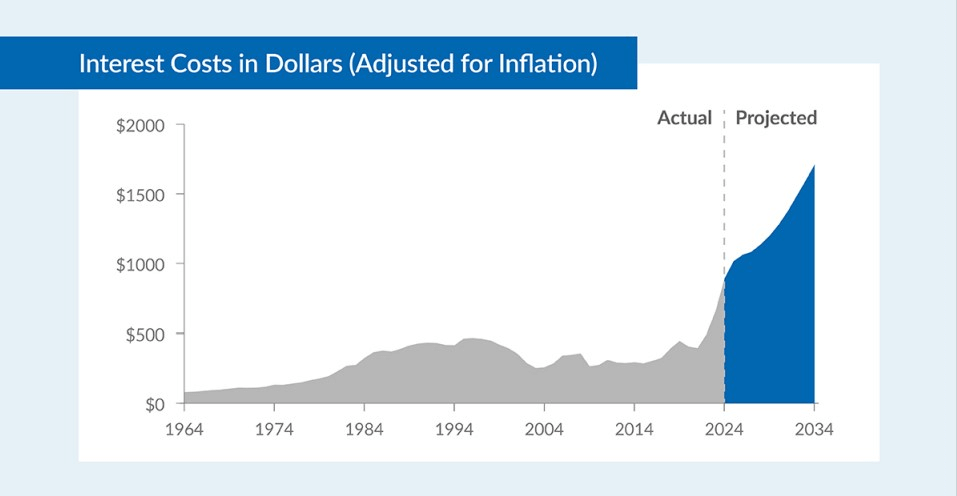

In a troubling revelation from the latest U.S. Budget Deficit report, interest payments on the U.S. federal debt are projected to hit $1.14 trillion for the whole year, raising serious concerns about the nation’s fiscal sustainability.

This surge in government outlays, combined with declining tax revenues, led to June’s fiscal deficit nearly tripling year-over-year to $228 billion, significantly overshooting the consensus estimate of $175 billion.

Economist E.J. Antoni reports that, according to the Federal Reserve’s June data, the interest on the national debt now equals 76% of all personal income taxes collected by the government, the Treasury’s largest revenue source.

Antoni highlights the alarming fact that three-quarters of personal income taxes are consumed solely by interest payments, raising concerns about congressional awareness and concern over the issue.

