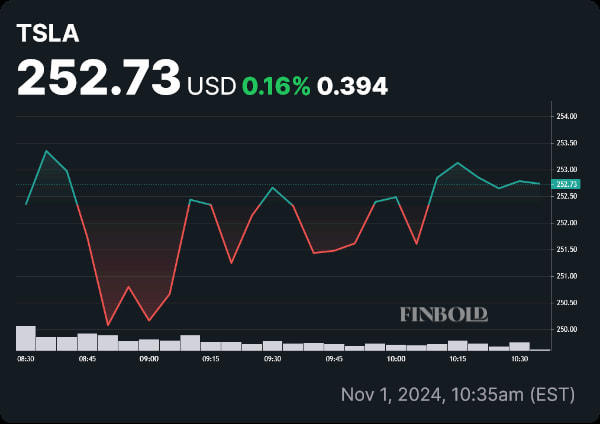

On November 1, shares of electric vehicle maker Tesla (NASDAQ: TSLA) opened at $252.34 before dropping to an intraday low of $250. However, shortly after, the stock began a gradual climb upward as co-founder and CEO Elon Musk took to X.

Tesla’s full self-driving (FSD) technology is now almost entirely artificial intelligence — as per the response Musk made to a 2022 video where the innovator predicted such an outcome.

At press time, TSLA shares have erased the losses of the previous dip — currently trading at $252.73, slightly above the day’s opening price.

Can hype continue to sustain Tesla stock?

There is little doubt that Tesla has had an enormous effect as a herald of the EV transition. Unfortunately, Musk has a history and a habit of overpromising, riding the hype train, and then underdelivering and endlessly delaying delivery targets.

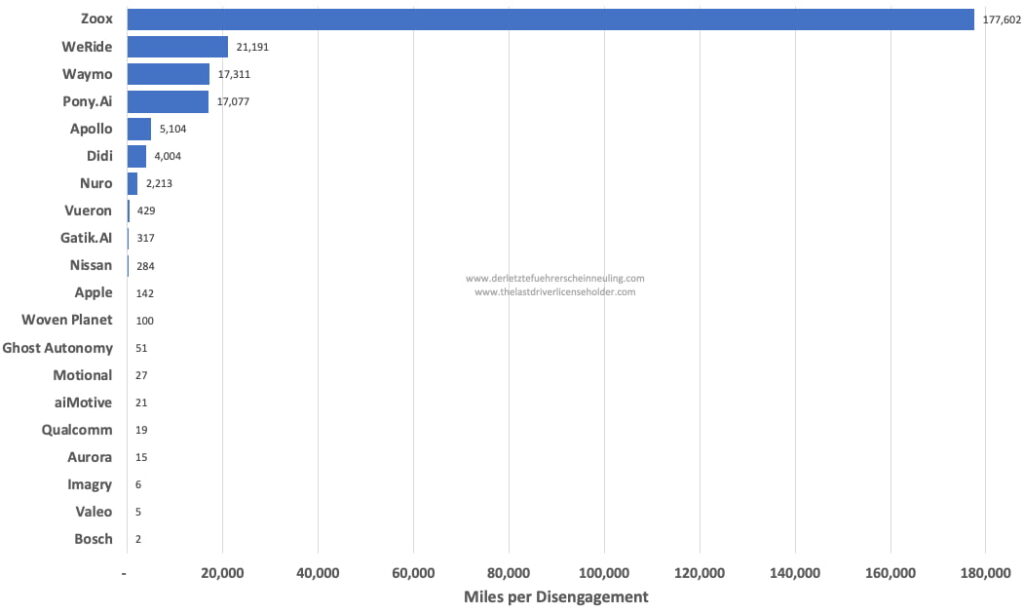

FSD is a particular sore spot — although metrics are improving, TSLA’s full self-driving tech still requires manual human intervention every 13 miles — a far cry from Waymo’s 17,311 miles according to California’s Department of Motor Vehicles (DMV).

Barring a stunning reversal of fortune, it seems like Tesla is losing the race to truly autonomous driving to key competitor Google (NASDAQ: GOOGL).

Musk has previously stated that Robotaxis could debut in 2025, but the situation is complicated by the need for extensive regulatory approval. As covered by Finbold, the CEO had first said that self-driving was ‘imminent’ back in 2014, a full decade ago.

While it might seem like Musk’s hopes will not materialize any time soon, he does have a history of successfully disrupting industries and subverting expectations. Full self-driving could be years away — but with a satisfying Q3 2024 report on October 2 that largely beat estimates, the business does have room to maneuver and refocus on crucial R&D areas.

Analysts offer mixed outlook on Tesla stock

Quite a few major Wall Street investment firms recently raised their TSLA price targets. George Gianarikas of Canaccord is among the more bullish equity researchers covering the stock — having set a $278 price target, up from the previous $254 mark, citing strength in the Chinese market. The estimate gives a 9.99% upside for TSLA shares.

Bank of America’s (NYSE: BAC) John Murphy was slightly more conservative — with a $265 price target that would equate to a 4.8% rise in price.

Notably, a recent 10-Q filing has revealed that three Tesla insiders — Kimbal Musk, Robyn Denholm, and Kathleen Wilson-Thompson, intend on selling TSLA stock amounting to roughly $295 million in value — possibly signaling that internal confidence in the company’s future prospects has been shaken.

Featured image:

Around the World Photos, Scottsdale, Arizona — August 9, 2023. Digital Image. Shutterstock