U.S. politicians have an informational edge over your everyday investor. Moreover, their committee assignments allow them to regulate the very industries they often invest in. Unsurprisingly, this tends to manifest in the form of numerous suspicious stock trades, which secure significant gains in short timeframes.

Worse still, the penalties for failing to comply with the rules that govern this practice are largely ineffective. To use a simple example, in September 2024, California Representative Darrell Issa reported a trade worth $175 million, a staggering 580 days late — yet faced only a $200 fine.

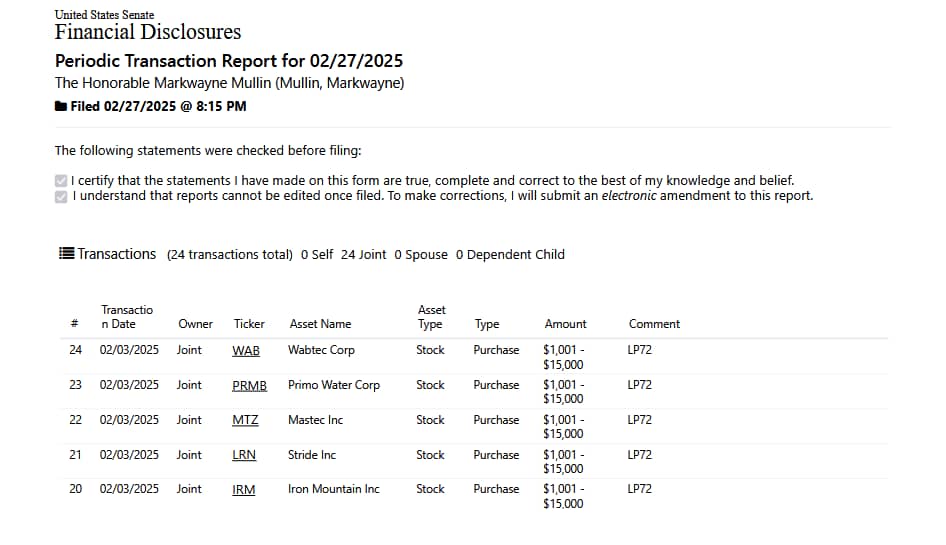

Back in January, Finbold reported on a stock trade made by Oklahoma Senator Markwayne Mullin — a $1,001 to $15,000 investment in Stride, Inc. That purchase was made on July 30, but only disclosed on December 31.

The Senator had already secured a 38.45% gain on Stride, Inc stock (NYSE: LRN), which was trading at $103.93, by the time of our previous coverage. As of the time of writing, Mullin is up approximately 76% on his first purchase of LRN stock.

Moreover, Finbold’s senatorial trading radar recently picked up a filing that reveals that the Senator has doubled down on his purchase.

Receive Signals on US Senators' Stock Trades

Stay up-to-date on the trading activity of US Senators. The signal triggers based on updates from the Senate disclosure reports, notifying you of their latest stock transactions.

Oklahoma Senator’s suspicious stock trade currently in the red

A periodic transaction report published on February 27 shows that Mullin bought an additional $1,001 to $15,000 worth of LRN stock on February 3.

What makes this a suspicious stock trade is the fact that the junior Senator from Oklahoma sits on the Senate Committee on Education. Stride, Inc. is a for-profit education company that provides virtual solutions to schools, both private and public, as well as government agencies.

So, what about his timing? As mentioned earlier, the Senator is up 76% on his initial purchase. On the other hand, the price of LRN stock has actually decreased by 2.51% since his second suspicious trade.

At the time of Markwayne Mullin’s second purchase, Stride, Inc. stock was trading at $ $137.66. By press time on February 28, LRN shares were changing hands at $134.21.

Accordingly, the Senator’s suspicious stock trade is currently some 2.51% in the red. On a year-to-date (YTD) basis, the price of Stride, Inc stock has increased by 29.13% — and there’s a high probability that this small loss is just the result of a temporary dip.

However, there is relatively little doubt that a for-profit education business with such strong momentum will thrive — particularly given the Trump administration’s intentions to bring about cuts in the Department of Education.

Featured image via Shutterstock