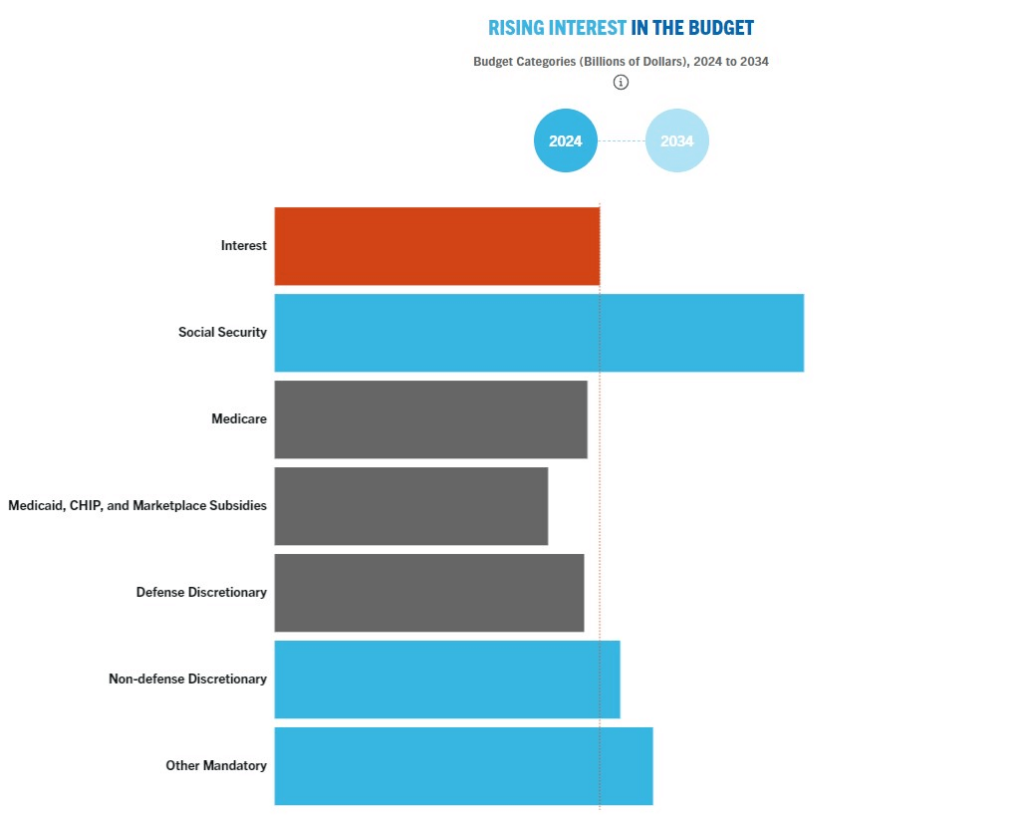

He further notes that interest on the national debt was the government’s single largest expense in June, surpassing critical public services such as the Department of Health and Human Services and the Social Security Administration.

The Treasury expects interest payments to exceed $1.14 trillion this fiscal year, but Antoni cautions that this figure may be an optimistic projection, implying that the actual cost could be even higher.

“Consider it caught up: interest on the debt surpassed both the Dept. of Health and Human Services and the Social Security Admin. to become the single biggest line item in the Treasury’s monthly statement for Jun – still think this is fine?

The Treasury now expects interest on the federal debt to breach $1.14 trillion this fiscal year; if that estimate is anything like their usual overly optimistic projections, then be prepared for it to be much higher.”

Growing government expenditure and decreasing tax receipts aided the deficit

Government expenditures reached $646 billion in June, a 15% increase and an uptick of almost $100 billion from the previous year.

Simultaneously, tax receipts plummeted 9.2%, from $461 billion to $418 billion, the largest decline observed since June 2020 during the depths of the Covid lockdown-induced recession.

Rapidly rising interest rates have spurred the dramatic widening of the budget deficit as the Federal Reserve attempts to rectify the monumental policy failures of 2020 and 2021. During this period, the Fed kept interest rates at near-zero levels while injecting trillions into various asset bubbles.

Consequently, the fiscal deficit for the first nine months of the current fiscal year is already the third highest on record, trailing only the crisis years of 2020 and 2021. With a fiscal deficit of $1.393 trillion for 2022 to date, this represents a 170% increase compared to the same period last year, with an overall cost of servicing the federal debt rising 33% in a single year.

2024 is already a record year when it comes to the U.S. debt interest

The Treasury Monthly Statement reveals a shocking figure: in the current fiscal year’s first nine months, the U.S. has already accumulated an unprecedented $652 billion in gross debt interest, surpassing the comparable period’s interest expense payment from a year ago by over 25%, amounting to $521 billion.

Even if the Fed reduces interest rates, the delay in rolling over maturing debt ensures that actual interest payments will continue to climb for the foreseeable future. Notably, the weighted average interest on the total outstanding debt at the end of June was only 2.76%, a level not seen since January 2012.

Given the Fed’s indication of maintaining “higher for longer” rates, the blended rate on the debt could breach the 4% mark within a year, resulting in interest payments on the total U.S. debt of $32.3 trillion, reaching $1.3 trillion within 12 months, potentially outstripping social security as the single largest U.S. government expenditure.

As the threshold of $1 trillion in interest payments approaches, it is crucial that these figures become a significant point of discussion in the forthcoming presidential elections, stimulating an urgent debate on fiscal responsibility and sustainable economic management.