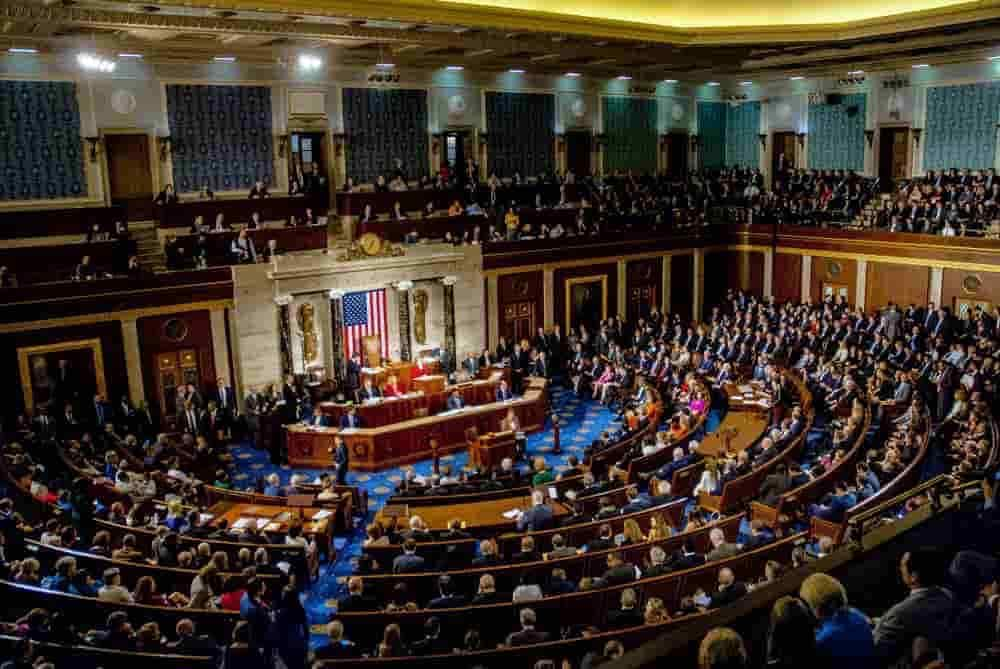

The stock market activity of various U.S. elected officials has come under increased scrutiny of late. Representatives have ways of influencing how various companies perform by, for example helping them get government contracts and passing favorable legislation.

The fact that many elected officials have been consistently and significantly outperforming the stock market with their investments gave rise to controversy and allegations of insider trading. It also led to the introduction of the ‘Ban Congressional Stock Trading Act.’

While the act aiming to force Representatives to either divest or place their investments in blind trusts is yet to be made into law – despite having broad bipartisan support as noted by Representative Ken Buck – multiple figures and organizations across the internet have started dutifully tracking officials’ trading activity.

The trend also gave rise to several trading strategies specifically aiming to copy politicians’ trades, just as Jim Cramer’s seemingly consistently wrong calls triggered the creation of “inverse Cramer” approaches.

Nancy and Paul Pelosi’s highly successful portfolio

Out of all U.S. politicians, the investments made by Nancy and Paul Pelosi have perhaps been the most controversial. This is hardly surprising given the prominent role that Representative Pelosi used to hold in Congress and her staggering returns on seemingly odd trades.

Still, it is important to note that Representative Pelosi does not trade stocks directly, and the portfolio is managed by her husband, Paul.

The Nancy Pelosi trading strategy has been highly successful and has a total return rate of 184.27%, per the data compiled by the QuiverStrategies website. Quiver Quantitavie, the X profile behind the website, also shared that the Representative’s portfolio grew by 14% this month and by 49% this year.

In the same period, the S&P 500, the index tracking America’s largest stocks that are generally seen as a decent gauge for the market’s overall performance, grew 9.31% in the last 30 days and 19.11% year-to-date – significantly less than the Nancy Pelosi portfolio.

What are the Pelosis trading

Given the recent trends, it isn’t surprising that Representative Pelosi’s portfolio heavily favors technology stocks. Microsoft (NASDAQ: MSFT) accounts for about a quarter of her holdings, Apple (NASDAQ: AAPL) a third, and Alphabet (NASDAQ: GOOGL) just under 20%. Other stocks that are significantly represented are Amazon (NASDAQ: AMZN), Tesla (NASDAQ: TSLA), and Crowdstrike (NASDAQ: CRWD).

Generally, the main point of contention with Pelosi’s investment strategy is the timing of her trades. Some noteworthy examples are a 2021 purchase of Nvidia (NASDAQ: NVDA) stocks that occurred just before the semiconductor giant’s shares surged on the news that the company is reaching an agreement on a large purchase with the U.S. government.

Another notable example is the purchase of Apple and Microsoft stock in May 2022, which coincided with NASDAQ’s bottom in that period. Still, the Pelosi’s don’t always make well-timed trades, as was highlighted in 2021 when they acquired Roblox (NYSE: RBLX) shares just before they took a significant plunge.

Interesting trades in the Senate

Strangely timed stock trades aren’t confined to the U.S. Congress. Throughout November, Finbold has been reporting on an interesting investment made by Senator Tina Smith – a member of the Committee on Health.

Senator Smith acquired the shares of Tactile System (NASDAQ: TCDM) early in the month and is, at the time of publication, more than 40% in the green on the purchase. The company itself is interesting as it is a relatively small pharmaceutical firm based in Smith’s home state of Minnesota. Despite its size, it was awarded millions in government contracts.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.