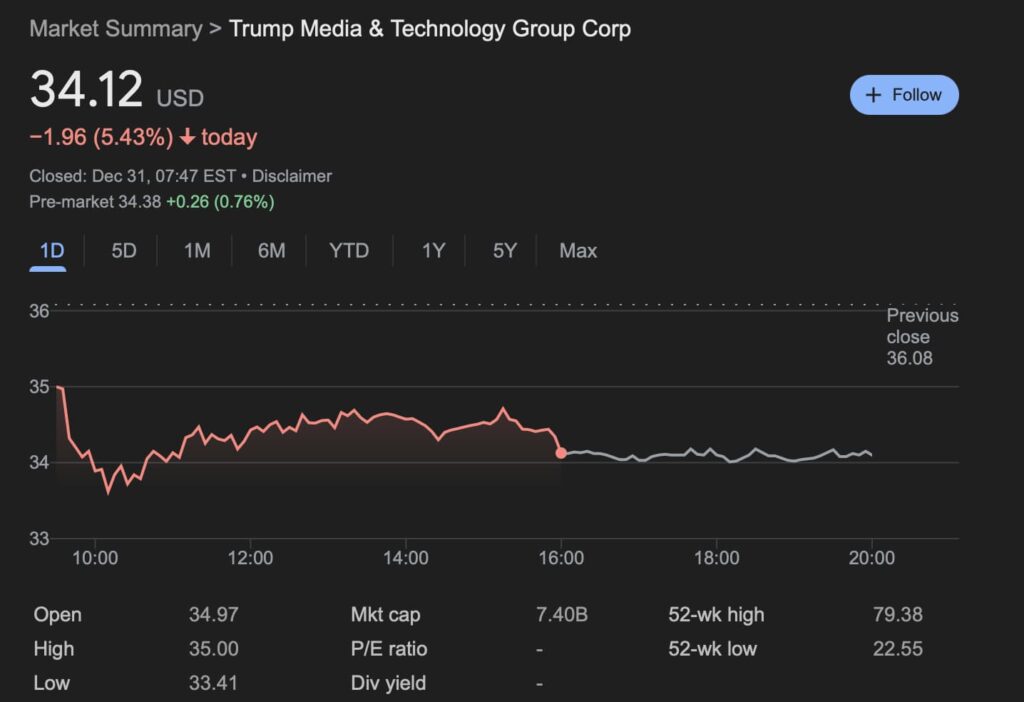

The stock closed at $34.12 on Monday, marking a 5.43% dip on the day, though it remains up 5.02% over the past month and an impressive 95.53% year-to-date.

DJT recent trading patterns and outlook

In the past month, DJT has fluctuated between $31.08 and $38.83, reflecting a wide trading range that suggests investor indecision.

The stock is currently trading in the middle of this range, with resistance levels identified at $35.43 to $36.02. Support lies just beneath its current level at $34.11, reinforced by multiple trend lines across different time frames.

However, trading volume has noticeably dropped in recent sessions, which could indicate waning momentum. This lack of conviction could keep the stock tethered in its mid-$30 range without a significant catalyst.

Election and post-election Trump Media shares price action

Trump Media experienced dramatic swings around key political events in 2024. After climbing to a high of $51.51 on October 29, just before the U.S. presidential election, the stock corrected sharply, closing at $33.94 on Election Day, November 5.

Despite briefly dipping below $30 in mid-November, DJT has largely stabilized in the mid-$30 range since then.

While the stock saw a “buy the rumor, sell the news” spike ahead of the election, many investors now anticipate a similar rally leading into Inauguration Day on January 20, 2025. Such events often spark speculative buying, driven by expectations surrounding President-elect Donald Trump’s policies, which are seen as favorable for sectors like banking, energy, and cryptocurrency.

Trump’s stake and market sentiment

A key overhang on DJT shares this year has been concerns about whether Trump might liquidate part of his holdings. According to the latest SEC filing, Trump has not sold any shares of the firm, maintaining his 114 million-share stake.

However, his ownership percentage has diluted from 64.9% in April to 52.9% today due to an increase in outstanding shares, now totaling 216 million.

The market remains cautious about the possibility of Trump offloading shares, even as he reaffirmed his commitment earlier this year not to sell any of his stake.

Investors view his holdings as a stabilizing force for the stock, but lingering speculation about potential sales has capped enthusiasm.

Challenges and catalysts for 2025

While DJT’s stock performance has been politically charged, its financial fundamentals remain a concern. The company has yet to turn a profit, and its value is tied heavily to its political relevance rather than traditional revenue or earnings metrics.

This has made the stock particularly volatile, especially as Trump Media continues to play a central role in U.S. politics.

Heading into Inauguration Day, analysts expect the stock could experience another speculative rally, similar to the pre-election surge.

However, any gains may be short-lived unless backed by substantial progress in the company’s business model or clear signals that Trump Media can achieve sustainable profitability.

Price prediction for Inauguration Day

Given the current trading patterns and market sentiment, DJT could test resistance near $36 in the lead-up to January 20, 2025, particularly if speculative buying picks up.

A breakout above $38 would signal renewed bullish momentum, though the stock’s inability to hold such levels in the past suggests caution. On the downside, a breach of the $34 support could see the stock retesting the $31 range.

While the broader market is expected to rally on optimism surrounding Trump’s inauguration and policy agenda, DJT’s performance will largely depend on investor sentiment, political developments, and the company’s ability to address its long-term financial viability.

For now, traders may see DJT as a short-term play, with a potential spike fueled by political fervor rather than fundamentals.

Featured image via Shutterstock