Trump Media & Technology Group (NASDAQ: DJT), the parent company of social media platform Truth Social, saw its stock price surge by 5% over the course of a single trading session on Friday.

Dramatic swings aren’t anything new for DJT — however, this time around, the causes behind the surge go beyond standard media hype. The most recent polling data available suggests that Trump has been gaining ground in several key battleground states, increasing his chances of success in what is an already tight race.

At Friday’s closing bell, DJT shares traded at $25.28 apiece — having rallied by 4.81% on the daily chart and bringing weekly gains to 50.39%. On a year-to-date (YTD) basis, Trump Media stock is up 44.87%.

The stock is undoubtedly going to keep on accruing momentum as we draw closer to the election. Traders can expect to see the $30 price point tested in the coming weeks, barring any bearish news — if the news cycle is beneficial to Trump, recent highs seen in June and July around $39 could be the next level of resistance.

DJT rises on Nate Silver and FiveThirtyEight data

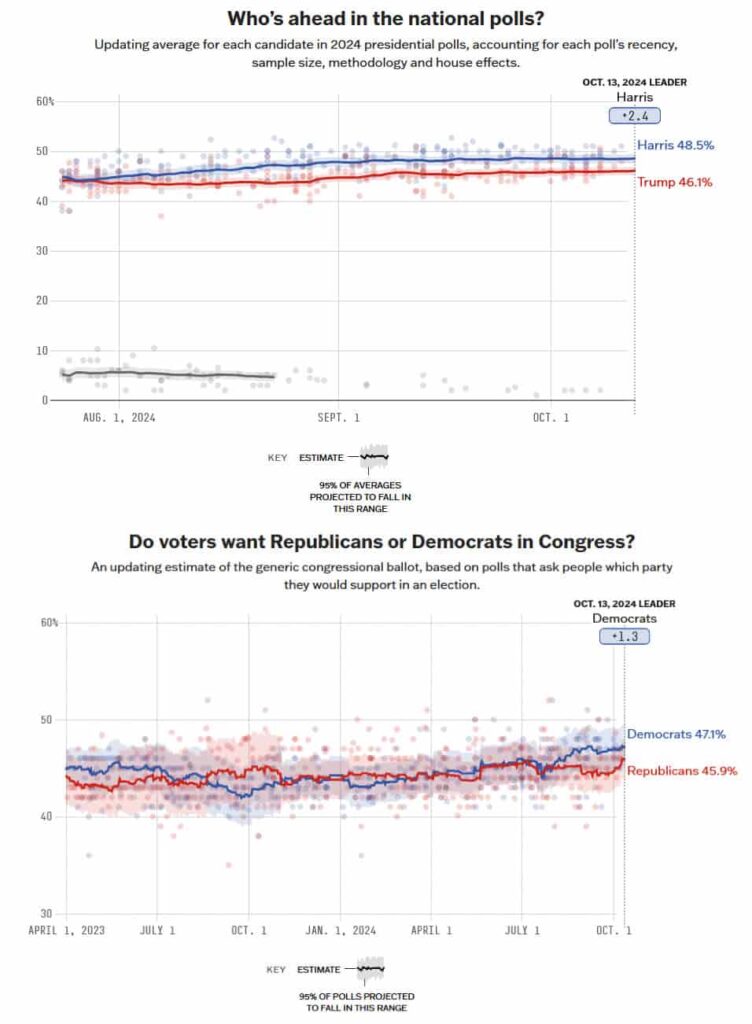

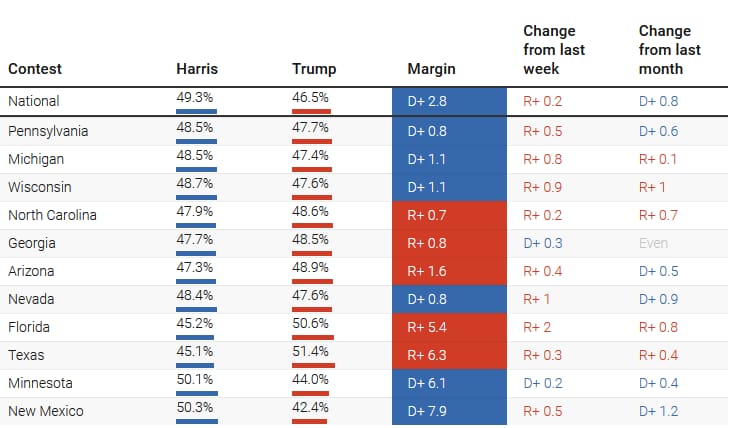

Vice President Kamala Harris’ favorability rating is now 46.8% — the same percentage of people polled also hold an unfavorable opinion of her. In terms of national polls, aggregate data on October 13 suggests a 48.5% to 46.1% split in Harris’ favor — however, U.S. elections are not decided by popular vote.

Although general polling suggests that 47.1% of respondents would rather see Democrats take Congressional control, compared to 45.9% for Republicans, Trump has steadily been closing the gap in the most crucial swing states.

In the last week alone, poll numbers from Pennsylvania, Michigan, Wisconsin, North Carolina, Arizona, and Nevada have shifted in Trump’s favor, per Nate Silver’s model. Nevada saw the biggest change — a 1% swing, reducing the margin to 0.8% in favor of Democrats, followed by a 0.9% swing in Wisconsin, where the margin is now at 1.1%.

Betting markets are also quite bullish on Trump — after elector betting was legalized on October 3, resident-only platform Kalshi was pointing to a tight race until October 10 — as it currently stands, Trump is a clear favorite, with 54% odds compared to Harris’ 46%. On the nonresident platform Polymarket, Trump has 54.1% odds at press time.

Trump Media volatility and long-term outlook

DJT’s price action is entirely dependent on the media coverage of Trump. After his running mate, JD Vance, delivered an unexpectedly strong debate performance, Trump Media stock price shot up 16% in a week.

A week after that, following a rally in Butler Pennsylvania, the site of the first failed attempt on the former President’s life, which saw billionaire and Tesla (NASDAQ: TSLA) CEO Elon Musk endorse the republican candidate, DJT shares rallied by another 50%.

While these wild swings might be appealing to short-term traders, it’s important to remember that trading the stock at this point in time essentially boils down to betting on the results of the election.

Current stock prices do not reflect the fundamental value of the business — while a Trump victory would certainly cause a rally, initiating a long position after the upswings seen in the last month is a risky proposition not fit for the faint of heart.

However, even in the case of a Harris presidency, DJT could end up as a good value play — if shares prices drop significantly, investors could stand to benefit from purchasing equity in what could become a crucial part of U.S. conservative media.