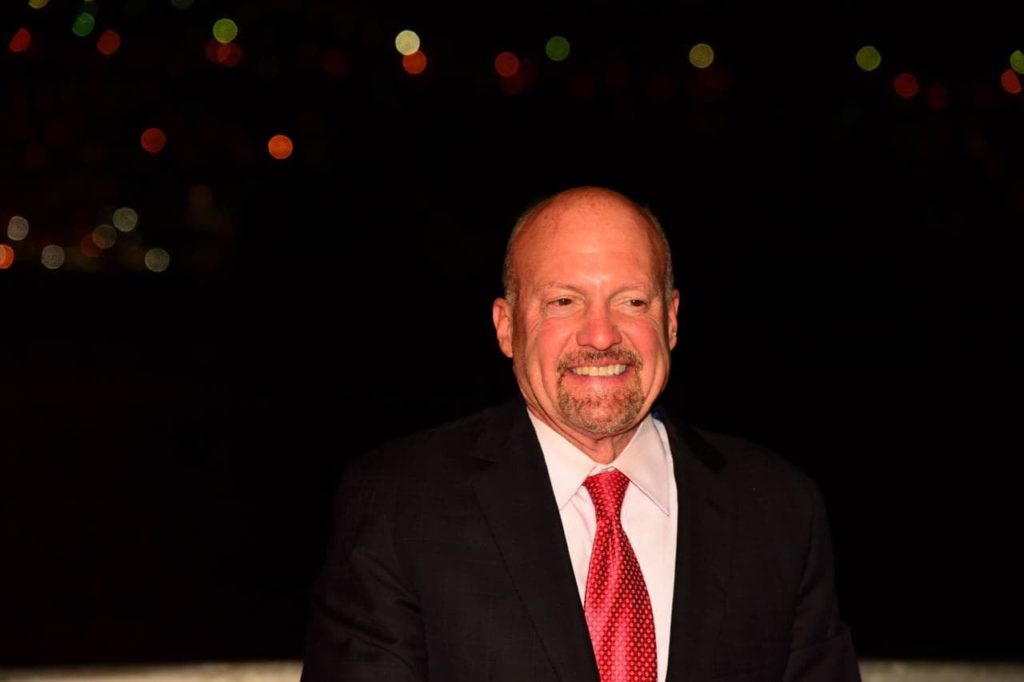

After First Republic Bank (NYSE: FRC) became another victim of the banking crisis a couple of months after Jim Cramer endorsed it, several other large banks have been suffering major losses, despite the TV personality and CNBC’s ‘Mad Money’ host predicting the end of the contagion after the First Republic.

Indeed, a Twitter page ‘Inverse Cramer (Not Jim Cramer),’ created for the purpose of ridiculing Cramer’s investment recommendations that ended up being inaccurate, has pointed out that four different banks have been struggling after he announced the end of the banking crisis, according to a tweet shared on May 5.

Specifically, the banks in question are PacWest Bancorp, Metropolitan Bank Holding Corp, Comerica Incorporated (NYSE: CMA), and Western Alliance Bancorporation, and the Twitter community brought to the attention that the host in late April said that “the collapse of First Republic bank could mark the end of the mini banking crisis that started in March.”

Banking struggles continue

As of press time, the stock of PacWest Bancorp (NASDAQ: PACW) has declined 55.63% in the last five days, while Metropolitan Bank Holding Corp (NYSE: MCB) has lost 26.84%, Comerica Incorporated 21.11%, and Western Alliance Bancorporation (NYSE: WAL) has erased 37.14%, as per the latest Google Finance data.

Interestingly, Scott Hamilton, the global payments and liquidity expert and contributing editor at Finextra Research, had listed FRC, PacWest, and Western Alliance as the next dominos to fall after the infamous developments around Silvergate Bank, Silicon Valley Bank (SVB), Signature Bank, and Credit Suisse, in his article published on March 13.

Meanwhile, the collective market capitalization of publicly-traded regional banks has dropped a staggering 78% since the year’s turn, declining from $475 billion in January to $100 billion in May, as observed by the CEO of finance media company Grit Capital Genevieve Roch-Decter, who has warned that “regional banks [are] about to go extinct,” in her tweet on May 4.

As Finbold reported on April 26, despite a brief recovery in mid-March, the stock of First Republic had tanked 90% since Jim Cramer called it a “very good bank” on March 10, and the trend has continued as the banking institution is currently trading hands at the low price of $0.31 – a massive decline from $121.22, where it stood on January 1.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.